CYB Breaks out, TLS finds support, Amazon stirs the market while the ASX fails 6000 again (TLS, CYB, GSW)

WHAT MATTERED TODAY

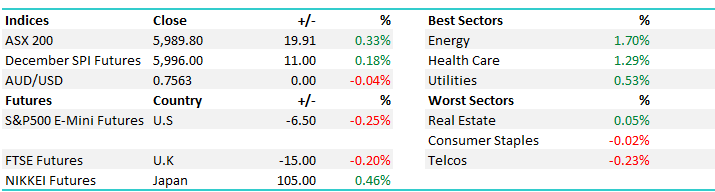

The best of it was seen early on today with the market opening strong before sellers came over the top from around midday. A move of +20pts (0.33%) locally today is a weak effort given the +300pts (1.3%) we saw on the Dow overnight – still, a reasonable way to end the week. We continue to think that a pullback down to sub 5900 is the likely path for Aussie stocks into the start of November, before strong seasonality takes hold towards Christmas. A reasonably active week for the MM Portfolios with a repositioning to take advantage of higher interest rates within the income portfolio, while we took a nice profit in Aristocrat within the Growth Portfolio.

6000 once again seems to be an issue for the market, as strength was sold into sending the market down 20points from its highs. CBA was one of the main detractors here, testing the $80 mark early before closing lower as sellers kicked in around 12.30pm. Interestingly, CBA was the only major bank to finish lower today, clearly the market expects the Royal Commission to hit CBA the hardest.

On the mkt today, Energy did best while most weakness was felt in the telco space - a range today of +/- 36 points, a high of 6011, a low of 5975 and a close of 5989, up 20pts or 0.33%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

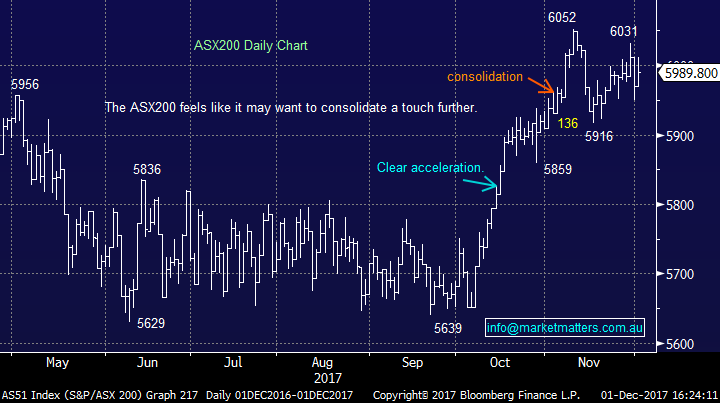

As suggested above, some higher than usual activity across our portfolios this week, with all activity across our portfolios outlined below;

TOP MOVERS

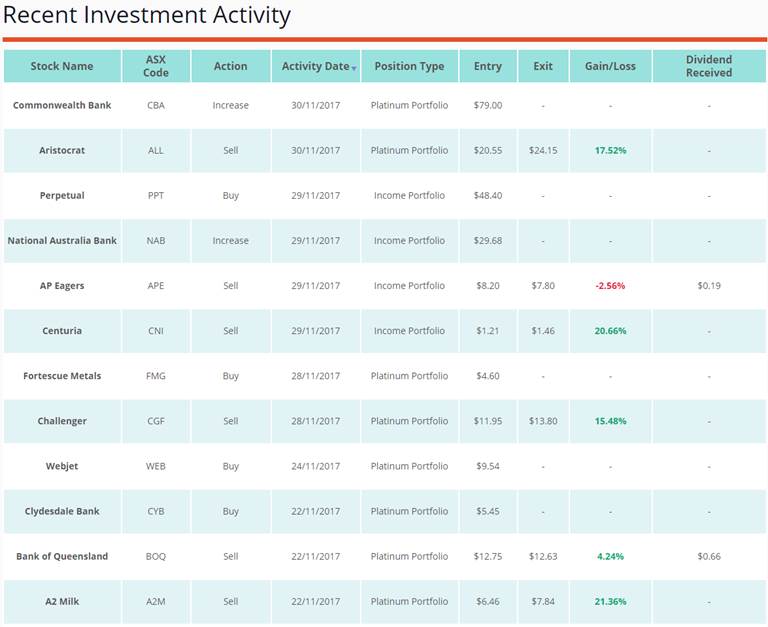

1.Telstra - This morning Telstra downgraded FY18 numbers by ~6% on the back of delayed NBN one off payments after the announcement earlier this week that HFC line NBN connections will be reworked. A sizeable near term downgraded, however the payments are still built in to Telstra’s profits, and will flow through to the bottom line in FY19 and beyond. On the back of some bad news, TLS only fell -0.3% to $3.42, and with the risk of sounding like a broken record, a market that does not fall on bad news is a strong market.

Telstra (TLS) Daily Chart

2. CYBG – Clydesdale continued its strong rally today, and despite finishing a long way from intra-day highs, was one of the best performing financials today. The developments around the intricacies of Brexit continue to be more positive than the market has expected, and as expectations around rising British interest rates, and so to the British Pound, trading conditions for CYB improve. Momentum in CYB remains, which we hold in the MM Growth Portfolio, closing 1.8% higher today.

Clydesdale (CYB) Daily Chart

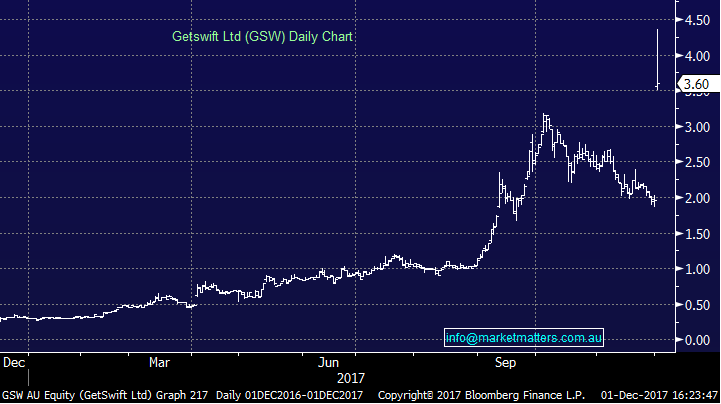

3. Getswift – GSW more than doubled this morning when news broke of a “global agreement” with Amazon. The details of the agreement are yet to be released, but despite the lack of detail, traders jumped into the stock without hesitation which was placed into a trading halt after trading for only 10 minutes this morning The logistics company is yet to finalize terms with Amazon, nonetheless this seems to be the buzz word in the market these days and speculation runs high for any company involved with the global conglomerate. GSW is one to watch, already jumping 1100% year to date.

Getswift (GSW) Daily Chart

OUR CALLS

We revised our SELL level this morning for Nanosonics to $2.69. the stock was up +4.7% today and will continue to remain patient here on our exit. NAN is a position we re-evaluate on a daily basis and today’s move shows that we should be patient with our exit, looking to reduce the loss as much as possible.

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Wednesday or Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 01/12/2017. 4.20PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here