Choppy day ends in the green – no change to Aussie interest rates

Another choppy session intra-day and it seemed the market was being led more by the Futures rather than any specific trends on the stock / sector level. The RBA sat on their hands in terms of interest rates, however it now seems the risk is up rather than down. Elsewhere the parliamentary banking enquiry was taking place with ANZ and CBA under the microscope today and although it’s obviously an interesting platform to hear from the banks about accountability, transparency, internal processes etc and any improvement here is clearly a positive thing, from a shareholder perspective, it’s not overly meaningful at this stage. What it probably does is strengthen their resolve to offload their Wealth Management businesses given they contribute only small numbers to overall earnings but bring a barrage of reputational and regulatory risk. This year should see some large transactions in that space with interest from overseas investors, along with local players like Macquarie and IOOF.

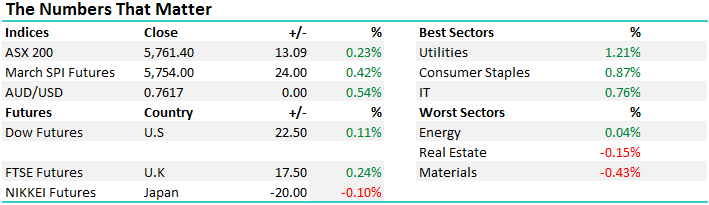

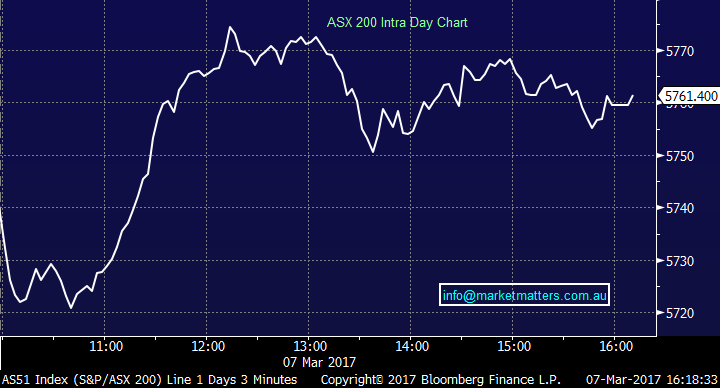

On the market today, we had a lower open this morning mainly following weakness in the commodity complex overnight… a range of +/- 55 points, a high of 5774, a low of 5719 and a close of 57661, up +15pts or +0.26%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

March is often a quieter month for the equity market after the frantic pace set during the Feb reporting season. Stocks go ex-dividend, the index typically trades in a reasonably tight range and volatility is generally pretty low. As we’ve written numerous times over the last month or so, banks typically do fairly well over the next few months in aggregate, and we have the added benefit of the ‘reflationary trade’ which is assisting the diversified financials as well. The insurers, fund managers and investment banks are all part of that and feature in our portfolio at the moment. As we wrote this morning, a pause looks likely in the U.S for now and that will obviously impact trading here, which fits with our seasonal work, however we remain bullish stocks and expect a higher top to form later on in the year, or early in 2018.

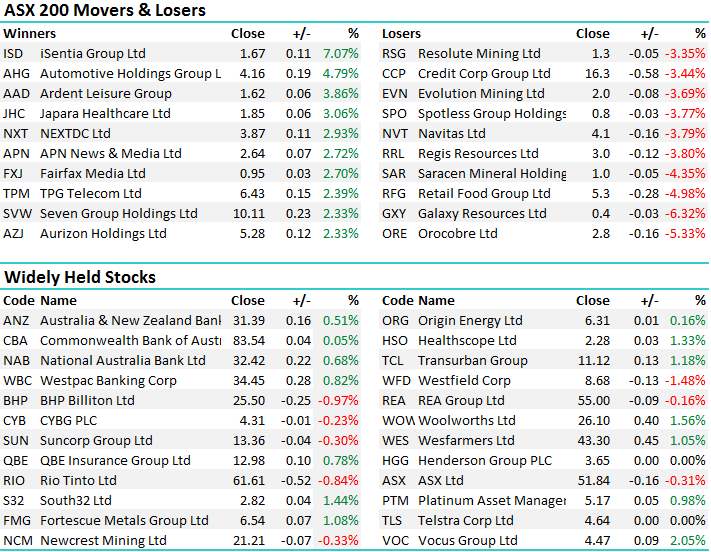

There was actually an interesting article in the Fin Review yesterday around active managers having a very tough 2016, but according to their quant analysis, this year should be a lot better given that the tight correlation we saw on stock markets last year will start to diverge, which therefore throws up more opportunities for the informed. Two points worth highlighting here; 1. This should benefit fund managers that have had a very tough 2016 with the likes of PTM and HGG near enough to 12 month lows despite the equity markets performing well over the past year 2. This will clearly suit Market Matters given we have a more active bias and are very much focussed on positioning from a top down perspective, and being in the right sectors / stocks at the right time, rather than running a diversified portfolio and hoping some of it works.

For those that didn’t read this morning’s note, we’d encourage you to do so as it sets out a very clear path of thought that is typical of our approach. We talk about the ‘yield stocks’ which is a sector we’ve been negative on for a while now, and avoided the carnage in that space throughout 2016. These stocks dropped 20-30% on the expectations that interest rates would rise, yet we only saw one rate hike in 2016. We have now got three rate hikes priced in from the US Fed over 2017, and the obvious path for the ‘high yield sector’ should be down, however stocks typically move 6-12 months ahead of changes to underlying trends so we now need to be thinking past the next 3 US rate hikes – which we did in the morning note today.

Have a great night,

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 07/03/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here