Friday weakness resigns the market to a negative week

WHAT MATTERED TODAY

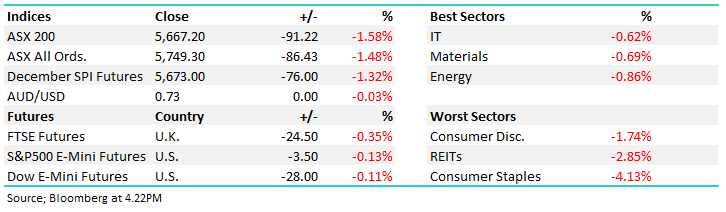

What was forecasted to be a more subdued session today quickly turned into a bloodbath as the market gave back this week’s gains and some. The sharp fall to end the week has been attributed to more push back against BREXIT as well as market fears heading into the G20. World leader’s will begin meeting in Argentina tonight and all eyes will be on the US-China talks with traders taking the prudent approach and taking risk off the table heading into a big weekend of talks. Today’s fall ensured the market ended -49points lower for the week, and a decent -163 point fall for the month of November.

Coca-Cola’s (ASX: CCL) AGM disappointed, and the stock slumped as management pointed to another transitional year for the company. Aristocrat Leisure (ASX: ALL) was also soft as analysts downgraded numbers following yesterday’s FY18 results report.

Overall, the index closed down -91 points or -1.58% today to 5667 and was down -0.86% on the week. Dow Futures are trading down -28 points / -0.11%.

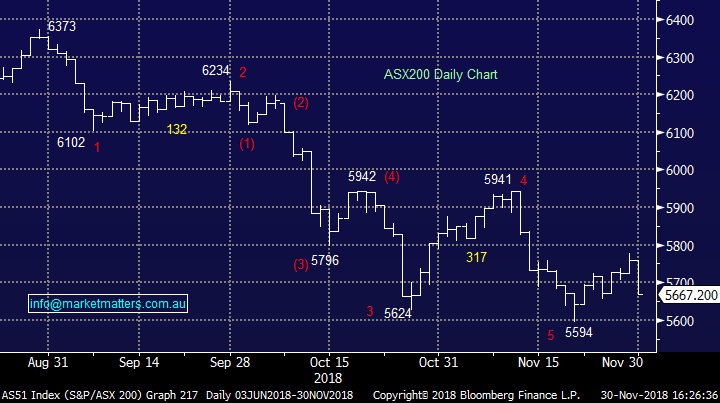

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; Citi group spun a positive story on the banks today, saying that the big four are trading at a 30% discount to the market. The investment bank noted Royal Commission fears and a housing slowdown has contributed to the discount, however they argued the worst case has been priced in, contributing to upside from the banks current prices – a point we agree with at MM.

Sectors this week; the growth names rallied this week despite the soft market as traders pile into the beaten down IT sector.

Stocks this week; Coca-Cola (ASX: CCL) slumped today as management signalled 2019 to be another transitional year for the company as they fight headwinds. Afterpay (SX: APT) got a boost from ASIC helping them top the boards – we spoke about this earlier in the week

During the week we covered a diverse range of topics in our notes, with a number of actionable insights…

Bingo (ASX: BIN) share price falling on ACCC concerns; The Waste Management business has taken another during the week after the ACCC voiced concerns over its proposed takeover of Dial-a-Dump. BIN raised $425m in new capital in August on the expectation the deal would be done, however it seems the market ‘sniffed out’ the ACCC’s reservations and sold ahead of the latest news. click here

Aristocrat (ASX: ALL) posts soft result, shares weaker; Full year profit growth of 34% to $730m was below the markets expectations of $757.8m with the miss attributed to rising costs. The uplift in profits was also supported by acquisitions of Big Fish & Plarium for a total close to $2b. click here

Media stocks are under pressure, should you be buying into this fall? Media stocks have been on the nose recently, with all 9 names in the space falling a considerable amount. Has this created value?– click here

Market valuation; The current price to earnings (P/E) ratio of the ASX 200 is 15.81x however 1 year forward is 14.58x, which is about average. If we apply a PE multiple of 15x on expected earnings 1 year out, we get an index that should be trading at 5892, or 2.86% above where it is today plus dividends of 5% equates to an ~8% return – pretty standard. If we get bullish and apply a multiple of 16x (justifiable given low interest rates), the index should be trading at 6285, or 9.8% above yesterday’s close plus 5% yield equates to a ~15% return. If we look at the collective of analysts target prices and add in forecast yield, the total expected shareholder return is ~16%, but as I say, analysts often drink the coolade and are generally a positive bunch. click here

ASIC give AfterPay (ASX: APT) and Zip Co (ASX: Z1P) a boost; The buy now pay later space was dealt some good news during the week as investors read through ASIC’s latest media release.– click here

OUR CALLS

No changes the portfolios today.

Watch out for the weekend report. Have a great night,

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 30/11/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.