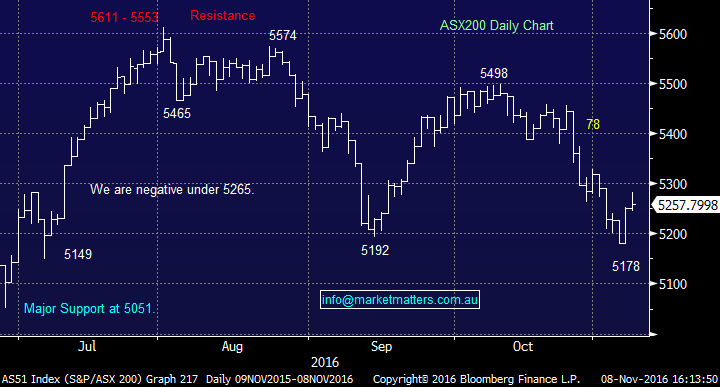

Energy strong again – Banks weak

What Mattered Today

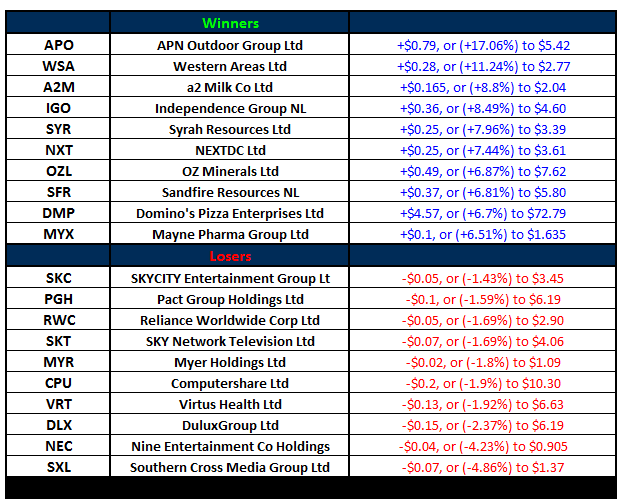

A bit of a nothing session above the water today on the back of the +70pt rally yesterday & the +371pts the DOW put on overnight – Banks the main drag it seemed following a trading update from CBA…more on that below however there were a few BIG moves from individual stocks that caught our eye…

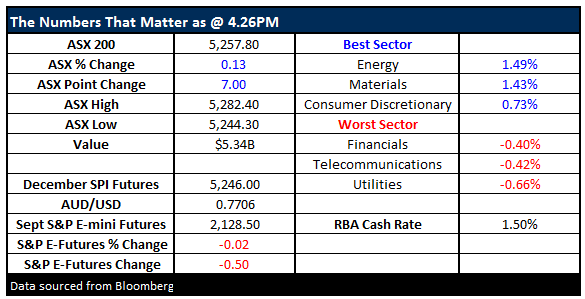

Dominos (DMP) – the tech/food/delivery behemoth was up +6.7% after their AGM yesterday sparked some decent broker upgrades today…DMP was trading at $80.69 in August, dropped 28% to a $58 low last week and is now back above $72. The market loves this stock and it’s priced accordingly although we concede it’s got very good growth (around 30%pa for the next few years). Do you BUY/SELL/HOLD DMP here? At best it’s a hold for us but personally, I don’t get how you justify such a massive multiple for a maturing business that has clear competitive pressures building. Maybe it’s just annoyance that we’re not in it but this volatility is typical of a top forming….

