Cannabis & Travel, the sectors the flew high today!

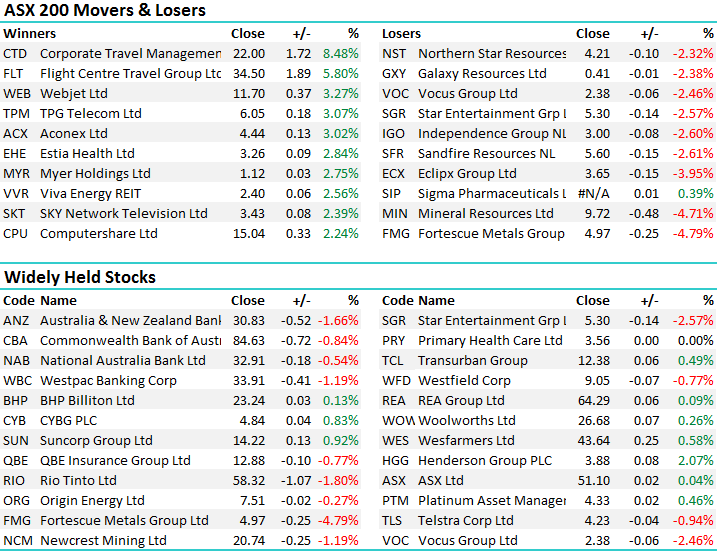

A tale of two markets today with some decent weakness playing out across the board early on with continued selling amongst the banks and a weak overseas lead in the Copper and Iron Ore markets putting pressure on local material stocks. That played out till mid-afternoon before buyers stepped into the fray, but it was largely targeted towards the resource stocks. BHP for instance traded down to a low of $22.92 before closing up on the day at $23.24 – a good turnaround. Oz Minerals was also weak early on before good support became obvious and the stock closed down just 4c, despite the 4% decline in Copper overnight. The same couldn’t be said for the banks despite a good set of numbers from NAB this morning. The marginal buyer of banks is hard to pin point at the moment and we continue to think that resources will outperform the banks over the next month or so.

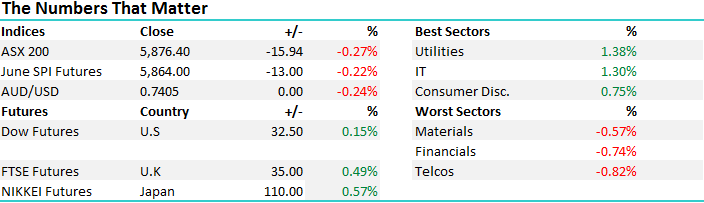

A reasonably range today of +/- 37 points, a high of 5893, a low of 5856 and a close of 5876, off -16pts or -0.27%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

NAB; The result was good and NAB outperformed the sector today but still finished in the red. A clean set of numbers from NAB which is nice with good margin management, a strong capital position, low bad debts and gradually improving returns. At the top line, revenue was weak and this shows the struggle banks will likely have going forward growing earnings in an environment where regulators want to see lower lending growth. Overall a good result from NAB, about a 2% beat in terms of earnings and importantly the dividend was maintained.

