Challenger – $1bn+ annuity sales for the 2nd straight qtr

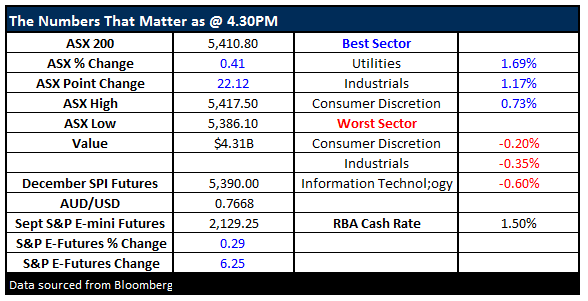

What Mattered Today

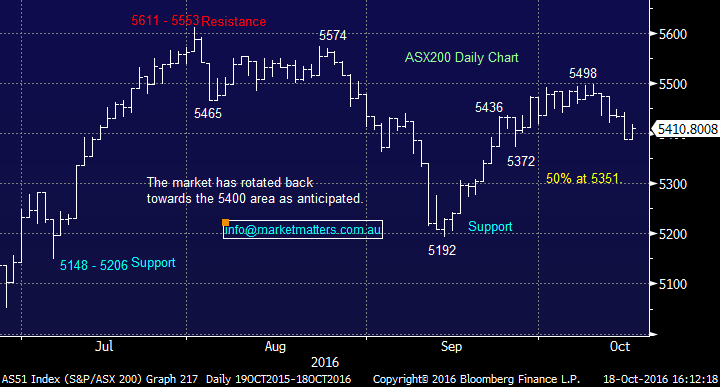

The markets struggled early but found a base around 10.30am before sustained buying saw the market close back up above 5400. As we wrote this morning, we’ve been looking for a pullback to the 5400 area following the 300-point advance since mid-September, a strong market will now hold this area and commence a recovery back towards 5500.

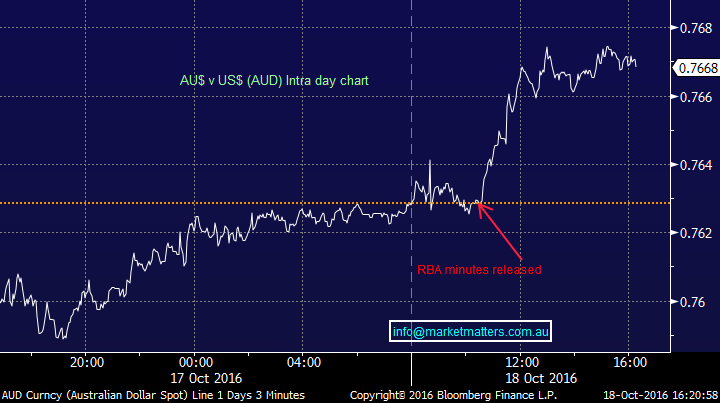

The strength was reasonable today with commentary from new RBA Governor Philip Lowe coinciding with the release of the RBA minutes from their last meeting. The main message from both is that if things evolve as the RBA expects, it’s not going cut interest rates further. More cuts will only come if we see inflation is weaker for longer, the labour market deteriorates or the housing market cools considerably – all of which could happen but at this stage are not their base case scenario. Unsurprisingly, the Aussie dollar rallied on the comments and dragged the market up as well…

Casino stocks were a mixed bag – Crown (CWN) put on +1.7% after yesterday’s 13.9% decline but the other guys saw a bit of selling – Star (SGR) was down over 5% at one stage but recovered to be down only -0.54%. We covered our thoughts on the sector this morning with the note available on the website here

Elsewhere on the market, we had a range today of +/- 31 points, a high of 5417, a low of 5386 and a close of 5410, up +22pts or +0.41%.

