Choppy action continues (RWC)

WHAT MATTERED TODAY

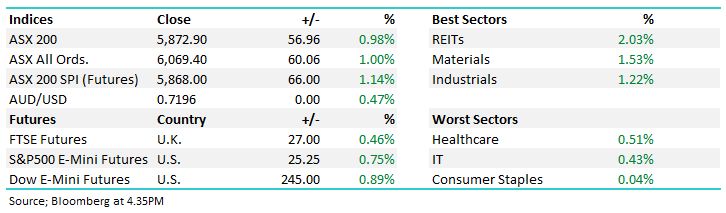

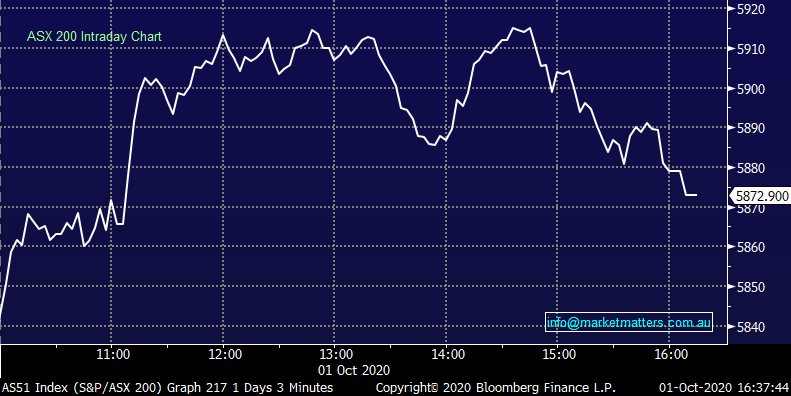

October started on the front foot with the idnex getting off to a better than expected start. The US gave us a strong lead; however futures were originally pointing to just an 11 point gain prior to reopening. By the time equities were opening, investors had woken up to the disparity in performance between our futures and overseas indicies. The +100 pt marker was the sticking point though – the index had a push at the 5915 level 3 times throughout the day with each turn failing to go on with it. The final effort came with around 90 minutes left in the session before equities rolled gave up mmuch of the good work to close 44pts below the high.

Property stocks were the best bid, gaining more than 2%. Retail focused names were the pick of the bunch as investors pin the hopes low case numbers leading to increased foottraffic, and hopefully bring the end of rent wars with many retailers. Materials were a distant second – iron ore names were well bid on a strong iron ore print, though China now enters the “Golden Week” holiday which means trading in iron ore will be light until the back end of next week. While all sectors finished higher, consumer staples only marginally broke the into the black.

By the close, the ASX 200 was up by 57pts / +0.98%. Dow Futures are trading up 234pts/+0.85%

ASX 200 Chart

ASX 200 Chart

CATHCING MY EYE

Reliance Worldwide (RWC) +10.47%: the standout today, held an investor day which saw the company tracking ahead of expectations through the first quarter of the year. The plumbing manufacturer noted that strong growth in the north Americas had continued and was still more than offsetting some weaker performance seen in the Asian segment. Europe had also seen pent up demand come through following the lockdowns as August and September saw 5% & 24% growth on the prior year to more than offset the -4% seen in July. Reliance singled out Australian operations as a weak point, noting the falling building approvals and new starts weighing on demand. A nice pop above $4 for the stock today though, the breakout looks reasonable. Perhaps the comments are a red flag for names leveraged to local construction in the near term though.

Reliance Worldwide (RWC) Chart

BROKER MOVES

· Whitehaven Raised to Buy at Shaw and Partners; PT A$2

· Hub24 Cut to Hold at Morgans Financial Limited; PT A$18.10

· Platinum Asset Raised to Buy at Morningstar

· Bank of Queensland Raised to Buy at Morningstar

· Fortescue Raised to Neutral at Credit Suisse; PT A$16.50

· BHP Raised to Outperform at Credit Suisse; PT A$39

· BHP Group PLC Raised to Outperform at Credit Suisse

· Rio Tinto Raised to Neutral at Credit Suisse; PT 5,000 pence

OUR CALLS

No changes today

Major Movers Today

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.