CBA underpins strength in the market today (CBA, A2M, VCX, CNI)

A weaker open to kick things off this morning however a strong quarterly trading update from CBA helped the market recover from early losses to close slightly higher on the session. Yesterday we saw BHP with the weight of the mkt behind it, contributing +11 index points to the ASX 200 while today it was CBA’s turn, interestingly enough adding +11 index points . We actually used todays strength to reduce our overweight holding in CBA / the banking sector generally by 4.5% for the MM Growth Portfolio. That wasn’t a call on CBA specifically given the result was strong + we retained a 3% weighting, however it was a move to tweak our overweight exposure in the Growth Portfolio into what’s typically a weak seasonal period for the banks coming into the middle of November.

NAB goes ex-dividend tomorrow and we have a 10% exposure in the MM Growth Portfolio, while Westpac goes ex on the 13th and we also have a 10% allocation there – while we’ve also got BOQ, CBA and SUN to round out the sector. Clearly a large allocation and trimming some CBA into strength today made sense. Elsewhere, we bought A2 Milk (A2M) this morning and they recovered strongly while in the Income Portfolio we trimmed Centuria (CNI) and used the funds to establish a new position in Vicinity Centres (VCX). More on these stocks below.

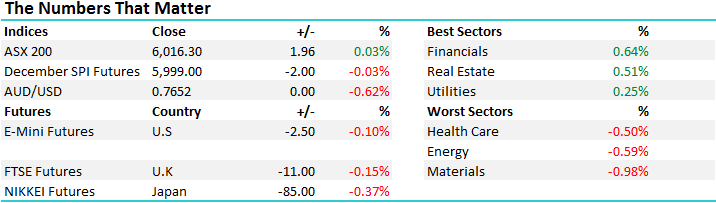

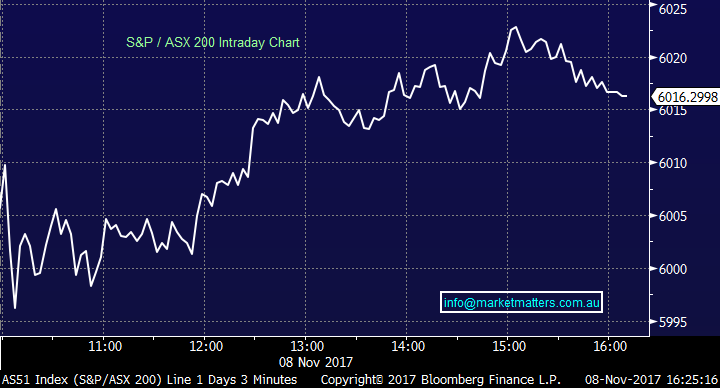

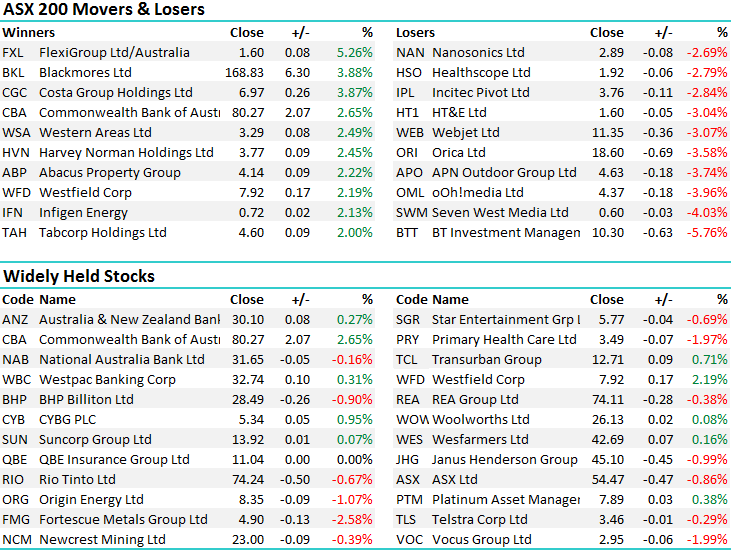

Overall, the Financials did best today adding +0.64% while the Material stocks gave back some of yesterday’s gains, dropping by -0.98% – a range today of +/- 26 points, a high of 6022, a low of 5996 and a close of 6016, up +1pt or +0.03%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

