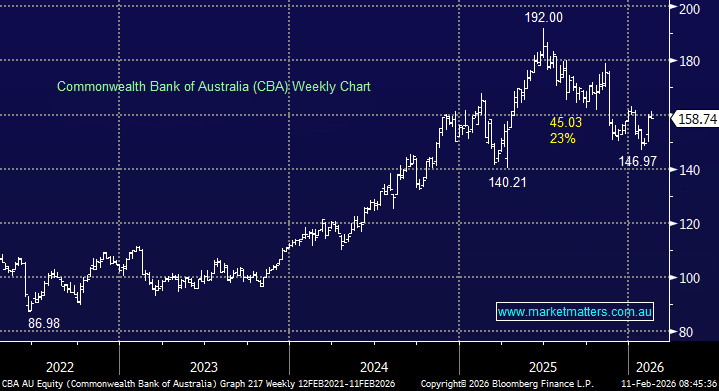

Commonwealth Banks (CBA) result looks good

CBA delivered a solid 1H result this morning, beating consensus on cash profit and lifting the interim dividend, with volume growth and improving credit quality offsetting margin pressure and higher costs. Net interest margin held at 2.04%, while ROE improved to 13.8%, reinforcing CBA’s earnings resilience despite competitive home lending conditions.

1H highlights:

- Cash profit (cont. ops) $5.45bn vs $5.18bn expected

- Interim dividend $2.35 (vs $2.25 y/y)

- Business Banking cash profit +14% y/y; Retail +1.4% y/y

- Operating expenses +8.1% y/y (inflation + tech investment)

- CET1 12.3% (strong capital position)

Margins slightly pressured by competition and lower Markets income, but lending and deposit growth supported earnings. Credit quality improved (lower impairments; home loan arrears down).

Ongoing tech spend (+10% y/y) to support digital and GenAI capability. No buyback in the half; payout ratio target remains 70–80%.

- Overall, a dependable result that underlines CBA’s balance-sheet strength and earnings durability, even as cost inflation and margin competition persist.