Has the canary finally croaked?

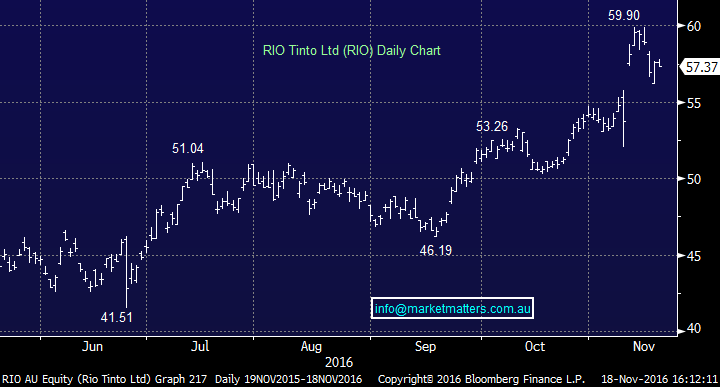

What Mattered Today

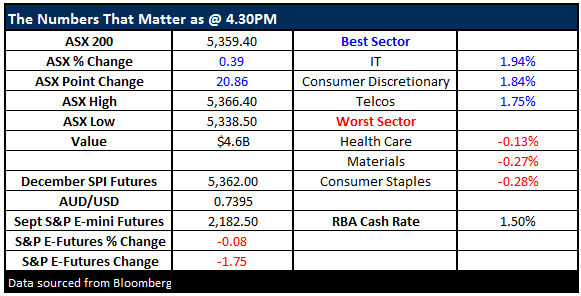

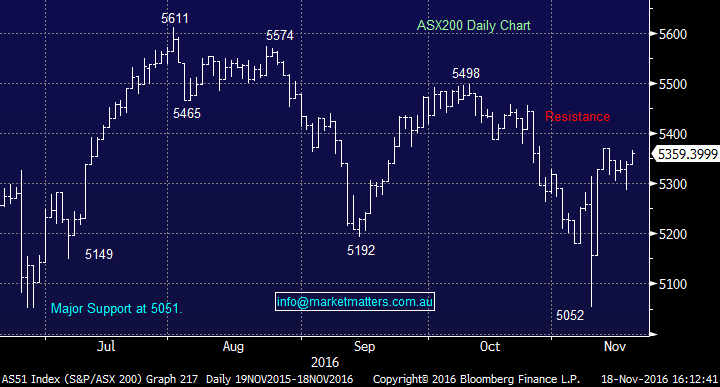

A quiet session to end the week, with the ASX 200 chopping around the gain line before a reasonable rally into the close saw it end marginally higher. The range today was +/-28 points, a high of 5,366 and a low of 5,338 – with a close at 5359 – up +20pts or +0.39%. For the week, the index was marginally lower, down 0.3%, with a range of +/- 80 points – so reasonably tight. Turnover was ~20% below the 20 day average today so it seemed most were enjoying the sunshine in Sydney…

Recapping some of our thoughts over the past week, we went negative the commodity space early on using Whitehaven Coal (WHC) as the ‘canary in the coal mine’, while we also dipped out toe into some of the ‘unloved’ defensive yield names that have been hit hard in recent months – putting some money in some unloved stocks - plus we had a crack at the ‘higher $US story’ by adding two other stocks that have been performing nicely. A bank was trimmed to make room while our cash now sits at below 10%. We re-capped our views on our holdings this morning, however a couple of charts are worthwhile reviewing….

1. The canary has croaked…..Whitehaven lead the rally in the commodity space from the Jan/Feb lows but has now started to roll over – down another 25c (8.93%) today. It looks bearish on the charts + insiders have sold some + it failed to rally even when coal prices moved higher….We think the canary has croaked short term and we’re now cautious commodities from here.

Whitehaven Coal (WHC) Daily Chart

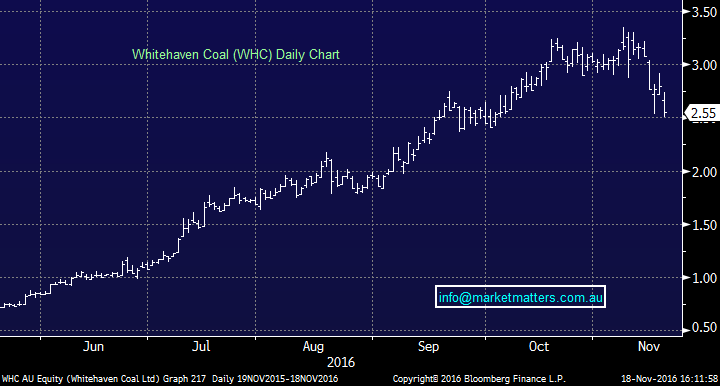

RIO the next to roll over??

