Earnings season hots up….

After yesterday’s strength the market came back to earth today with some selling in both the banks and resources, while a number of the companies that reported earnings yesterday / today had big share price reactions – Mortgage Insurer Genworth for instance on the upside after announcing a big share buy-back ($100m) while Resmed copped a hiding after showing lower growth than its 26x multiple would like – the stock down -5.69% and it’s just another example of highly valued healthcare stocks struggling. They’ll be a time to step back into that sector, however we’re not there yet.

Elsewhere CYBG, the old Clydesdale Bank (CYB) had a great session adding +7.27% to close at $4.72 – back up above our original buy price after the stock had dealt us some pain in recent times. They delivered a quarterly trading update showing margins up, volumes were good, loan losses down while they’re travelling ahead on their cost out story. The weak pound is providing a bit of a headwind however the trends in the underlying business remain positive. We continue to like the story, own it in the Growth portfolio and todays result and share price reaction is pleasing.

CYBG Daily Chart

Rio Tinto has dropped with their 1H result and they’ve missed in terms of earnings but other metrics look OK; 1H underlying earnings came in at $3.94b versus the mkt expectations of $4.26b, however they now plan to return $3b in cash to shareholders, which represents 75% of 1H underlying earnings. They said in Feb that total cash returns to shareholders over longer term will be 40%-60% of underlying earnings and they’ve just re-jigged this number fairly sharply. The interim dividend is $1.10/share – the biggest interim divi in RIO’s history, or $2b and they also increased the current buyback by $1b of their London listed shares.

Clearly RIO have a lot of cash + they managed to reduce their net debt by $2b giving them a net gearing ratio of just 13%, which is a lot lower than the 20-30% they guide to + they still see $5b in additional free cash flow by end of 2021.

Share price reaction will be interesting – not sure if the mkt will focus on the earnings miss, or the strong underlying metrics of the business & increased buy back. We own RIO in the Growth Portfolio

RIO Tinto Daily Chart

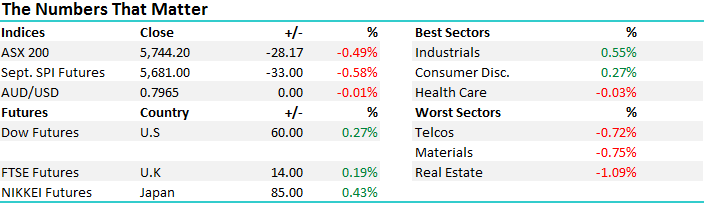

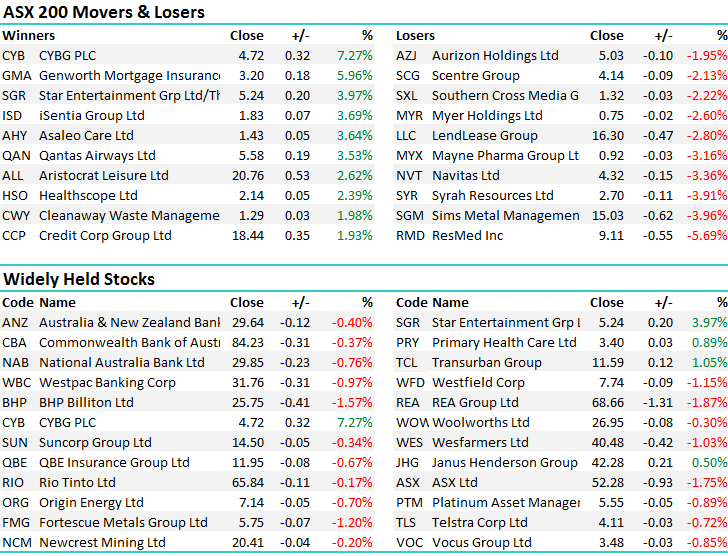

On the broader market today, the Industrial stocks did best, Qantas a clear standout adding +3.53% following weakness in the Oil price overnight, while the Real Estate stocks were hit hardest - an overall range of +/- 41 points, a high of 5779, a low of 5738 and a close of 5744, off -28pts or -0.49%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 02/08/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here