Equities dust themselves off after a morning rout (CWY, WOR, MTS)

WHAT MATTERED TODAY

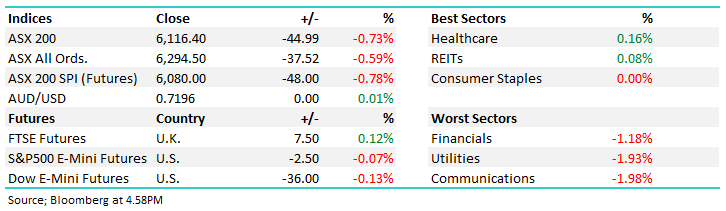

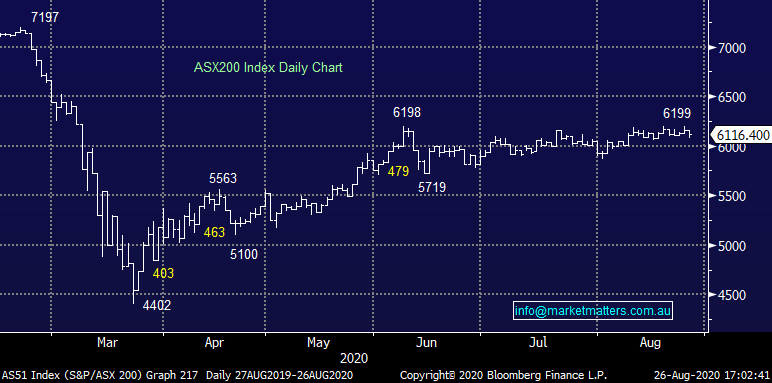

Yesterday’s weakness continued today despite a seemingly strong lead from the US overnight which made fresh all time highs on the S&P. The local weakness topped 120pts in around 26 hours following yesterday’s lunge at 6200 to the midday low today before equities staged a mild recovery into the afternoon. Still the Aussie market underperformed Asian indices throughout the session which traded broadly flat on the day. The market heavy weights – financials and resources – dragged the index, while Telstra’s dividend weighed on the communications sector. Healthcare and REITs the only sectors to finish better. Local construction data was far better than expected, with Construction Work Done for the 2nd quarter contracting just 0.7% compared to expectations closer to -6% though this had little impact on equities at the print. Risk markets now look to Fed Chair Jerome Powell who is set to speak tomorrow in the US, looking for a continuation of the accommodative approach the central bank has taken so far through the pandemic.

Reporting season is in its final throws now. We discussed a number of names in today’s income report, touching on Cleanaway (CWY), Worley (WOR) & Metcash (MTS) below.

Overall, the ASX 200 fell -45pts / -0.73% to close at 6116. Dow Futures are trading down -36pts / -0.13%

LOCAL REPORTING CALENDAR: CLICK HERE **Please note, data sourced from Bloomberg, not all ASX companies are on this list and dates can vary**