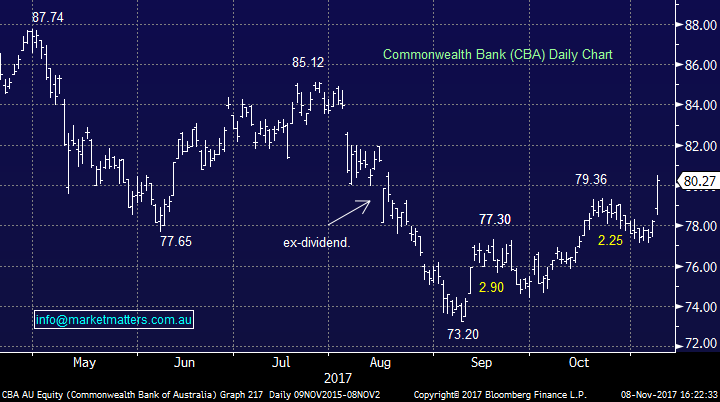

Commonwealth Bank (CBA) – Analysts turned negative on CBA in recent months after the ASTRAC scandal + others and ripped the PE premium out of the stock sending it down to a low of $73.20 in September, however today CBA came back with a vengeance delivering a strong quarterly earnings result and the stock popped – closing up +2.65% to $80.27. Interesting to read some analyst rationale in recent times with one today saying Change in CEO, potential fines, and cultural change risk keep us on the side line for now…not sure what cultural change risk is but it seems negative!

Also interesting to have a look (pre-upgrades that will flow through tomorrow) what two of the better ranked analysts thought of the stock recently. Credit Suisse cut hard on the AUSTRAC issue and went bearish throwing a $75 price target at the stock however in fairness their track record is not great from 2012, chasing the stock higher with their SELL calls (red dots).

TS Lim from Bells has called this stock well, and didn’t get caught up in the scandal putting a buy on it at lower levels – only going to a HOLD recently post rally but maintained $82.10 target. Good call TS.

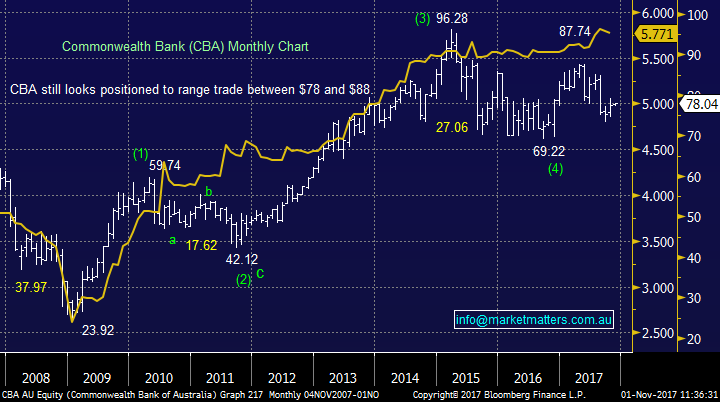

In terms of our read of the stock, we wrote about it in the income report last week saying;

Commonwealth Bank (CBA); The decline in share price recently following reputational issues is all about a PE re-rate, not the reduced outlook in terms of earnings as the chart shows. In fact, CBA should be earning more now than they did when they were trading at $96. This simply means that market sentiment has changed, which caused a drop in the stock and we should take advantage of it. We have 7.5% of the Income Portfolio in CBA.

Commonwealth Bank (CBA) monthly chart versus Earnings Expectations

Drilling down in today’s update, we saw cash profit of $2.65bn, bad debt charge of $198m, margins up, revenue +4%, costs +4% and the bad debt charge down -20%. We’ll see analysts begrudgingly upgrade CBA on the back of this result however the buying today was strong pre-empting that. That said, we maintain a 3% holding in the stock for the Growth Portfolio and a 7.5% holding in the Income Portfolio looking for higher levels over time. Interestingly, analysts now saying the stock is 4-5% cheap versus their long term PE, however when the stock was on the nose, CBA was classed as too expensive versus the banking sector generally. This is commonly known as curve fitting rhetoric!

CBA Daily Chart

Elsewhere, we added Vicinity Centres (VCX) to the income portfolio today, after reducing our exposure to Centuria (CNI) – taking a nice 18% profit in the process. We covered this in the Income Report today.

We also took a position in A2 Milk (A2M) into weakness this morning – a stock we’ve flagged on numerous occasions of late as a shorter term growth play into weakness. We bought below $6.50 this morning for the Growth Portfolio with the stock recovering nicely to close at $6.73. This will continue to be volatile and a move below $6 and we will likely add to the position to take it to a ~6-7% holding, conversely a strong recovery and we’re likely sellers into strength. Volume today was BIG with 2.4 x the 20 day average.

A2 Milk (A2M) Daily Chart

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 8/11/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here