ASX 200 Intra-Day Chart

ASX 200 daily chart

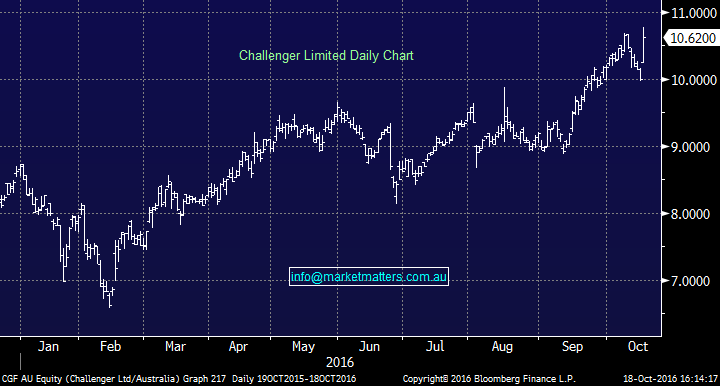

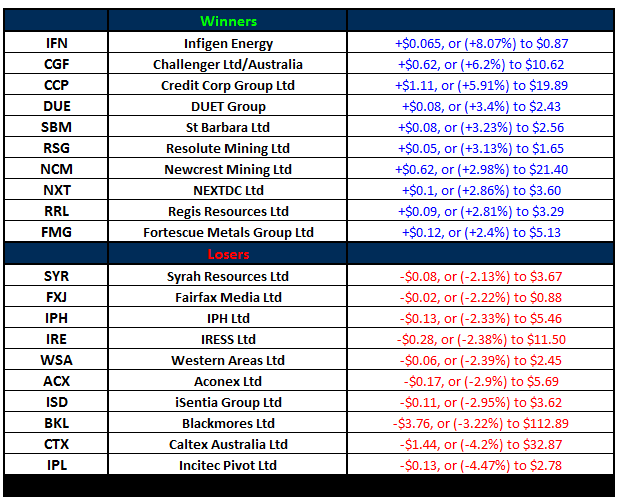

Challenger Group Financial (CGF);Released another cracking set of annuity sales numbers today and the stock rallied +6.2% on the back of it. They sold $1,033m of annuities for the three months to Sep which is up +46% on the same time last year. It’s a big number (obviously) but all the better coming off a good Q4 result as well. We should see upgraded numbers for this stock with talk about +20% yoy sale growth now being overly conservative.

The key to it seems to be lifetime annuity sales which accounted for 29% of the sales in the quarter. More broadly, with around $70bn going into retirement each year, the current $4bn that is finding a home in annuities seems a bit light on to us. If we assume that over time, we’ll get allocations closer to 20-25%, that equates to around $14bn pa flowing into annuities. The only main issue stems come from the capital side. Annuities are a highly capital intensive and the more they write, the more capital they require.

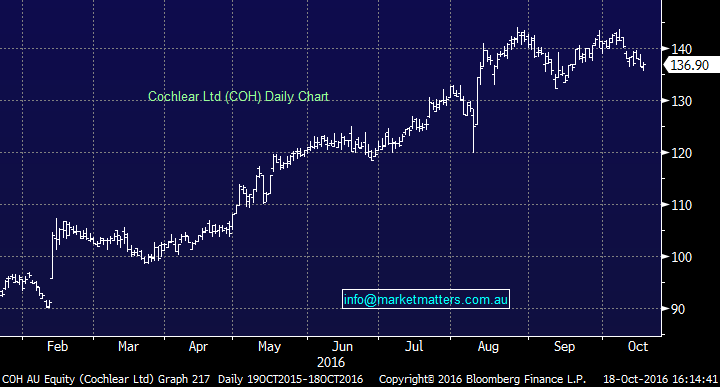

Cochlear (COH) had their AGM today and there was nothing too earthshattering to report. The business remains on track and was up +0.17% on the session. In our mind, this stock has run too hard and now trades at a big premium to its longer term valuation – leaving it susceptible to shocks. A great business, and great story for Australia but it’s simply too expensive at this point in time.

