Comyn gets the nod for his first result in charge of CBA

Stock

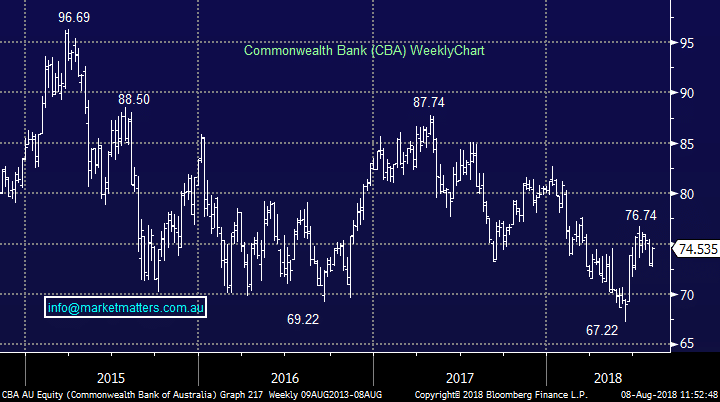

Commonwealth Bank (CBA) $74.54 as at 8/08/2018Event

The CBA result was out this morning and it was messy however that was to be expected amid charges from the money-laundering settlement, margin pressure from short-term funding costs (CBA have not repriced loans higher) and the overall financial cost of ongoing regulatory issues. Actuals v expectations – about inline Underlying trends Loan growth: running at 2% for the FY18 financial year for the bank and its Australian business Margins; the Australian loan to deposit spread fell by 2 bps from 1H18 to 2H18 and so did the net interest margin, expect some re-pricing up of CBA mortgage rates Credit Quality; this was better with new and increased impaired assets falling from $1.25B in 1H18 to $882M in 2H18 plus we saw past due loans remain stable Trading Income; this was weak however that was well flagged Costs; overall costs were higher thanks to one offs however costs in the underlying business are being well managed (ex Capital; Tier 1 capital remained flat at 10.1% Commonwealth Bank (CBA) Chart

Commonwealth Bank (CBA) Chart