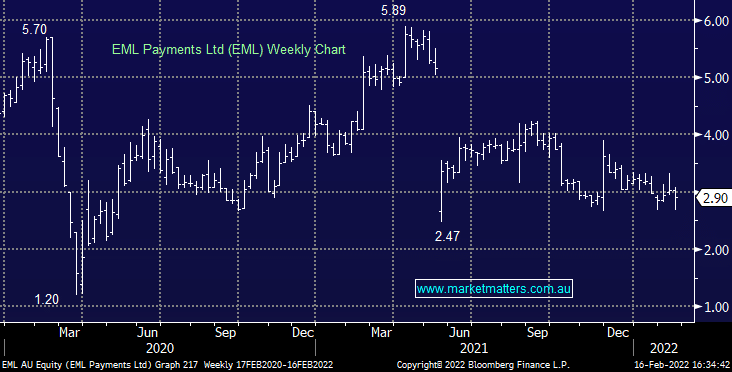

EML Payments (EML) shares slide after soft 1H

EML -3.97%: a choppy ride for the payment solutions business today on the back of a mixed 1st half result. Revenue of $113m was a slight miss, EBITDA fell 4% to $26.9m but they maintained full year guidance of $58-65m in EBITDA which will require a big second half to reach. The positive news is that the sales pipeline is growing, up 30% in the half to $13.6b and they are starting to see more establishment fees coming through. They are also leveraged to higher interest rates – for every 1% hike across all jurisdictions, EML expects to add $14-15m to EBITDA and while this is unlikely to come through near term it does provide ‘free’ growth over the medium term if and when central banks move. Shares recovered strongly off the lows today. Guidance doesn’t look too far out of reach but I suspect many analysts will take a conservative view for now.