GPT mixed results enough for the market

GPT Group +0.52%

The diversified property manager was out with half year results that confirmed the big separation in performance between classes of property through the first half of the year. GPT manage office, retail and industrial space making it a great bell weather for reporting season across the REIT space.

Office: Leasing held up reasonably well in the first half with the portfolio value cut by a slim 1.7%, while 94% of the rent was collected in the second quarter. GPT’s office exposure is high quality, though it currently sits at 94.4% occupied which is on the lower end of expectations.

Logistics: the key winner from COVID related changes to property owners, saw 98% of rents collected while valuations improved +2.3%. over the half. Demand for space remains strong here, with nearly 100% of the portfolio occupied and strong inbound demand for 2 current developments in Western Sydney.

Retail: Where the issues start to pop up with rental collections down significantly to 36% in the 2nd quarter, down from an already weak 90% print the quarter prior. 45% of GPT’s retail book is located in Melbourne so that while the company was heralding its 91% of stores open at 30 June, this number has since slipped considerably. As a result of the confluence of changes, the retail book value was downgraded 10.5% through the period.

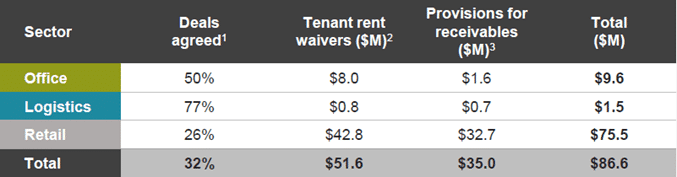

Source; Company

GPT are in the midst of re-negotiating a large portion of its leases with a total of 81% of rent collected over the book, the landlord expects to receive an additional 3% only with the remainder either provisioned for, or lost to new agreements. They announced funds from operations (FFO) of 12.55cps, down 23% on last year despite growth in leasable space. The interim dividend of 9.3cps was nearly a 30% cut to last year. Concerningly, GPT blamed a 25% increase in incentives on successful lease deals, though this is often a leading indicator of further cuts to rent. Despite the dire read, the market was reasonably supportive of the stock today – it currently trades on a steep discount to NTA which came in at $5.52 at the end of the financial year.

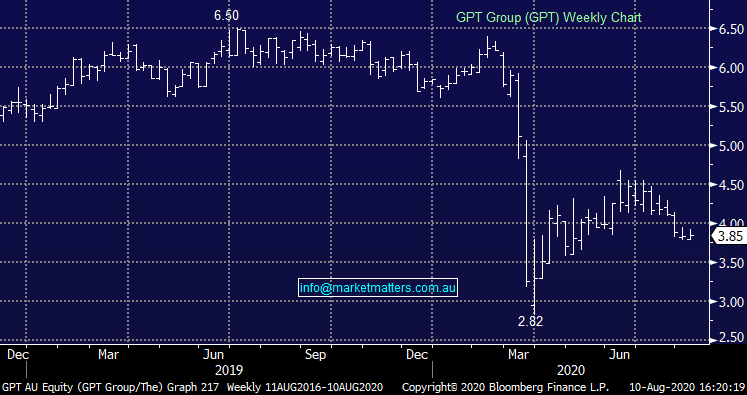

GPT Group (GPT) Chart

Source; Company

GPT are in the midst of re-negotiating a large portion of its leases with a total of 81% of rent collected over the book, the landlord expects to receive an additional 3% only with the remainder either provisioned for, or lost to new agreements. They announced funds from operations (FFO) of 12.55cps, down 23% on last year despite growth in leasable space. The interim dividend of 9.3cps was nearly a 30% cut to last year. Concerningly, GPT blamed a 25% increase in incentives on successful lease deals, though this is often a leading indicator of further cuts to rent. Despite the dire read, the market was reasonably supportive of the stock today – it currently trades on a steep discount to NTA which came in at $5.52 at the end of the financial year.

GPT Group (GPT) Chart