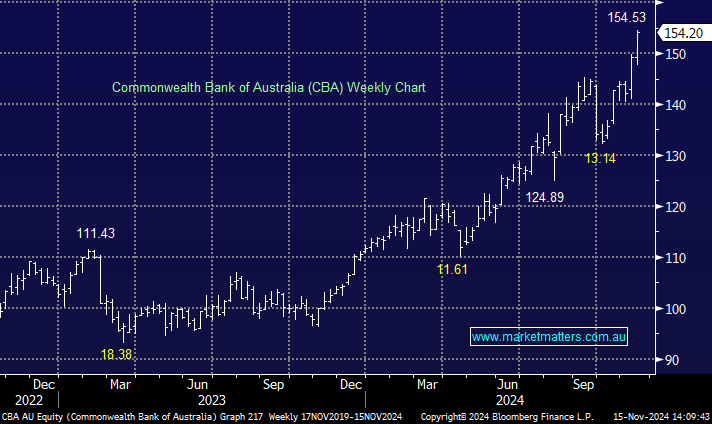

Go with the flow – Commonwealth Bank (CBA) grinds higher on solid result

CBA –0.42%: Released its 1Q25 trading update this week and was ahead of consensus on key metrics but closed slightly lower on a down day for the banks amid full valuations across the sector. There were limited surprises from an earnings mix perspective with most core business functions performing as expected.

- QoQ revenue growth of 3.5%, outpacing FY24 quarters

- Cash profit of $2.5bn for the quarter -mildly ahead of expectations

- Cost growth of only 3%, driving core earnings higher

- Underlying NIM broadly stable

- Loan impairment expense of $160m below expectations – portfolio credit quality remained sound with limited new bad debt

Overall, a very solid result from CBA in line with its big 4 peers also reporting over the past few weeks. While the move was muted on the day, the bank hit fresh all time highs through the end of the week. We might normally see a more positive reaction to such a result, but given the shares are up +10% in the past month, the appetite for the banks on these rich valuations might be starting to wane slightly.

We will stick on the side of momentum for now and continue to hold the stock in the Active Income Portfolio.