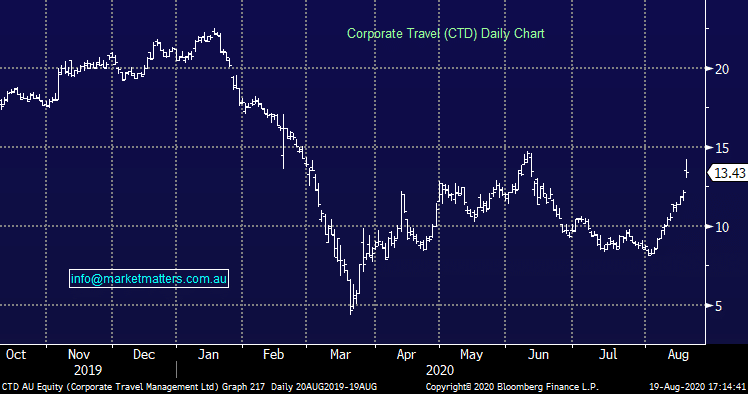

Corporate Travel (CTD) shows significant impact on virus

Corporate Travel (CTD) +10.63%

A stock we wrote about favourably earlier in the week as a leveraged play on a vaccine / economy reopening and today they delivered a better result than downbeat expectations. Revenue was $349.9m v $331m expected, underlying NPAT wad $32m v $31m expected and they talked to a strong level of client retention (97%) and winning of new business in all regions they operate in. 4Q20 performance was better than they guided to in May, they lost $3m a month on average v the $5-10m they were expecting with net cash sitting at $55m as at the 17th August v $60m at end of June. While a long road to recover awaits, we like CTD’s low fixed cost business model and exposure to essential business related travel, although conceded that we’re now in a new world where a combination of Zoom + face to face will be the future…

Corporate Travel (CTD) Chart