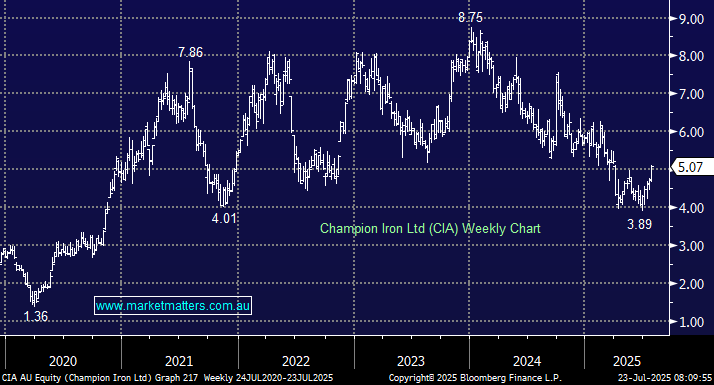

Champion Iron (CIA) enjoys the new Iron Ore tailwind

CIA’s key asset is the Bloom Lake mining complex located in northern Quebec Canada. They acquired it in 2016 and restarted production in early 2018, currently producing around 15Mtpa of high-grade iron (+66% Fe) meaning they attract a higher price than the benchmark 62% Fe. For comparison, Fortescue (FMG) is low grade (57% Fe) and is subject to a discount. i.e. higher Iron content in the ore gets a better price, around ~$US110/Mt at their last quarterly.

However, CIA is a high-cost producer, with C1 cash costs ~C$80/Mt and FY26 is a transition year for them, with the shift into higher grade production following a further US$350m being spent to upgrade around half of Bloom Lake to 69% Fe; with commissioning expected in 2H 2025. Their treasury department has also been active, last month, they announced the issue of US$500m in senior notes due in 2032 to repay existing credit facilities. The notes were priced at an interest rate of 7.875%pa. At their last quarterly (31st March) they had drawn debt of US$492m at an estimated average cost of around 6.8%pa.

- Our focus on debt here is not to raise a red flag, CIA maintains a conservative balance sheet, our focus is more around the rate at which they’re able to raise money, being sub 8% for 7 years bonds which is okay – for comparison, FMG has lots of cash but chooses to issue bonds to remain present in the market, and pays around 5%.

While it’s hard to escape the currently high cash costs for CIA, they do have a targeted strategy towards high grade operations predicated on the push towards greener alternatives in steel production that value higher grade inputs. Under Trump, the focus has shifted away from carbon emissions, though we ultimately expect government policy in CIA’s target markets (EU) and the growth in green steel production to be supportive over time. Free cash flow is likely to also improve from 2026 with major capital programs completed.

- CIA is a ~$2.7bn company, with solid earnings, improving free cash flow and pays a dividend of ~4.5% (unfranked)