Dominos (DMP) daily chart

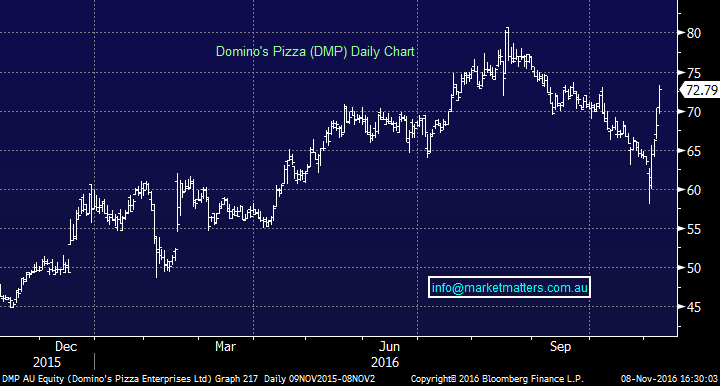

One stock we are in after it dropped ~30% is Healthscope (HSO), which rallied +4.52% today to close at $2.31. We’ve got 5% of the portfolio from around current levels and were looking to top up if it traded sub $2.10 but it hasn’t played out (yet). The investment thematic here remains sounds – aging population, an incentivised government to promote private health, a proven track record etc. When stocks downgrade, they do have to work through some overhang before they pick themselves up off the matt and rally back but we think HSO is worth being in while that plays out.

Healthscope (HSO) daily chart

A few that are struggling to get up off the floor following bad news are Flight Centre (FLT), Star (SGR) & TPG Telecom (TPM)…we wrote about 2 of these stocks this morning but haven’t pulled the trigger on either. With stocks that get hit on 1/ a bad result or 2/ bad external news they can take a while to regain form. Insto’s take some time to sell given liquidity and naturally we have some in there for a short term bounce back and if that doesn’t play out they create more supply of shares which further caps prices.

SGR has been in the ‘sin bin’ for 6 weeks and we’ll be watching the nature of any selling before buying, while TPG looks good on a risk reward basis, but again, we’ve only seen a 7 week decline which feels a little short to us (from a time perspective)

Anyway, we know everyone is sick of the US election (we hear you Helen!!), but it is ‘sort of’ important. Tomorrow we should get a good indication of the result during our own trading day…so we’ll be one of the first markets to react. On most modelling Clinton gets up by varying margins – but the market (post the move overnight) is not mostly factoring this in – which obviously creates a bigger risk if Trump sneaks through.

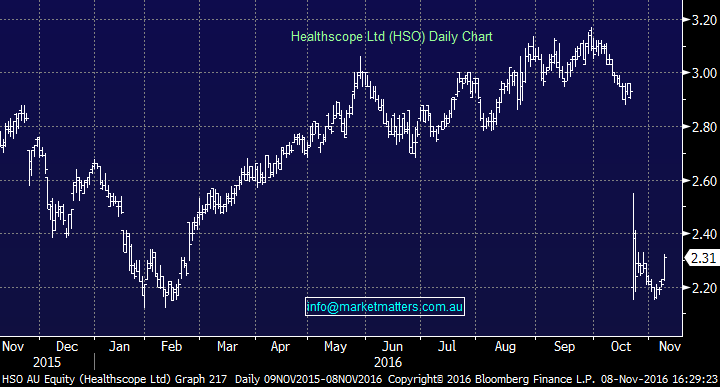

On our market today, we had a range of +/- 38 points, a high of 5282, a low of 5244 and a close of 5244, up +7pts or +0.13%. Value was reasonable at $5.34bn.

ASX 200 Intra-Day Chart

ASX 200 daily chart

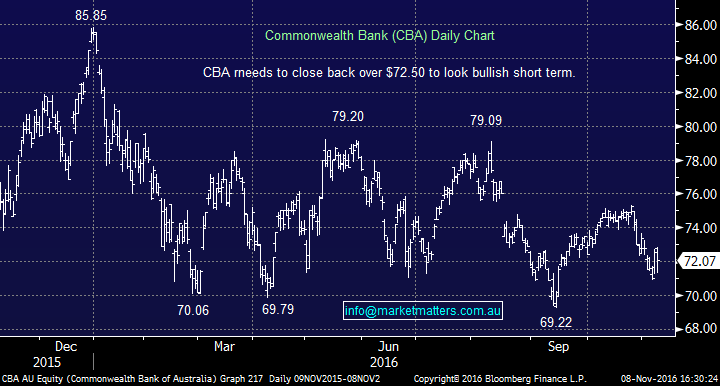

Commonwealth Bank (CBA) & the sector; CBA had their Q1 trading update today which was pretty much inline with expectations –one issue was around margins which has been a headwind for the sector. Higher funding costs, meaning they need to pay more to attract term deposit $$ has had an impact. This will improve as rates go up so nothing in this result, nor the results from the other majors that change our view here. November seasonally weak, so we’ll stay underweight for now BUT will revisit at the end of the month....