Rio Tinto (RIO) Daily Chart

2. The $US has rallied this week – pretty strongly when we look at the daily chart on expectations for FED hike in December. It’s a done deal it would seem and another two hikes are now getting priced in to the market for 2017…A higher $US is obviously negative for commodities – BUT it’s positive for US earners and we added three of them to the portfolio this week…

US Dollar Index (DXY) Daily Chart

Westfield has a good session today on the back of some very bullish broker commentary – the stocks put on +3.35% to close at $8.94– according to Credit Suisse they reckon “WFD pricing in complete development shutdown and more. Assuming spot FX & flat cap rates, we estimate WFD could shut down its entire development business in Dec-17, incur the associated costs, pay a special dividend of A$0.20ps+ to investors & still be worth more than the current share price. In absolute terms, WFD’s current pricing falls well short of its intrinsic value. In relative terms – when benchmarked against Groups that have far less capacity to add value – it is even more difficult to justify” (Source Credit Suisse).

Westfield Corp (WFD) Daily Chart

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

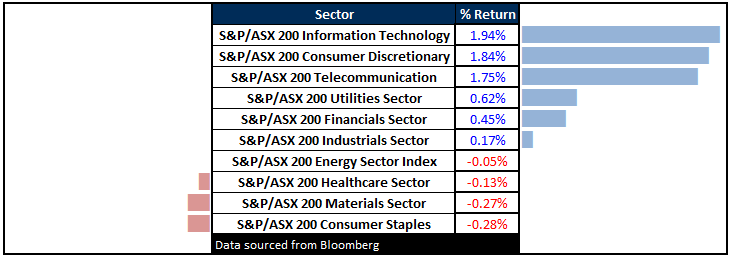

Sectors

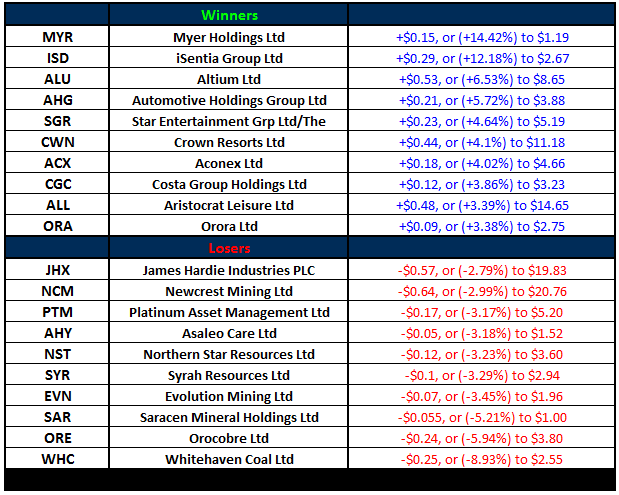

ASX 200 Movers

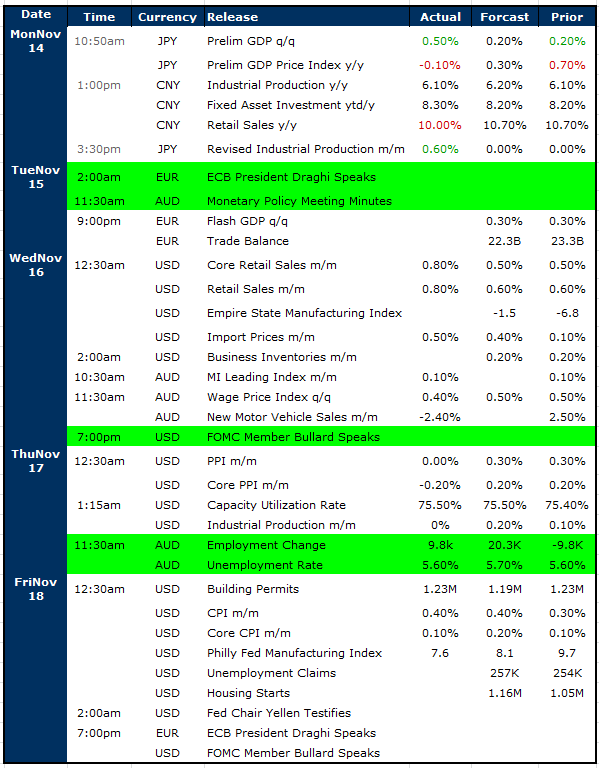

Select Economic Data - Stuff that really Matters in Green

What Matters Overseas

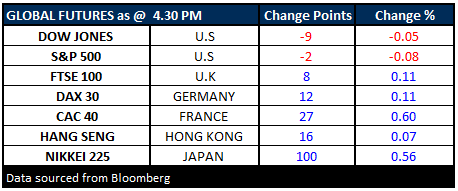

FUTURES mixed….

Have a great Weekend – and watch out for MM report on Sunday.

The Market Matters Team

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 18/11/2016. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions.

You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here