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

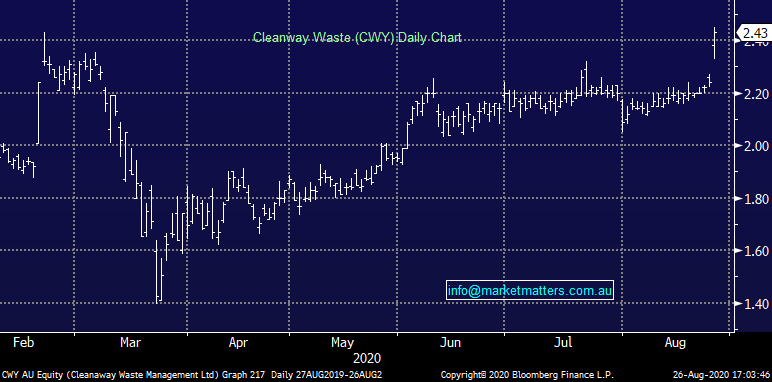

Cleanaway (CWY) +8.48%: followed peer Bingo in beating FY20 expectations. Profit grew nearly 9% to $152.9m, beating expectations by close to 7% while EBITDA margins expanded 60bps to 22.5%. The integration of the Toxfree and SKM acquisitions which helped margins while the push into western Sydney progresses at the company’s EfW project. They declined to give guidance given the uncertainties in the current trading environment, but they did say July was tracking in line with the “FY20 average monthly performance” – the market has FY21 profit marginally higher than FY20 so Cleanaway looked to have started better than expected given the Melbourne lockdown situation. We like CWY, but prefer BIN.

Cleanaway (CWY) Chart

Worley (WOR) +6.37%: delivered a messy result that was broadly speaking a miss. EBITDA at $743m was far below expectations however the numbers were messy given it was the first full year with the big acquisition of Jacob’s Engineering business. The result was hampered by movement restrictions preventing work being completed at a number of sites and on a number or contracts The company won an additional $2b in contracts in the fourth quarter, which was surprisingly strong and in line with the final quarter of FY19. A healthy 25c final dividend was well ahead of expectations which pleased investors.

Worley (WOR) Chart

Metcash (MTS) +2.4%: held their AGM today, providing an update on performance since their April year end result. Food sales continues to grow above historical levels, up 11% in the first quarter of their financial year – this is despite losing the contract to supply Drake’s supermarkets in SA. Liquor is matching the food performance, also up 11% on pcp while hardware is leading the pack at 19%. Costs remain elevated though the numbers prove that the COVID tailwinds remain for now.

BROKER MOVES

- Johns Lyng Raised to Buy at Moelis & Company; PT A$3.20

- Scentre Group Raised to Positive at Evans & Partners Pty Ltd

- Nanosonics Cut to Sell at Bell Potter; PT A$4.95

- Oil Search Raised to Add at Morgans Financial Limited

- Sims Cut to Hold at Morningstar

- Oil Search Raised to Buy at Citi

- Stockland Cut to Neutral at Credit Suisse; PT A$3.96

- Bingo Industries Cut to Neutral at Credit Suisse; PT A$2.40

- Western Areas Raised to Outperform at Credit Suisse; PT A$2.50

- Stockland Cut to Hold at Jefferies; PT A$4.11

- Perenti Cut to Hold at Moelis & Company; PT A$1.33

- Integral Diagnostics Raised to Outperform at Credit Suisse

- G8 Education Raised to Buy at Moelis & Company; PT A$1.38

OUR CALLS

No changes today

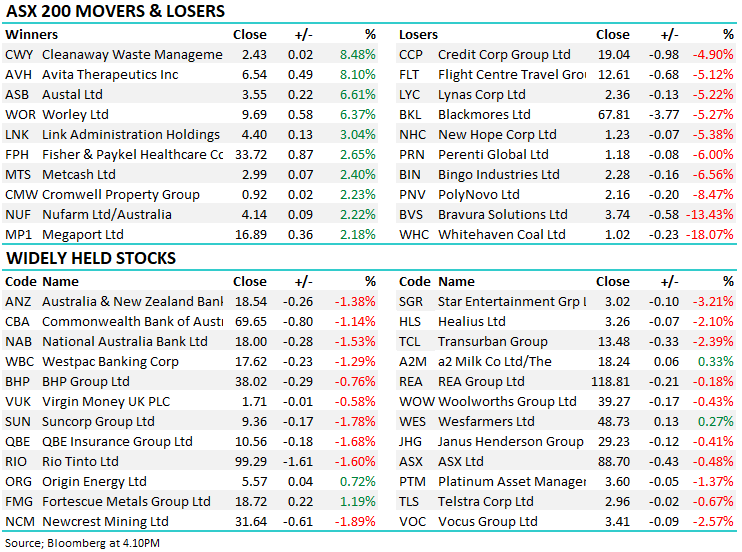

Major Movers Today

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.