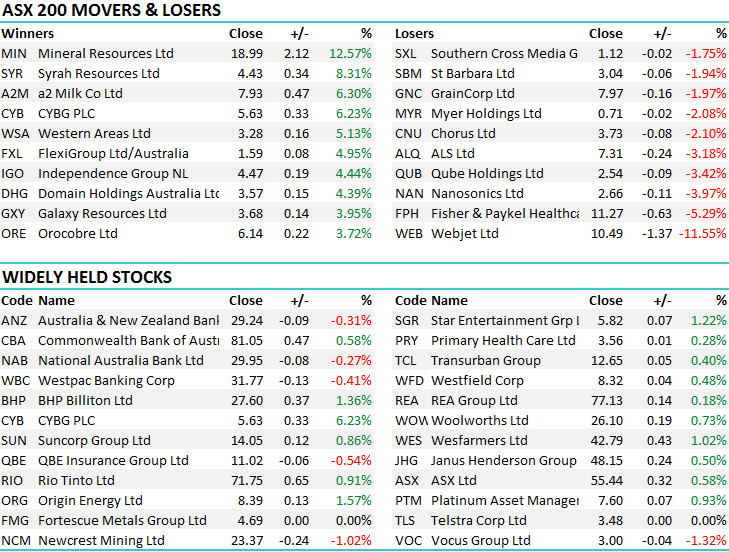

Energy, Nickel the stars in the session – we took a nice +20% profit in A2 Milk today (MIN, WEB, IGO, BOQ, A2M, CYB)

WHAT MATTERED

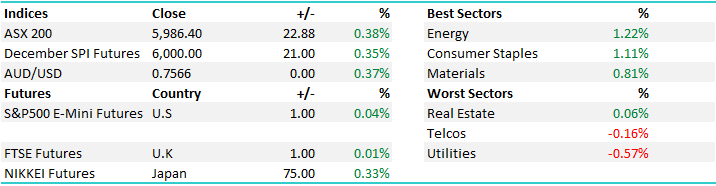

The buyers jumped back on top today with the index seeing strong bids into any weakness – although not enough to see 6000 breached by the close of trade + some decent selling kicked in around the match. The energy stocks did best led by Woodside (WPL) which closed back up above the Shell placement price, +1.49% better at $31.36 – Santos also copping some buying to close up +1.18% at $5.13 – no more news on a bid but buyers still happy to position for one it would seem.

Our target for oil still remains around $70 so looking to up weight in the sector makes sense – BHP still a target into weakness. On the flipside, the defensive sectors, Utilities and Telco’s provided most drag which is understandable given the bullish undertones throughout the session. Still, Thursday is Thanksgiving in the States, so a quiet session Friday and not a lot on the economic calendar to boot – maybe we limp into the weekend from here. Overall, a range today of +/- 27 points, a high of 5998, a low of 5971 and a close of 5986, up +23pts or +0.38%.

ASX 200 Intra-Day Chart – mkts got hit in the match

ASX 200 Daily Chart

TOP STOCKS TODAY

1. Mineral Resources (MIN) – stormed +12.57% higher today on good AGM comments, strong earnings guidance from their crushing business plus of course they have the x factor of the Lithium asset that the mkt likes. This is a ‘cheap’ growth stock, on 16x so about mkt multiple but with a good underlying platform for future earnings. The trend has been exceptionally strong as you can see from below BUT clearly not stretched and the rhetoric was still upbeat.

Mineral Resources Daily Chart

2. On the flipside, Webjet (WEB) disappointed the mkt today with guidance downgrade and this is an example of a stock trading on a reasonable multiple (22x) and struggling to deliver, however the price action over the past year could have told you the stock had lost momentum. Momentum was waning for a while here and best to avoid for now in our view – stock goes lower we think.

Webjet Daily Chart

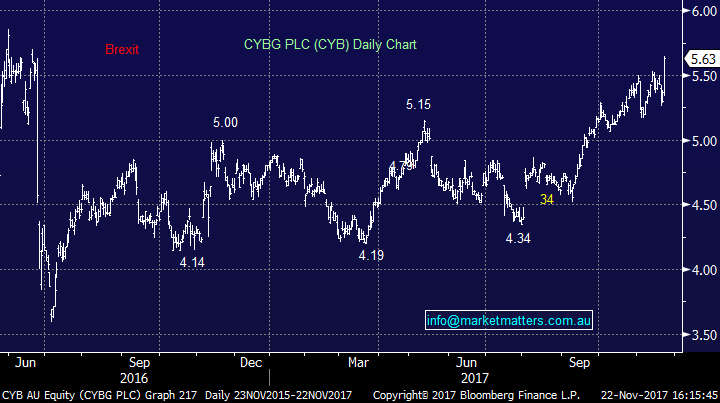

3. We liked the report from CYBG overnight in the UK, with earnings beating consensus by +7% and they topped ours by around 3%. The mkt was a little gun shy early however the result sunk in pretty quickly and buy orders flowed – we added it to the growth Portfolio today with a 5% weighting, taking our BOQ after getting a free dividend. More upside in CYB than BOQ from here given Growth + Costs + Capital Optimisation = share price going higher. Very few Aussie banks have a bridge like this, with 25% CAGR in profits over the next two years and tonnes of excess capital + the macro backdrop that should see UK rates higher which is a BIG boost for CYB earnings – we like the stock and are now back in…targeting $6 at least

CYBG Daily Chart

4. A2 Milk (A2M) – the growth stock of the moment had another good day post their AGM yesterday where they guided to better numbers for FY18 than the mkt had baked in – the stock up +6.3% to $7.93 – and looks like there will be an 8 in front of this one soon – the close today represents all time highs a good 25% bounce from recent weakness.

A2 Milk Daily Chart

5. Nickel is the place to be in the next 12 months or so according to Glencore, with bullish commentary overnight saying that they estimate a 170,000-tonne global nickel supply deficit (it’s only a 2,000,000t market) this year on the back of a 9% increase in demand from the steel sector. The estimate is among the biggest deficit in years and is higher than most deficit forecasts. The supply side is tight and the demand side is clearly building in Nickel and the two plays to look at on the ASX are Western Areas (WSA) and Independence Group (IGO) we own IGO and the stock looks good here – happy holders for now. IGO closed up +4.44% to $4.47

Independence Group Daily Chart

OUR CALLS

We sold our 3% holding in A2 Milk (A2M) at $7.84 today locking in a ~20% profit in the last two weeks. The performance in this business is clearly strong, however we think volatility will start to creep up and better risk / reward opportunities will present themselves in the future. Given we have been keen on CYBG for some time, and post the report overnight, we wanted CYB added to our overall banking exposure and in fairness, regret selling our previous holding.

As we suggested in the alert today, remaining open minded is clearly key in this type of environment and we demonstrated that in today’s switch in the Growth Portfolio, selling Bank of QLD (BOQ) to fund a 5% allocation into CYB. BOQ is showing a ~4% profit inclusive of the recent dividend and we see better opportunity at the stage in CYBG in terms of capital upside.

The Income Report today looked at the Wealth Sector which is an area we like – in terms of growth more so that income however Perpetual is starting to come back into a reasonable area – now on our radar for a BUY in the MM Income Portfolio.

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 22/11/2017.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here