Employment remains strong, although analysts not convinced (PGH, ECX)

WHAT MATTERED TODAY

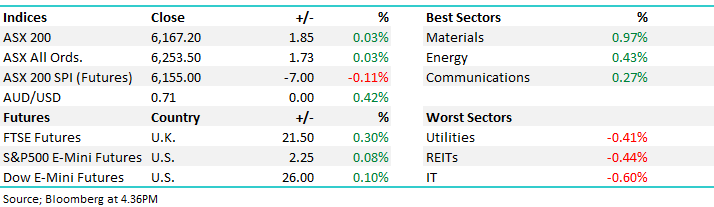

I feel like we’ve written about choppy sessions all weak however today was another one where the market traded in a reasonable range but had various periods of decent selling only to see some aggressive buying come into weakness – Futures led again by the look – big volume through on the buy side between 3.30pm & close which dragged the market +31pts up from the intra session lows – a big aggressive move and volume overall was high today – about $8bn through the bourse.

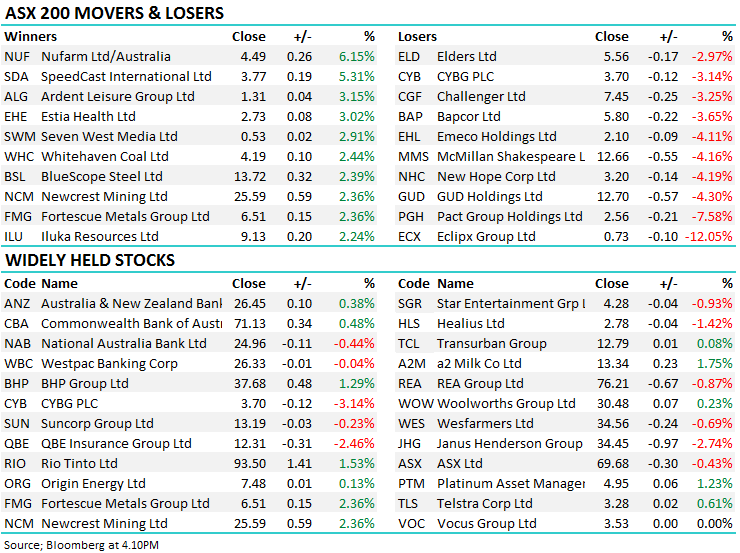

Materials bounced back today after yesterday’s sell off to lead the gains – Fortescue (FMG) led the weakness yesterday but bounced hardest today adding +2.36% to close at $6.56, BHP +1.26% & RIO +1.53% while 3 of the big 4 banks ended higher – NAB the only laggard on the day.

The US Federal Reserve was again very dovish early this morning our time keeping rates on hold – no change was expected however the commentary now calls for stability in rates for the rest of 2019. More importantly though, the Fed now plans to maintain rather than reduce its balance sheet which will obviously improve liquidity making financial conditions easier. US Futures were marginally higher throughout our time zone while Asian markets were largely in the green.

Overall today, the ASX 200 added 2points or 0.03% to 6167. Dow Futures are up +30pts / +0.12%

ASX 200 Chart - Big pop in last r

ASX 200 Chart

CATCHING OUR EYE;

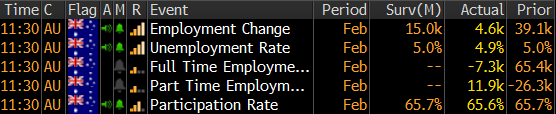

Local employment data out today showing the unemployment rate fell 0.1% in February to an eight-year low of 4.9% however the participation rate was lower which drove the move.

Employment data

Strong employment data is underpinning the RBA’s decision to hold rates firm at 1.5% however the majority of analysis suggests that’s a temporary thing, employment will soften and the RBA will be forced cut however the AUD remained firm on the news trading up at 71.44c…the battler continues to battle on.

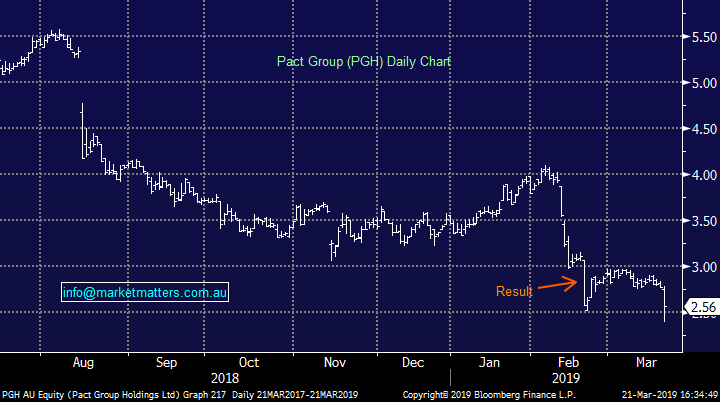

Pact Group (PGH) -7.58% is a stock we own in the Growth Portfolio and it was hit today trading to a low of $2.39 before closing at $2.56. UBS handled the sell down of a $65m line of stock at a ~9% discount to market – about 7.5% of the company. This stock is controlled by Raphael Geminder and there’s been continued talk about a privatisation and this is a another sign that it could be on the cards. Presumably, any privatisation would need to be at a higher level, and today’s low looks like a good one. While we’re now in the red on the position, and more info regarding the block trade will no doubt come out, this has now gotten a lot more interesting and we add to our current small ~2% position

Pact Group (PGH) Chart

Broker Moves: Citi going out on a limb to upgrade ECX to a BUY with a $1.29 PT – although the stock continued to slide today down another 12% to 73c

Upgrade to Buy, But Clearly High Risk — Just seven weeks after Eclipx guided FY19e NPATA to be “broadly in-line with reported FY18 NPATA”, it has retracted that guidance and disclosed that NPATA for the 5 months to February was down - 42% which resulted in the stock closing down -56% at $0.83. Notwithstanding the headwinds facing Eclipx, we feel Eclipx is oversold. We upgrade Eclipx to Buy, acknowledge ambiguity exists and add a High Risk to the rating, lower our FY19e- FY21e NPATA forecasts by -28% to -31% and lower our target price -46% to $1.29 (source Citi)

· Cochlear Downgraded to Sell at Deutsche Bank; PT Set to A$157

· Healius Upgraded to Buy at Deutsche Bank; PT Set to A$3.01

· Nufarm Upgraded to Add at Morgans Financial; PT A$6.30

· Nufarm Downgraded to Neutral at JPMorgan; PT A$4.50

· Eclipx Upgraded to Buy at Citi; PT A$1.29

· Synlait Milk Upgraded to Buy at Goldman; PT NZ$11.60

· Independence Group Cut to Hold at Argonaut Securities; PT A$4.90

· OZ Minerals Upgraded to Buy at Argonaut Securities; PT A$10.60

· Regis Resources Cut to Hold at Argonaut Securities; PT A$5.40

· Doray Cut to Hold at Argonaut Securities; Price Target A$0.48

· City Chic Collective Ltd Rated New Buy at Baillieu Holst Ltd

· Money3 Rated New Buy at Baillieu Holst Ltd; PT A$2.55

OUR CALLS

No changes today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 21/03/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence