CBA grows earnings in a tough environment (CBA, NEC, WHC, IVC)

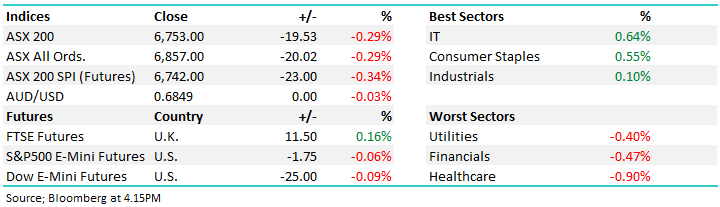

WHAT MATTERED TODAY

The market backed off from early highs today which came in at 6779, the highest point for the ASX 200 since August, a drop of -26pts from the intra session milestone as the now very influential CSL gave back half of yesterday’s gains while Westpac traded ex-dividend today for 80cps fully franked and declined by 98cps to close at $26.80 – which is still $1.48 / 5.8% above the recent placement price. The SPP is now open allowing existing shareholders the ability to buy up to 30k worth of stock at that price – we view that as a good deal.

CBA was out with a trading update this morning showing why it trades at a sector premium – income growth at +4% was strong in a tough environment. More on that below.

At the sector front today, IT stocks again saw some reasonable buying, although I get the distinct feeling this is simply a short term bounce before one more leg lower for the sector, resources were down although they traded up from the session lows as iron Ore bounced +2% in Asia.

US Futures were flat during our time zone, while Asian markets were mostly higher, up around +0.50%.

Overall, the ASX 200 closed -19pts/-0.29% lower today to 6753 – pulling back from recent highs. Dow Futures are trading pretty much flat.

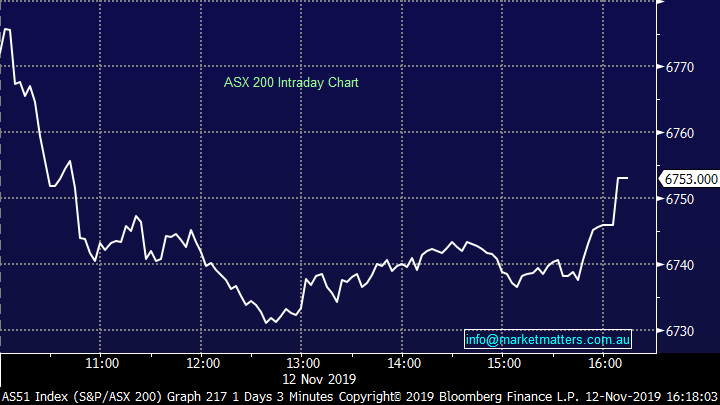

ASX 200 Chart

ASX 200 Chart

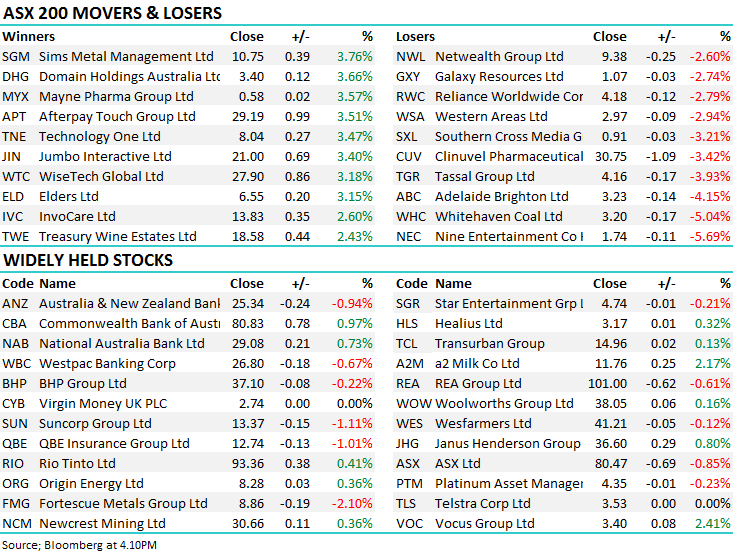

CATCHING MY EYE;

Commonwealth Bank (CBA) +0.97%: CBA this morning provided a trading update that was strong, stronger than the other banks in terms of income growth which came in at +4% from the quarterly average of 2H19 to 1Q20. The cash profit was $2.26B for 1Q20 however the reported line was $3.8B given the sale of the Colonial First State Asset Global Management business. Interestingly, home loan growth was 3.5% in 1Q20, business loan growth was 2.8% and deposits increased by 10%, all on an annualised basis. Expenses were higher up by 2% however that was below income growth leading to positive ‘jaws’. CET1 capital was 10.6% at 30/9/19 and going higher thanks to the above mentioned asset sale, somewhere around 11.2% moving to 11.7% by calendar year end – which is very strong.