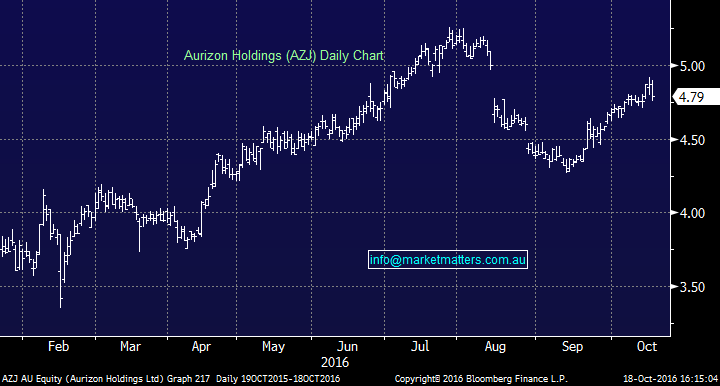

Aurizon (AZJ) also had their AGM today and re-affirmed recent guidance. The market had bid these guys up over the past few weeks so maybe some profit taking played out. Nothing to get us excited about this stock at current levels…

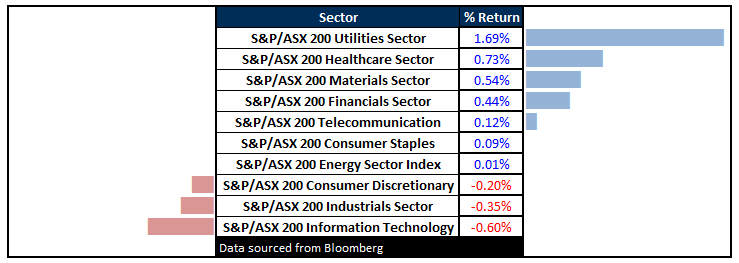

Sectors

ASX 200 Movers

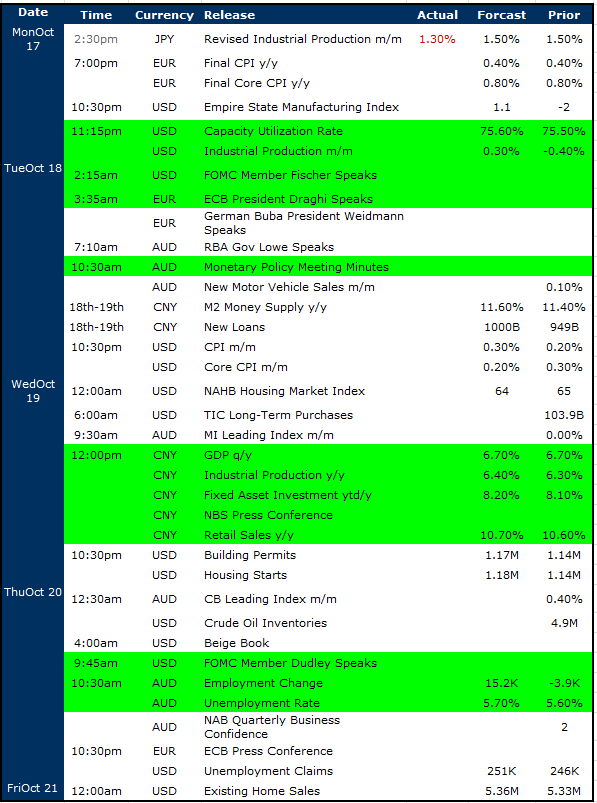

Select Economic Data - Stuff that really Matters in Green

What Matters Overseas

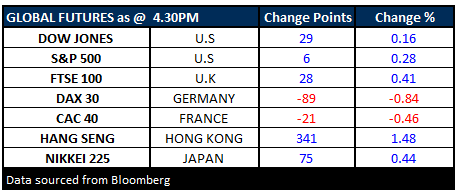

FUTURES mixed…

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 18/10/2016. 5:00PM. Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe. Click Here