Demerger talk sparks rally in BHP

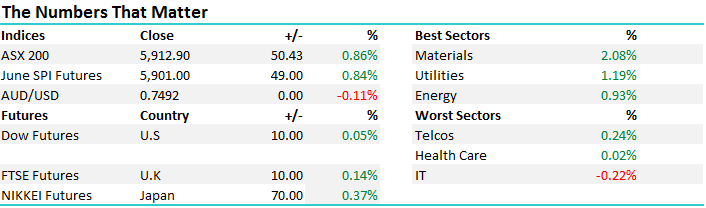

A very interesting session for Aussie stocks with the market opening higher but getting more bullish throughout the day with talk of a BHP demerger putting the cherry on top of the cake! We saw a range of +/- 46 points, a high of 5912, a low of 5866 and a close of 5912, up +50pts or +0.86%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart – Todays close over 5890 is very constructive and we are now targeting 6000 in the near term

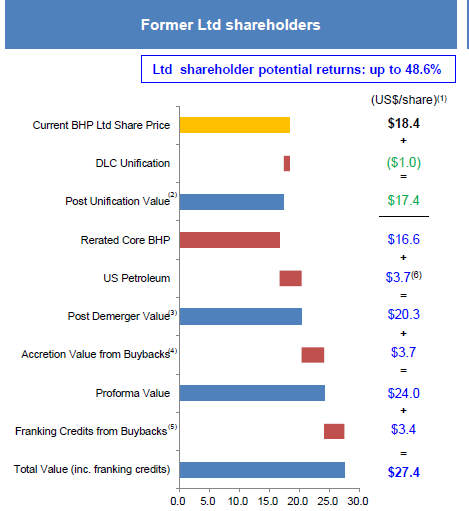

BHP – the BIG mover late in the session with the stock putting on ~+$1 in the last 20mins of trade following a press release from Elliot International, a U.S based hedge fund that speaks for 4.1% of BHP stock, outlining what they call a ‘value unlock’ plan for BHP . They have created a website, sent a letter to BHP Directors and articulated a path that – on their numbers could increase the value of shareholdings by ~50%...here’s a quick overview

1. Dual Listed Company structure should be collapsed – simplifies and sole listing in Australia

2. Demerging US petroleum assets to be spun off

3. Capital management targeting Australian shareholders only to enable “franking credit unlocking” by way of Off market buy backs.

4. Current structure highlights the lack of contribution for the “old Billiton” = some LATAM copper and coal assets (Australian and Colombia).

Source; http://www.valueunlockplanforbhp.com/

The presentation details BHP’s relatively poor performance in recent times and sets out a plan for unlocking shareholder value through a staged three step process. More details can be found on the website above, however clearly this is a very well researched take on the future of BHP. The market liked the proposition and we saw some very big lines of stock trading in the last 15mins and in the match + we also had some very big option lines go through after the announcement.

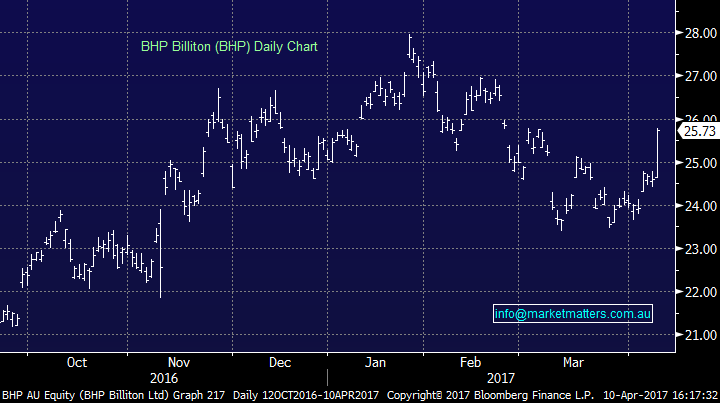

As shareholders of BHP, we like this sort of activism and critical evaluation of the status quo. Often companies find themselves with a structure / suite of assets that have been acquired over time, and may not be optimal now. They might have legacy structural issues, legacy projects that get ‘managed’ at best, but don’t offer a lot to overall performance to the group. Management / the board simply don’t want to rock the boat / generate extra work by undergoing a big corporate restructure + it can be very expensive. This is all understandable and we’re not suggesting this is the case with BHP , however it’s something to ponder. No doubt more to come on this proposal from Elliot and we wait to see how this all plays out, content that we have 5% of our portfolio in the stock. BHP closed up +4.64% to $25.73

BHP Daily Chart

Vocus (VOC); Clearly the thorn in our side for some time was sold today, with 5% of the portfolio switched into CYBG. As we wrote in the alert that went out today, this has been a very disappointing position however given the developments last week, we feel it is best to cut our position and move on. We tolerated a number of earnings downgrades following issues with the integration of Amcom, M2 Telecom, NextGen and others, and we see continued risks around earnings in the near term.

The stock is cheap relative to the market and the sector, however the risks around it have incrementally grown with each negative piece of news. Last week it was a competitor announcing plans to build a new subsea cable between Australia and South East Asia, directly competing with VOC’s Australia Singapore Cable (ASC). This compounds existing uncertainty created by the NBN on pricing, churn, margin compression, new entrants entering the market and turnover of key staff.

We have given this position a lot of room in the last few months, too much in hindsight and unfortunately it has failed to improve. For these reasons, we are taking our medicine and cutting the positon from the portfolio. We sold today at $3.77

Vocus Communications (VOC) Daily Chart

CYBG (CYB); The UK bank spun out of NAB in early 2016 looks appealing and today we allocated 5% of our portfolio to the stock. In simple terms, the stock trades at a steep discount to peers, has a lot of available leverage by stripping out currently high cost structures (cost to income ratio around 74%, with the company targeting ~50%), is leveraged to higher interest rates and an improving UK economy. Technically, the stock looks strong and we see better risk reward by purchasing CYB than was obvious by Vocus, hence the switch.

CYBG Daily Chart

Have a great night,

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 10/04/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here