Buyers step up before the day off (FMG, BHP, NAB, OZL)

WHAT MATTERED TODAY

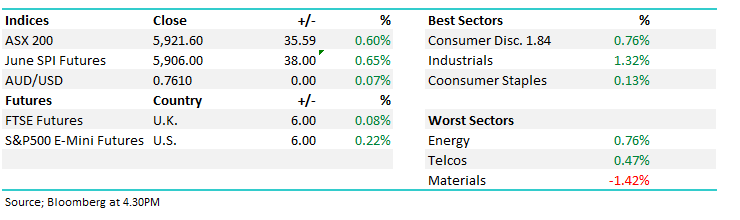

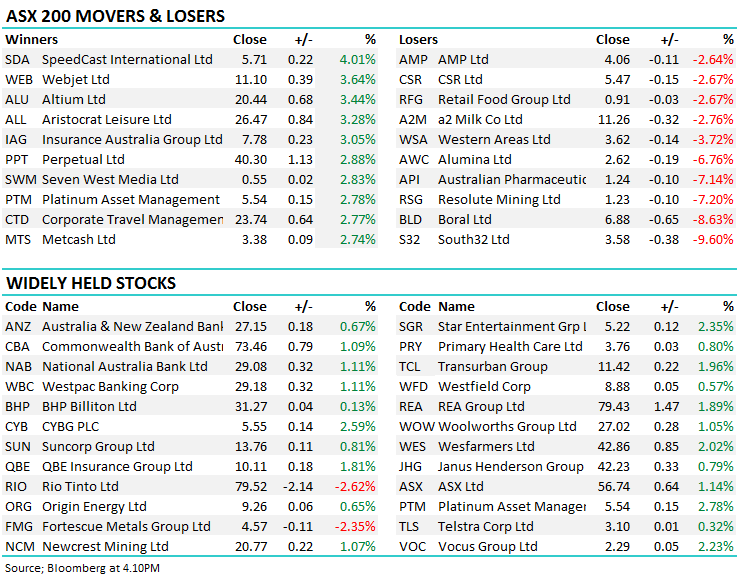

The market once again edged higher today, closing above to critical 5900 level, which is key MM turning bullish on the local market short term, looking for an assault on the 2018 highs. It was the banks once again that lead the market higher, finding some support after the fears of the Royal Commission subside. We have spoken at length over the role that the banks will play in the MM view of a push to fresh new 2018 highs before a larger pull back takes place and this occurred once again today.

IFL was under a cloud early on, after rallying post the FUMAS update around midday – although finishing near yesterday’s close and a long way from its highs it was good to see the share price react positively after the update. FMG announced their quarterly activities report – more on that later. Boral disappointed markets with the sale of their property at Greystanes – adding $56mil to EBITDA for the year – and investors smashed stock down ~8%.

Overall, another nudge higher today, the index adding 35pts or 0.6%, closing at 5921.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; Minor changes from the brokers today – Fortescue not helped by Clarksons following a miss in the quarterly report.

- Acrow Formwork and Construction Services (ACF AU): Rated New Buy at Bell Potter

