Flight Centre takes off on profit upgrade

***Market Matters New Income Report – Released Today – CLICK TO VIEW***

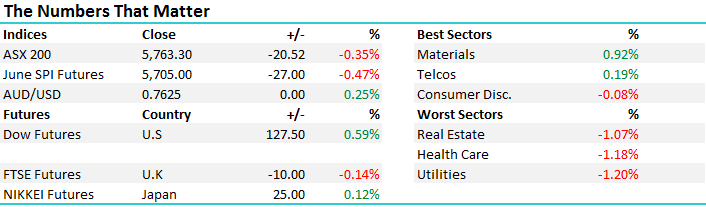

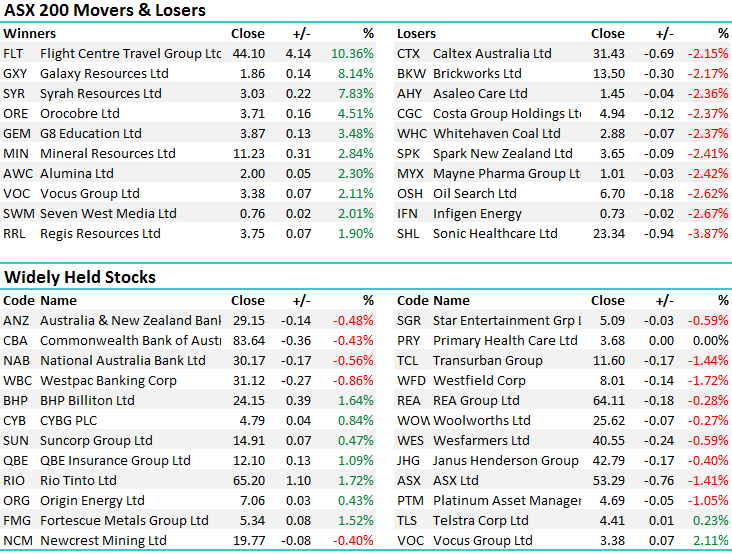

Some consolidation of yesterday’s gains played out in the market today with the Material stocks once again seeing most love while it was the ‘expensive defensives’ that continued to lag. Using Sydney Airports as a classic ‘defensive stock’ and using BHP as a classic risk on bet, SYD has fallen by -7.7% in the last 10 days while BHP has put on +9%. Picking those sort of trends is what the team at Market Matters is all about, and the ‘reflationary trade’ as we’ve called it has further to run. View our resource calls here

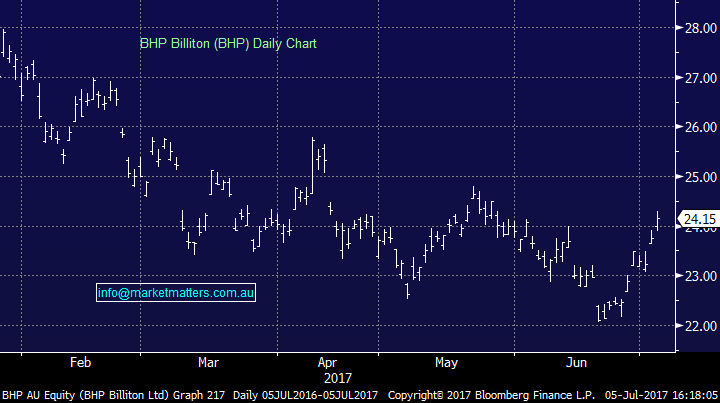

Staying on BHP for a moment, the very well regarded research house in the UK, Bernstein, that is has been a long term bear on BHP has just upgraded the stock to a BUY and this was most likely the catalyst for some strong buying in the BIG Australian today – with the stock closing up by +1.64% to close at $24.15. We own BHP in the portfolio with a 7.5% weighting.

BHP Billiton Daily Chart

On the broader market today, as mentioned, the miners led the charge adding +0.92% while the Untidies were hit hardest, down by -1.20% - an overall range of +/- 35 points, a high of 5790, a low of 5755 and a close of 5763, off –20pts or -0.35%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

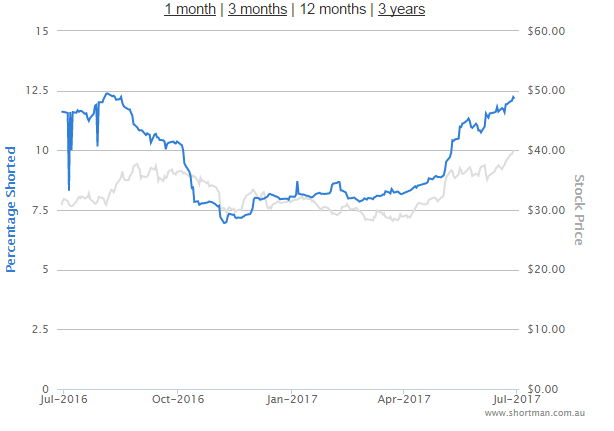

The gong however goes to the much shorted Flight Centre which ripped up by +10.36% to close at $44.10 on the back of a profit upgrade, a rare occurrence for the retailer after 5 consecutive downgrades to earnings. FLT sighted better sales in their international arms, a good online result and said that full year underlying profit before tax is expected to be between $325 million and $330 million, up from its previous forecast of between $300 million and $330 million.

Short positions are BIG in this stock on the imminent doom of bricks and mortar retailing of travel services, with plenty of said shorts now hurting no doubt!!!

If FLT enters an upgrade cycle which is certainly possible given it’s a momentum business (best shown in the 5 consecutive downgrades we saw), then this could really get it’s mojo back.

Flight Centre (FLT) Daily Chart

Alumina (AWC) is a stock we covered in our New Income Report today and it had a reasonable session – closing up +2.30% to $2.00. A recap below.

Alumina (AWC) $1.96 Forecast P/E of 12.5x Forecast Yield of 6.1% FF

Not your typical income stock however AWC, which owns 40% of the world’s largest Alumina business is shaping up to be a very strong income producer over the next few years with the parent company (AWAC) now ex-capex, with high free cash flow, AWC is likely to get a good stream of earnings, 80/90% of which land in investor pockets. 2016 was a big year for AWC with a restructuring of the business, a new CEO appointed and what seems like clear air ahead for this ‘non-traditional’ dividend stock. We are keen on AWC at current levels for income and growth.

Alumina (AWC) Weekly Chart

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 05/07/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here