Gold leads the charge today (NCM, VOC)

WHAT MATTERED TODAY

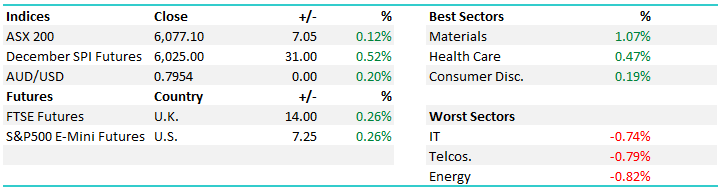

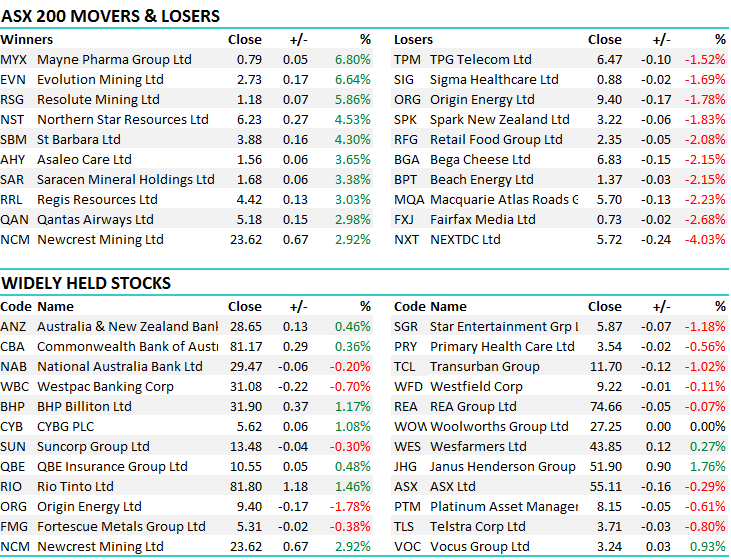

Another day that saw the best of it in early morning trade before sellers started to dominate from around 10.30am onwards. Iron Ore was sold in Asia with Futures trading around 2% lower which prompted a ‘sell the strength’ trade for the commodity stocks – Fortescue gave back early gains to finish slightly lower, while the likes of BHP and RIO finished mid-range for the day – but higher in aggregate. Most love was again in the Gold stocks which have just come off a decent week - Newcrest adding +2.92% today while the mid-caps were led by Evolution (EVN) which ran up +6.64%. More on the gold trade later.

Despite the selloff in Iron Ore after Cyclone Joyce failed to deliver any real fire and fury, the Material plays were still best on ground adding +1.07% while the Energy sector had a breather down -0.82%. An overall range today of +/- 33 points, a high of 6103, a low of 6070 and a close of 6077, up 7pts or +0.12%

**No trade in the US today**

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

CATCHING OUR EYE

1. Newcrest Mining (NCM) $23.62 / 2.92%; Golds were in focus today and did pretty well, largely on the back of 1. Continued selling in the $US and 2. It feels like buying ahead of some event risk, just not sure what event! We often see that Gold is a good leading indicator / canary in the coal mine for some impending weakness and the moves last week were strong + the moves in Aussie Gold stocks were also good today – the big question is where will the selling come from.

The local Aussie mkt looks soft and we can easily see this trend lower – its underbelly seems weak, yet the US market looks exceptionally strong, largely on the back of looming tax cuts that are clearly good for corporate profits and will likely feed to upbeat guidance from the upcoming reporting season BUT potentially more importantly, looming tax cuts have disincentivesed selling strong performing equities. Why sell now and pay higher capital gains tax if you can hold tight and pay a lower amount in the future? Makes sense and helps to explain the unabated rally for US stocks with the winners of the past year or so continuing to drive the mkt higher – however it also provides a good catalyst for selling post the cuts coming in.

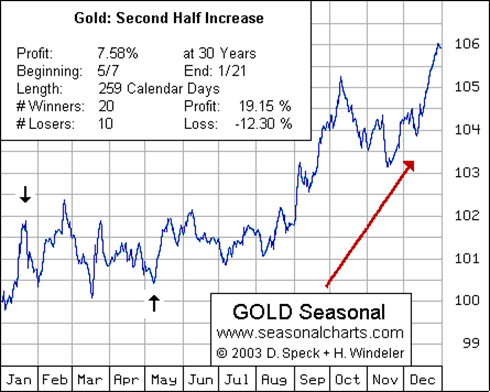

Anyway, back to Gold, from a seasonal perspective, January is strong and usually provides a decent selling opportunity, which is actually the case with the boarder market and we’re certainly conscious of that. In terms of the portfolio’s we manage that incorporate options, we’ve now skewed our options positions to further hedge the downside. We own Newcrest

Gold Seasonality

Newcrest Mining Daily Chart

2. Vocus Communications (VOC) $3.24 / 0.93%; Announced a new divisional operating structure today to hive off their enterprise and wholesale divisions of its Australian business into separate operating segments – the cynic in me suggests that it’s a ploy to refocus the markets attention elsewhere and to confuse analyst models that compare like for like on a rolling basis. If you change operating entities and restructure, it makes that comparison harder. No foundation to that claim of course however I’ve seen that sort of thing before from companies that are struggling in terms of performance. Stock up slightly on the news but nothing to get too excited about…We don’t own Vocus

Vocus Daily Chart

OUR CALLS

No changes to the portfolio’s today…

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 15/01/2017. 5.00PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here