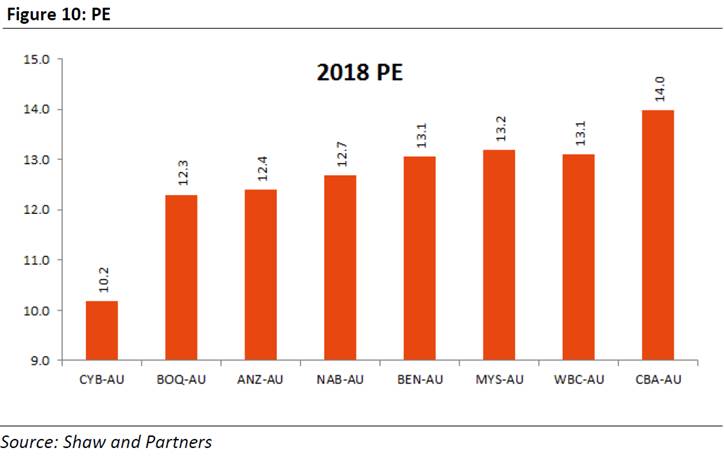

A good chart from Shaw and Partners highlighting current bank sector PE’s

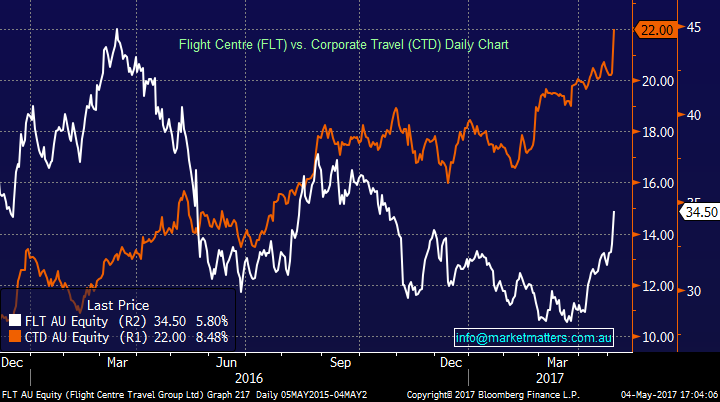

There’s been a Macquarie conference taking place over the last few days and this has resulted in a lot of companies providing more clarity around future earnings. A number of upgrades but a few unfortunate downgrades as well. Today we saw Corporate Travel (CTD) upgrade guidance and they now expect earnings of at least $97m, up from a range of $92-$97m and the stock was obviously strong on the back of it. This stock has had an incredible run in price over recent years massively outpacing it’s bigger sector rival in Flight Centre (FLT).

Today though, both stocks did exceptionally well and we’re seeing money flow strongly into the sector. Most analysts a more bearish on FLT given they’re string of recent downgrades however it seems the transformation strategy that is now underway is yielding results, and we’re seeing a more positive stance taken by the market. FLT sort of reminds us of QBE in a way. Historically a very well regarded business that hit a snag, had some industry dynamics work against it in terms of pricing, online competition etc and probably had it too good for too long. They were forced to re-asses and have now taken their medicine and are better for it. The question of whether or not bricks and mortar retailing of travel services is in structural decline or it’s simply cyclical does little to help here. More relevant might be the question around how FLT is integrating bricks and mortar with online channels and how such a model can yield results. Today’s presentation at the Macquarie conference seemed to address this. One to watch.

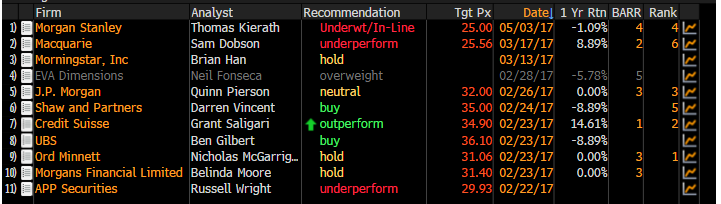

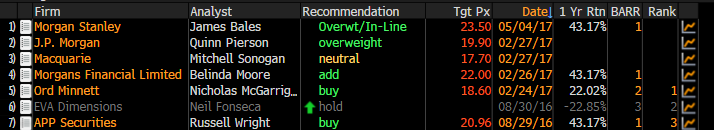

Flight Centre – Broker Calls

Corporate Travel – Broker calls

In terms of the Cannabis stocks, two new listings today in The Hydroponics Co (THC) and Cann Group (CAN) – both stocks up over 100% on day 1. A couple of mates over at Redleaf Equities were instrumental in the launch of THC so it’s great to see the stock fly.

Elsewhere, Henderson Group (HGG) a stock we have in the portfolio was lower today by 8c however it went ex-distribution by 15c – a good outcome for HGG and a stock we continue to like.

Henderson Group (HGG) Daily Chart

Have a great night,

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 04/05/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here