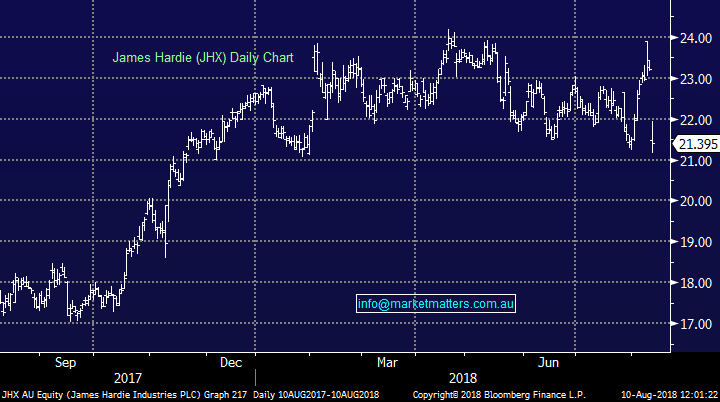

Foundations crumble under James Hardie (JHX)

Stock

James Hardie (JHX) $21.29 as at 10/08/2018Event

Building material supplier James Hardie is the worst performer in the ASX 200 this morning following a weak first quarter update missing expectations and showing signs there is a lot of work required to hit FY19 targets. Despite some impressive growth, EBIT for the quarter reached $US 107.1M, 12.5% below analysts’ expectations of $US 122.5M. Also key to the release was guidance, with the company looking for operating profit between $US 300 and 340M. While consensus falls within the range at $US 331m, the guidance relies on a number of factors outside of the companies control – “housing conditions in the United States continue to improve in line with our assumed forecast of new construction starts, input prices remain consistent and an average USD/AUD exchange rate that is at, or near current levels for the remainder of the year. Management cautions that although US housing activity has been improving, market conditions remain somewhat uncertain and some input costs remain volatile.” James Hardie (JHX) Chart