CSL upgrades guidance – keeps the market in the black + Santos SPP

What Mattered Today

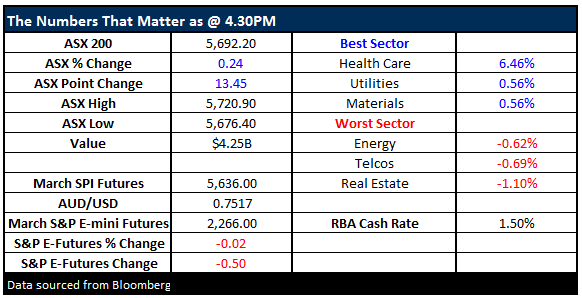

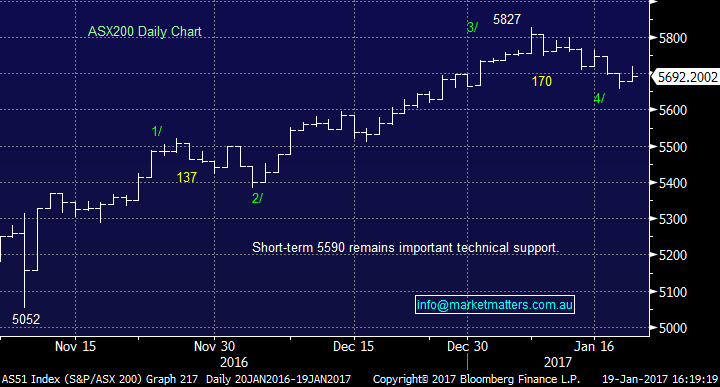

Another mixed bag on the market today with the optimism that was obvious in December / early January fading somewhat. For December the ASX 200 put on ~4% from 5440 before peaking on January 9 at 5827 – a run of +7% however the market is now in corrective mode and we’re somewhat 50/50 in the short term. Today’s close of 5692 (up +13pts) means the mkt is now down ~2.3% from the highs so nothing big / concerning. CSL rallied +12.49% today after upgrading earnings guidance (more on that below) and that added 18.6 index points to the 200. Without CSL, we would have been in red with both BHP and RIO reversing from their early highs, the banks down in aggregate and the Gold stocks pulling back after recent strength.

On the market, we had a range today of +/- 44 points, a high of 5720, a low of 5676 and a close of 5692, up +13pts or +0.24%.

ASX 200 Intra-Day Chart

ASX 200 Daily chart

CSL; Rallied hard today after upgrading earnings guidance from +11% profit growth (constant currency) to +18-20% profit growth, largely on the back of strong sales in a number of their products. Obviously good news for CSL and the Market Matters portfolio given we had a 10% allocation to the stock. We’ve used the strength to trim by half at $111.00 and will be holding for higher levels on the remaining allocation. CSL is a hard stock to trade given liquidity and a lot would have gotten bearish / short CSL when they missed market expectations for earnings back in August 2016. A high PE stock that misses / fails to deliver growth often becomes a target until they get back on track – which CSL clearly has done today.

CSL Daily Chart (CSL)

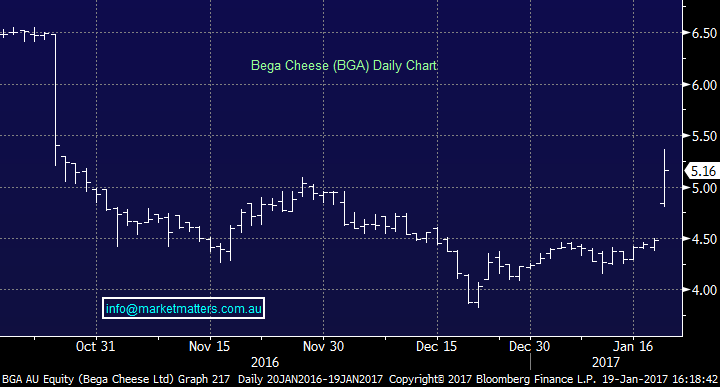

Bega (BGA); Nothing goes better than Cheese and Vegemite and Bega today announced a $460m deal to buy Vegemite and other Kraft branded products bringing the iconic brand back to Australia. It’s hard to see where the growth will come (other than normal population) growth given they’ve often failed when trying to leverage into new products (Cheesymite ring a bell!!). Anyway, BGA has been short of growth options with the stock price down 40% from October to the start of December – this deal should help and the market liked it sending shares up +15%.

