EML on track despite Gift card hit

EML Payments (EML) +12.77%: traded to a 10-week high today, now 300% higher than the low set in March. They provided a trading update talking to the impacts of COVID-19 as well as the completion of the PFS acquisition in April. With EBITDA at $27m through the first 9 months of the year, EML is on track to exceed the $35m expected by the market however a large portion of earnings comes from gift & incentive which has fallen substantially given the closure of retail stores across EMLs 1,100 programs. G&I saw a 29% fall in March into a 53% fall in April based on last year’s numbers, with uncertainty remaining around the rebound in Gross Debit Volume.

Post the acquisition, EML’s General Purpose Reloadable (GPR) business counts for more than half of revenues. This side of trade has yet to see significant impacts given the stability of the salary packaging vertical offsetting a small drop in online gaming GDV. All in all a reasonable announcement and the market enjoyed the focus on diversified earnings of the company. EML did flag insider selling of stock with the Chairman set to sell over $1m worth of shares in the coming weeks. Despite this, we do like the business, potentially one to pick up on any weakness on the back of the selling.

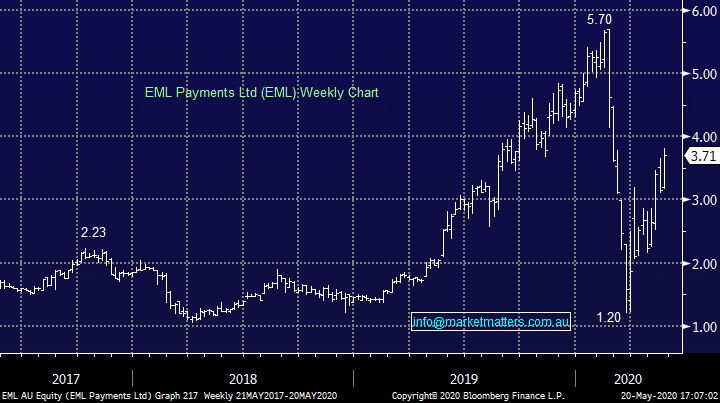

EML Payments (EML) Chart