Commonwealth Bank (CBA) daily chart

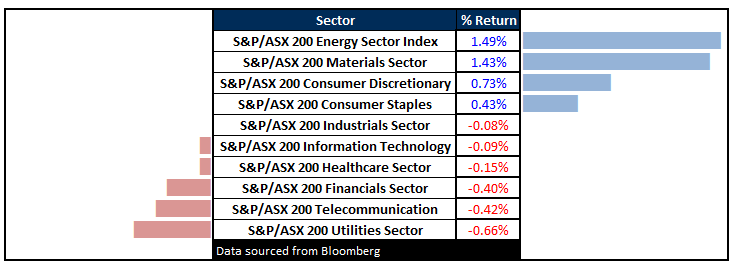

Sectors; Energy the go again today – ORG put on +1.49% while Materials chimed in. The concern for us in terms of Commodities is around the USD. Assume Hillary gets in, US stocks rally but so too does the $US. Seems the market has forgotten they’ll hike rates in December (now an 82% probability) – which should see a spike in the currency from where it’s trading now. Commodities have a had a good run and should cool off if that plays out….Be cautious commods here we think – sell optimism, buy pessimism the key.

ASX 200 Movers – Nickel up +6% last night put a rocket under IGO (which is Nickel and Gold – more Gold now but soon to be more Nickel) while WSA – which is pure Nickel was +11%. APO upgraded earnings after downgrading not long ago – all too hard there for us while the Copper guys saw some love with Oz (OZL) and Sandfire (SFR) well in the green. Oz presented at a UBS conference today and the mkt liked it and this comes on the back of a good trading update yesterday…We’re still overall negative Copper.

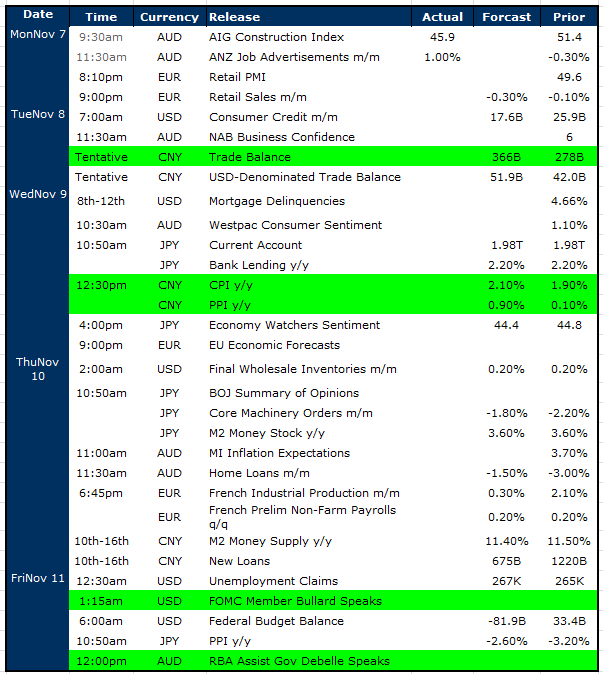

Select Economic Data - Stuff that really Matters in Green

What Matters Overseas

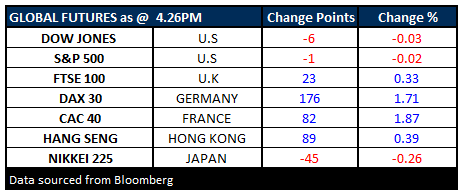

FUTURES muted in the States – Europe playing catch up from last night…

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 8/11/2016. 5.30P.M.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here