Bega Cheese (BGA) Daily Chart

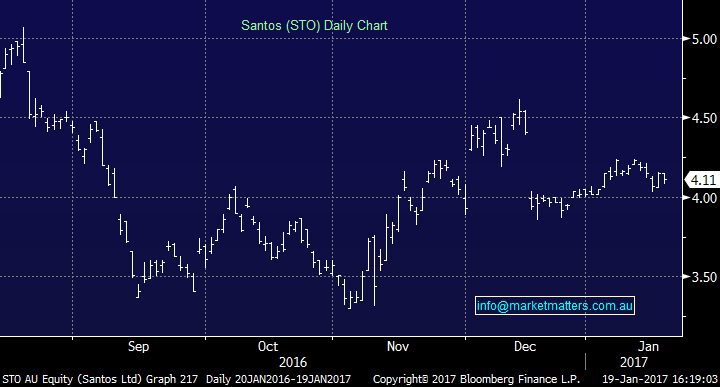

Santos (STO); Clarification from yesterday’s report; We outlined the metrics for the Share Purchase Plan (SPP) and omitted one important element of the offer. For clarification, the structure of the SPP includes a safeguard for retail investors with new stock being issued at the LESSER of a 2% discount to VWAP during the offer period or $4.06. The most therefore that a shareholder will pay is $4.06 per SPP Share. Importantly, this does not change our view on the stock.

Santos (STO) Daily Chart

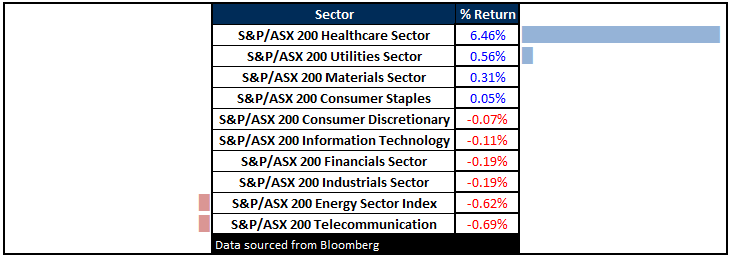

Sectors

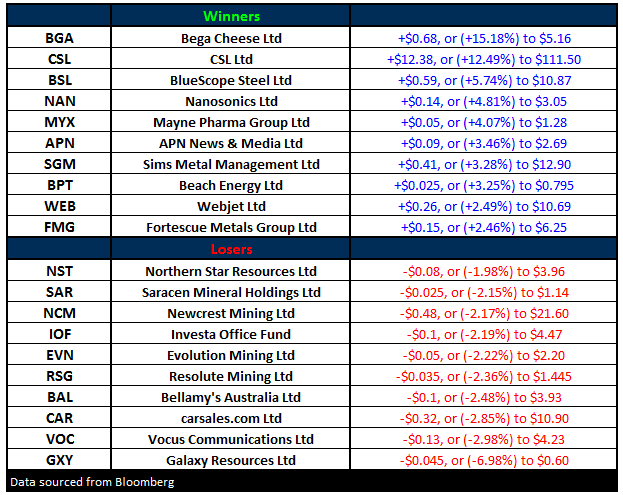

ASX 200 Movers

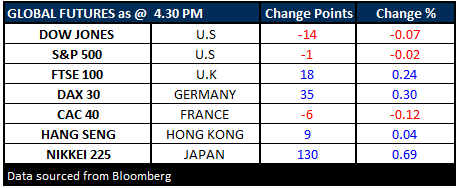

What Matters Overseas

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 19/01/2017. 4.45PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here