CBA full year report

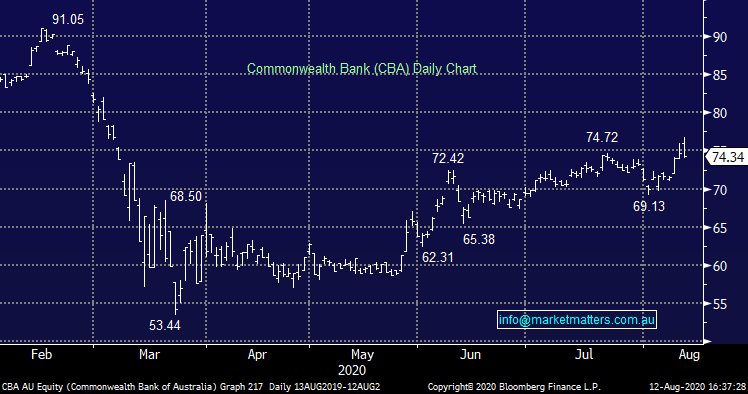

Commonwealth Bank (CBA) -0.48%

Released FY20 results this morning and I said on the recording yesterday (click here) that it was a good result and it was with CBA showing why it’s the No 1 bank in Australia. Reading through initial analyst commentary some are suggesting that cash profit was a decent miss ~7%, however a number of analysts (including ours) had earnings from Colonial in as a continuing operation which was not the case – CBA left that out. In any case there was some swings and roundabouts in the overall result, however following the conference call, I’m comfortable with our large position in the stock.

The dividend of 98cps for the half takes the full year payout to $2.98 fully franked, that’s obviously down sharply on last year but well ahead of what had been expected following APRA’s insistence of paying no more than 50% of earnings out in dividends. CBA paid out 49.95%! That move had a strong impact on capital which is sector leading with tier 1 at 11.6%. The nuts and bolts were as follows:

· Cash EPS was $4.13 for FY20 the dividend was $2.98, which included a final dividend of 98 cps.

· Capital is the strongest of the major banks with the common equity tier 1 (CET1) ratio at 11.6%.

· Income was down 2% from 1H20 to 2H20 on a cash earnings basis which included a 1% decline in net interest income. Average loan growth of 2% was offset by net interest margin (NIM) decline.

· NIM declined from 2.11% in 1H20 to 2.04% in 2H20 with half the decline due to a 12% increase in liquids.

· Commissions declined by 6% from 1H20 to 2H20 and there was a $108M impairment of aircraft assets in 2H20, which resulted in other banking income declining by $249M or 10% over the period.

· Expenses increased by 9% from 1H20 to 2H20 as a result of a $454M increase in the cost of the customer remediation program.

· The bad debt charge was $1.2B higher in 2H20 compared to 1H20 due to higher COVID-19 provisions. New impaired assets fell slightly from 1H20 to 2H20. The only area of notable increase in arrears was in credit cards.

All up: while there were areas of disappointment, there were also areas of pleasant surprise (being dividends, capital and credit quality).

Commonwealth Bank (CBA) Chart