All in all, another strong result from CBA showing income growth in a tough operating environment. CBA joins NAB as the top two banks in our view, followed by Westpac and lastly ANZ.

Commonwealth Bank (CBA) Chart

Nine Entertainment (NEC) –5.69%: Out with a trading update this morning at their AGM and although only early days, they flagged a soft start to the year across the business blaming weak consumer sentiment. This is a stock we’ve looked at a few times for the income portfolio, but never bought. The free to air TV business is struggling for the advertising dollar, the same trends are being seen in Radio with Alan Jones’ sock comments not helping while the digital and publishing areas have decent momentum. Stan is the exciting part of this business, and continues to track above company expectations. In terms of guidance, they are now expecting low single digit growth in FY20 Pro Forma EBITDA, which is below current expectations. $1.70 key support

Nine Entertainment (NEC) Chart

Whitehaven Coal (WHC) -5.04%:As we covered this morning a large line of WHC was done this AM at $3.22 by UBS, however the stock closed today at $3.20, below that placement price. Another large line of stock still hanging over the stock which has been escrowed for 60 days however after that its fair game. Today’s trade implies that UBS were left with a few in the tin after placing with institutions however I’m only speculating. Reiterating that we are looking for a low here, if it can happen while this exit from Farallon happens then it’s a bullish sign- these style of circumstances that can often be the reason form a very meaningful low for a stock. Technically we would be keen buyers below $3

Whitehaven Coal (WHC) Chart

Invocare (IVC) +2.60%: The funeral operators was up today on news they’ve bought two new funeral homes down the South Coast. While they didn’t give financial metrics on the price, the facilities do 400 funerals per annum with $3m in revenue a year. For those quick on the math and interested in what the average funeral cost is, that’s $7,500 a pop. IVC has struggled since they last reported on concerns around future growth. They have a good track record on acquisitions and today’s news looks like a positive catalyst.

Invocare (IVC) Chart

Broker moves;

· AP Eagers Rated New Hold at Bell Potter; PT A$13.25

· Domain Holdings Raised to Outperform at Macquarie; PT A$3.60

· Domain Holdings Raised to Overweight at JPMorgan; PT A$3.65

· Fortescue Cut to Hold at Shaw and Partners; PT A$9

· Suncorp Reinstated Buy at Goldman; PT A$14.55

OUR CALLS

In the Growth Portfolio, we sold Fortescue (FMG) for a ~30% profit and Bluescope for a ~20% profit while we attempted to buy Sims Group (SGM), however strong buying there through the session meant that we were only partially filled. Their AGM is on in 2 days so we’re reluctant to chase above the ~$10.65 handle for now. We’ll keep subscribers updated

In the Income Portfolio we cut CSR for a nice ~40% profit.

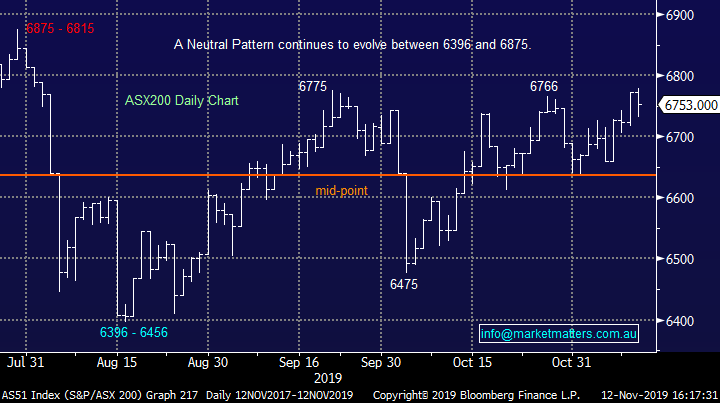

Major Movers Today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.