China National People’s Congress dull ASX bulls

WHAT MATTERED TODAY

The ASX gave up small gain early in the session with investors again remaining cautious into the weekend, taking back some of the gains seen on the index through the week. The main drop seen early came on the back of comments out of the delayed National People’s Congress in China where the communist party taking an aggressive tone against the stance of Australia and the US in terms of their handling of the corona virus outbreak. Despite the fighting words, talks quickly moved on to the need to stimulate the economy and its reliance on steel production to do so which would require Australian iron ore and likely keeping up an amicable relationship. The market seems to be caught in a wedge between geopolitical tensions along with economic shutdown vs the stimulus injections from central banks and governments. The battle continues.

Two big pieces of stock news for our income portfolio today – firstly Wesfarmers who announced it would cut 60-75 Target stores and convert a number of other sites into Kmart branded stores as well as a number of write-offs against the business. The move could see the number of Target stores in operation cut by more than 50%. Shares initially opened lower but tracked higher through the session – ultimately the restructure was expected after many years of Target chewing up profits. Ripping the band aid off may be the best thing for Wesfarmers longer term. We own WES in the Income Portfolio, unconcerned about the dividend given most of the costs are non-cash while the market tends to look at underlying results. Second of the bat was Sydney Airports (SYD) which told investors at the AGM that they did not see the need to raise equity even if there was no revenue through to the end of 2021. While I’s not a pretty sight for the airport at the moment, the comments mean that shareholders should expect some dividend return in the medium term if there are no hiccups as the travel restrictions are eased.

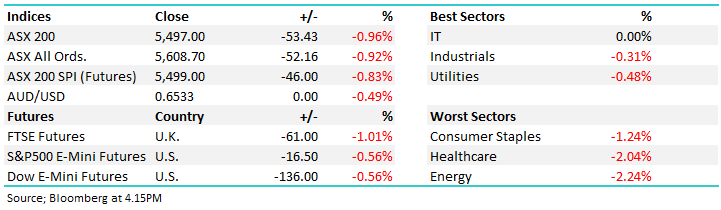

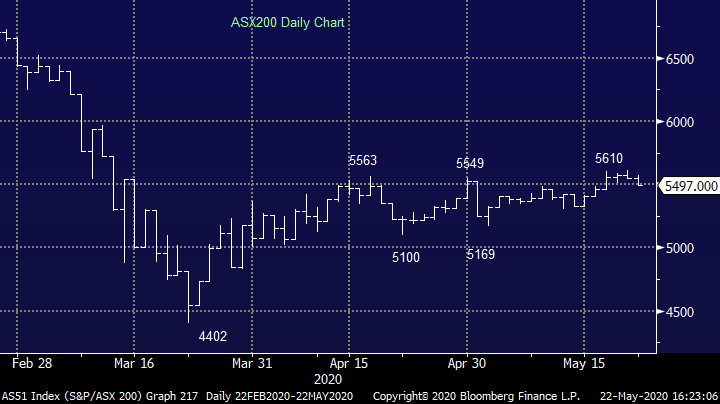

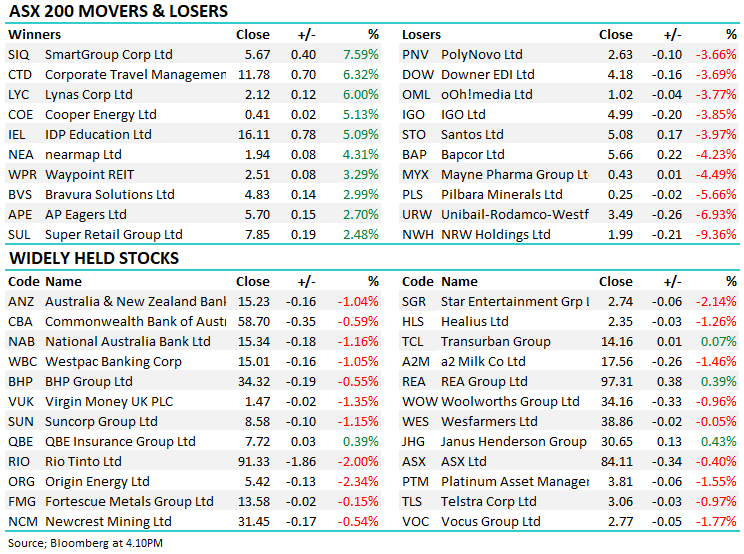

Overall, the ASX 200 closed down -53pts or -0.96% to 5550. Dow Futures are trading down -147pts/-0.60%.

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE;

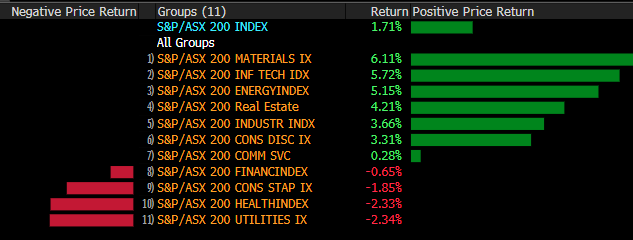

Sector moves this week

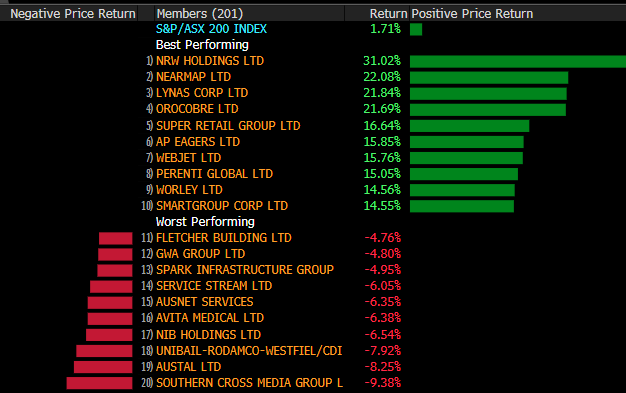

Stock moves this week

BROKER MOVES;

· NAB Raised to Buy at Bell Potter; PT A$17.30

· Adelaide Brighton Cut to Underperform at Macquarie; PT A$2.30

· NRW Holdings Raised to Overweight at Wilsons; PT A$3

· Mosaic Brands Cut to Market-Weight at Wilsons

· AusNet Raised to Hold at Morningstar

· Steadfast Cut to Hold at Morningstar

· GPT Group Raised to Buy at Jefferies; PT A$4.50

OUR CALLS

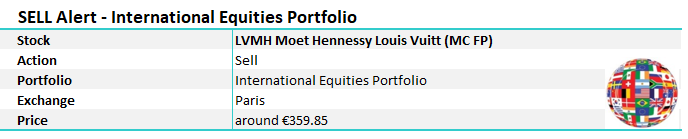

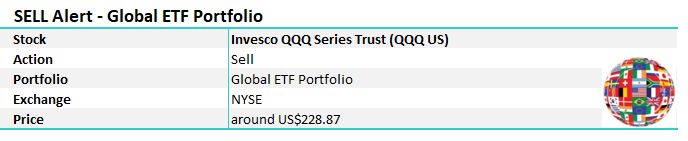

We are selling the QQQ ETF for a gain in the ETF portfolio and cutting LVMH for a loss in the international portfolio.

Major Movers Today

Have a great Weekend all

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.