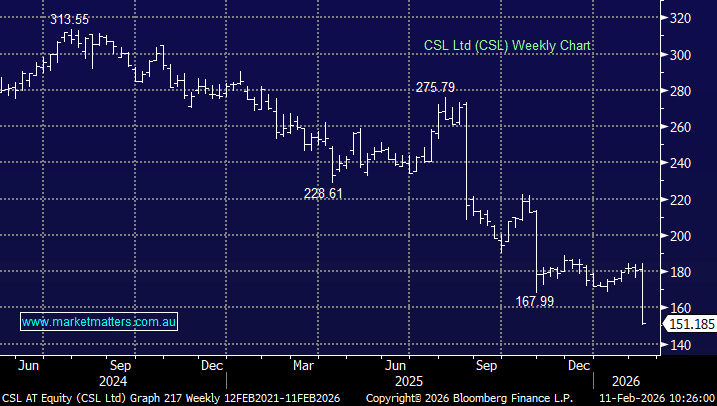

Citi see’s 25% drop in markets….ho hum! (LLC, CGF, RRL)

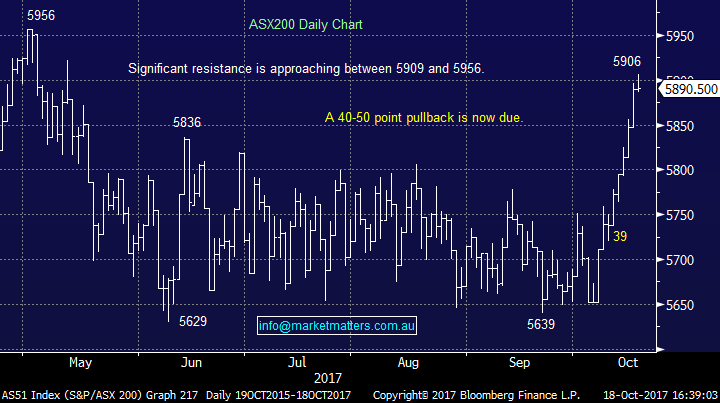

The Australian market edged higher again today with the index now up ~4.40% in the last 9 trading days – which is a big run if looked at in isolation however when considering the index traded in a tight 21 week range then a move of this magnitude shouldn’t surprise. That said, todays price action is starting to show signs of exhaustion and some consolidation would not surprise in the next few days as the markets looks to consolidate the new trading range. Analysts at Citi dominated the wires today with the headlines grabbing the attention of the afr.com which ran with the story of…..

We clearly need to pay our PR guys more money as MM’s call for a 25% correction surprisingly!!! did not garner the attention of the one called from Citi today. I think we’re more clear cut in our prediction which is predicated on simple statistics, with the market now in the 2nd longest bull market in history. Bull markets are broken when the market corrects by 20% or more, which is actually a fairly regular event, every 2.5 years in fact since the start of the century. We’ve now been 8years + so the call simply isn’t as BIG as it sounds. The issue now is that if this sort of scenario is being widely discussed / positioned for, then it’s less likely to play out. 2 examples of note last year with BREXIT and TRUMP – both scenarios led to a BIG drop in the mkt but in both instances the markets bounced back hard and fast as hedges unwound….the main message here, the more something gets talked about, the less likely it is to happen, or if it does, it won’t last long given mkt positioning.

In terms of Citi’s rationale, here goes…"I think it is remarkable how, on the one hand, central banks were so enthusiastic about distorting markets, and yet how they underestimate the magnitude of the distortionary effect of their policies – how sensitive markets are to their policies," King said.If financial markets do follow the past pattern – in which the price of assets such as equities and corporate bonds has risen in tandem with increased central bank liquidity – they are likely to flounder as soon as central banks scale back their monetary stimulus. "There's a huge degree of historic sensitivity," he noted. Source (AFR)

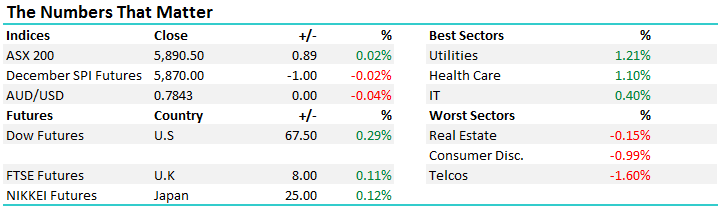

Big calls aside, the mkt edged up slightly however throughout the session we struggled to find buyers at higher levels and eventually, sellers got on top into the close….Just as I closed by intra-day shorts the mkt came off…Overall, the Utes did best followed closely by Healthcare which shows some risk appetite subsiding … while the Telcos provided most drag on the market – a range of +/- 19 points, a high of 5906, a low of 5886 and a close of 5890, fairly flat on the day, up 1pt or 0.02%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

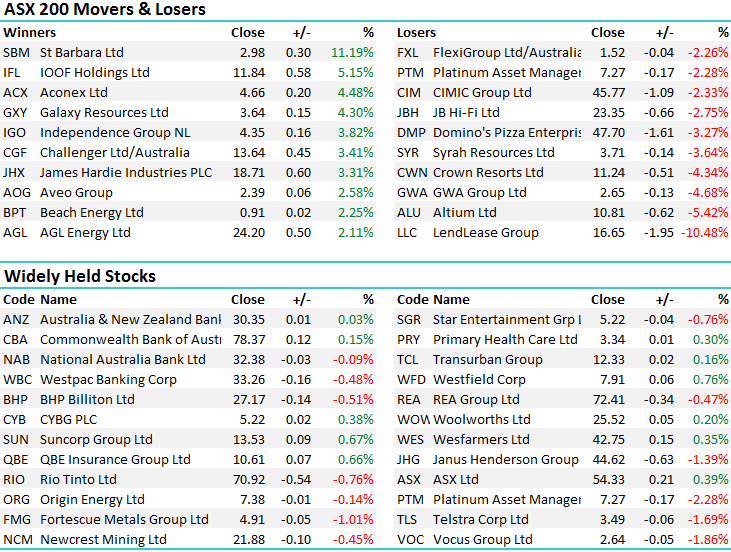

Regis Resources (RRL) – we sold today at $4.00 after being patient for the last few sessions with the stock trading up to a $4.03 high before closing at $3.97 – a profit in a short time of 9.33%. A reasonable result and we think the gold space is clearly worth trading around the edges…

Regis Resources Daily Chart

Lend Lease (LLC) - was whacked today by 10.48% with the stock closing at $16.65. A combination of a weak update from a stock trading on a high valuation. Some will argue that fact as the PE is reasonably modest however there are so many parts to the Lend Lease business, with the FUM business worth more in terms of multiple than the construction arm which operates on slim margins and has inherently higher risk – so a sum of the parts a better guide. Anyway, today they announced the 25% sale of its Retirement Living business to APG Asset Management + it also noted a weaker outlook for the Construction business in 1H18 relative to the prior corresponding period, which could impact the composition of LLC’s FY18 result. Lastly, it announced a new JV in the USA to develop telecom assets. No earnings impact from these events/transactions was provided – also noting that LLC did not provide FY18 earnings guidance at its recent FY17 result which is typical for that business. A stock now on our radar…

Lend Lease (LLC) Daily Chart

Challenger Group Financial (CGF) – continues to run hard and may be at our $14 price target sooner rather than later following the very good annuity sales number yesterday as we covered...Go CGF!

Challenger (CGF) Daily Chart

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 18/10/17. 4.30PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here