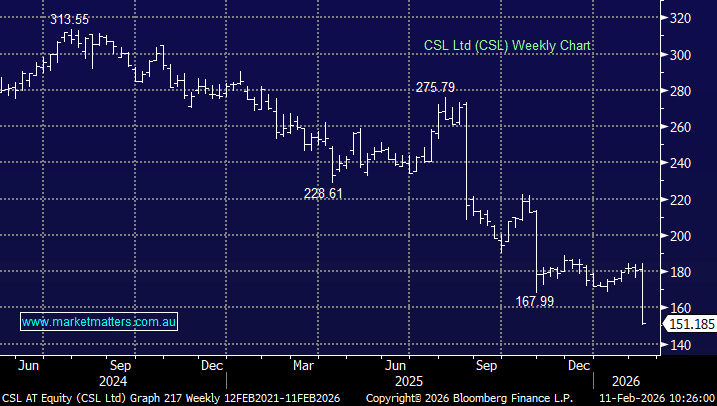

CSL plunges another 12%, is it time to buy?

CSL Ltd. shares have tumbled after the market appeared to focus on the biotech’s 81% decline in first-half profit, as opposed to their reaffirming FY26 guidance – it’s been a “glass half-empty” reaction, easy to comprehend following the strangely timed exit of CEO Paul McKenzie around 4pm yesterday:

1H26 Highlights:

- 1H revenue $8.3bn v estimated $8.46bn.

- NPAT (adjusted) $1.95bn v $2.07 YoY, but pretty much inline with $1.96bn expected

- Share buy back expanded from $US500mn to $US750mn.

- Dividend $1.30m v estimated $1.33.

They maintained their FY26 guidance which is for adjusted earnings (NPATA) to be up 4-7% for the year, with the market (consensus) currently at +5.5%, though they clearly have a lot of work to do in the 2H to achieve that result, and we suspect they’ll be some caution given the abrupt change of leadership.

- We suspected some weakness early today, but not over 10%, now it will be up to how well the message is received in their earnings call today.