- Fortescue (FMG AU): Downgraded to Neutral at Clarksons Platou

- Netwealth Group (NWL AU): Rated New Buy at Bell Potter; PT A$8.06

- iSelect (ISU AU): Downgraded to Hold at Bell Potter; PT A$0.48

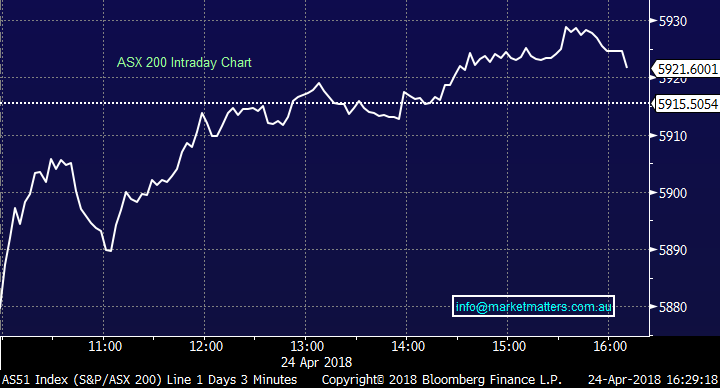

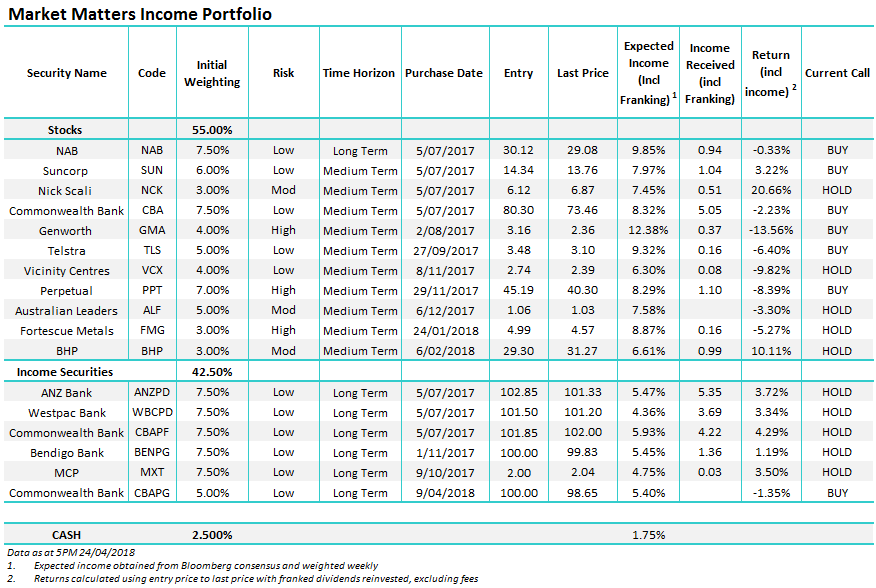

Income Portfolio; with the market up 1.37% over the past 5 days, the income portfolio has slightly lagged up ~0.5%. FMG was poor today after their March quarterly report that was release today. Production was down due to the poor weather over the quarter – this was expected – but costs were higher – should have been expected as while production falls costs won’t fall inline. What was positive was signs that the discount FMG receives for their lower grade ore is slowly eroding, and we may have seen the peak.

Fortescue metals (FMG) Chart

OUR CALLS

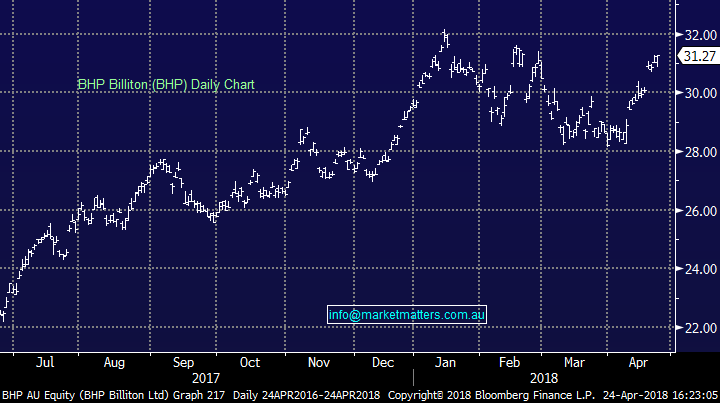

We sold OZL, reduced BHP and added to our NAB position in the Growth Portfolio today. We sold OZL in fear the tomorrow’s no trade day would see the US dollar spike higher and severely impact the copper price – feeling the risk reward was against us and the best option was to sell before the day off.

BHP Chart

NAB Chart

Have a great night – and enjoy a day off tomorrow.

Harry & the MM Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 24/04/2018. 4.30PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here