GrainCorp (GNC) signs an insurance safety net

Stock

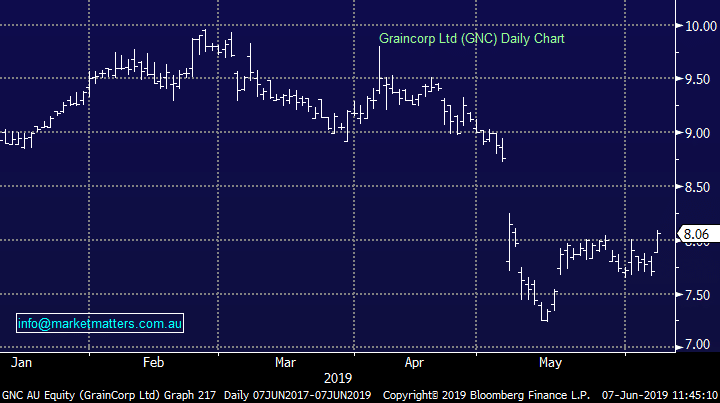

GrainCorp (GNC) $8.06 as at 07/06/2019

Event

Local grain dealer GrainCorp has seen its share price pop on news it had inked a 10-year long insurance deal against poor harvests. The deal will see GNC compensated if crop harvests fall below 15.3mt, while the company will have to pay the insurer, Aon, if production rises above 19.3mt.

Grain is the largest contributor to revenue for GNC by some margin, and is set to become an even bigger portion of earnings after the malt business is demerged. The insurance deal aims to smooth out earnings for the business, allowing better business planning through the cycle. In the 2018 financial year the drought stricken east coast of Australia managed 16.6mt, a fair distance from the record breaking 28.2mt in FY17.

The volatility of earnings for GNC in life after the malt business departs was playing on investors’ minds ahead of the demerger after it saw EBITDA fall from a $30m gain in the first half of FY18 to a $52m loss in 1H19. On the day, the stock fell almost 7% while GNC is currently trading around 20% below this year’s high set in February.

GrainCorp (GNC) Chart

Market Matters Take/Outlook

Market Matters Take/Outlook