Buyers step up and buy the dip

WHAT MATTERED TODAY

A weak open to trade this morning with the Australian market following overseas indices down the chute early – however buyers stepped into the weakness and the market experienced a fairly impressive +60pt recovery from the lows. The ASX 200 finished down ~44points which actually felt like a win….

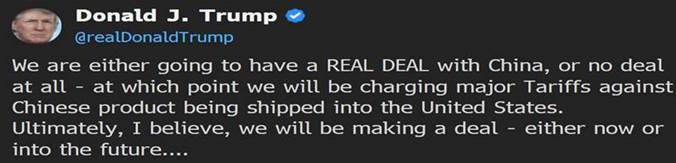

Trump tweeted the following during our session…

While it was being reported that China said the trade meeting with the U.S. was “very successful” and is “confident” of implementing the results agreed upon at the talks, but didn’t provide any further details on the outcome.

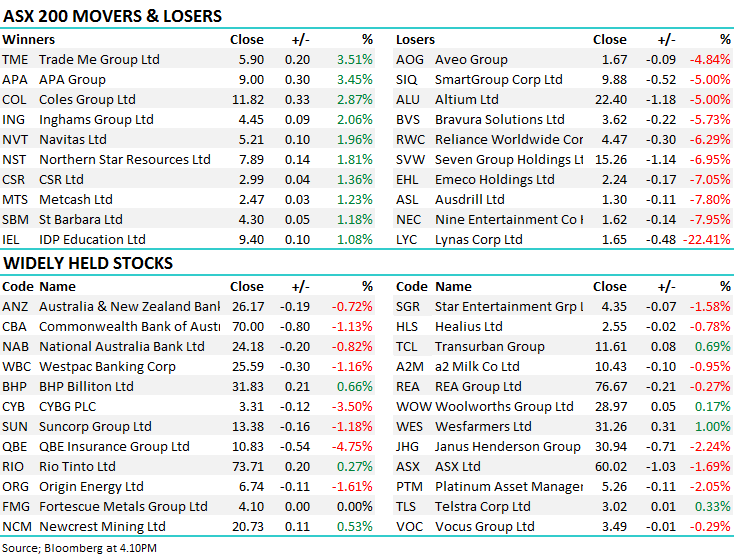

We also saw Chinese data out around lunchtime which was firmer than expected, the Caixin PMI a strong beat on expectations which underpinned a decent move higher in the resource sector – BHP Billiton (ASX: BHP) and Rio Tinto (ASX: RIO) both finished up on the session which is a decent sign given the DOW finished down ~800points.

Chinese Manufacturing Data Today

I put on a ~30m presentation today at lunchtime, which can be viewed here – providing a quick update on our market view. We had a busy morning on the desk and as a consequence the webinar was done off the cuff, so apologies for that however it may be useful for some. Click on the image below to view. We cover our view for stocks into Christmas, the inverted yield curve which we also covered in today’s income report

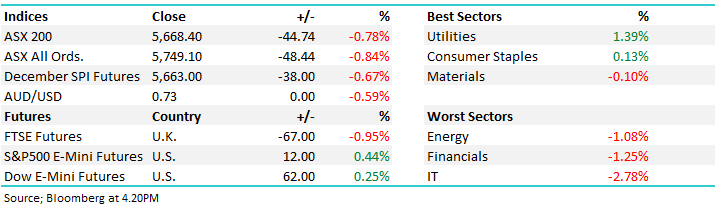

Overall, the ASX 200 closed down -44 points or -0.78% to 5668. Dow Futures are currently trading up +61 points or +0.24%. The US markets are closed tonight for the Bush Funeral.

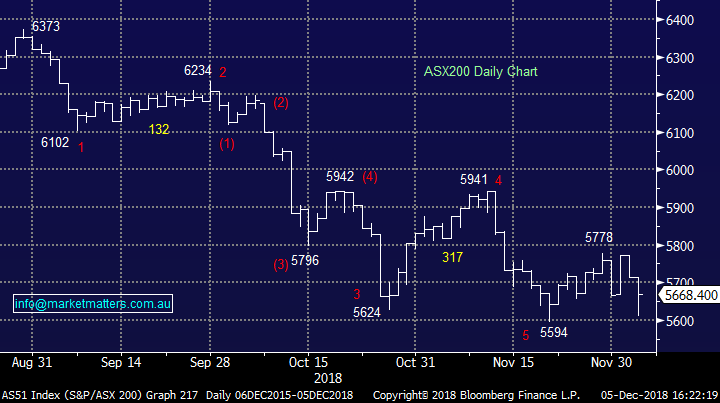

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Broker Moves; Macquarie have been busy recently, upgrading Sandfire Resources, Whitehaven, Alacer Gold and New Hope as a result of price changes; bank cut ratings on Orocobre, Alumina, Galaxy Resources and Regis Resources

ELSEWHERE:

· Pinnacle Investment Management Group New Outperform at Macquarie

· Sandfire Upgraded to Outperform at Macquarie; PT A$7.70

· Galaxy Resources Cut to Neutral at Macquarie; Price Target A$3

· Alacer Gold GDRs Upgraded to Outperform at Macquarie; PT A$2.70

· Orocobre Downgraded to Neutral at Macquarie; PT A$4.60

· Whitehaven Upgraded to Outperform at Macquarie; PT A$5.60

· Whitehaven Reinstated at Goldman With Neutral; PT A$4.60

· Regis Resources Cut to Neutral at Macquarie; Price Target A$4.50

· New Hope Upgraded to Outperform at Macquarie; PT A$4

· Coles Group Upgraded to Outperform at Macquarie; PT A$13.48

· Sims Metal Reinstated at Morgan Stanley With Overweight; PT A$15

· Beach Energy Downgraded to Hold at Morningstar

· Wesfarmers Upgraded to Hold at Morningstar

· AusNet Rated New Sector Perform at RBC; PT A$1.60

· Huon Aquaculture Cut to Neutral at Credit Suisse; PT A$4.90

· Alumina Rated New Buy at Goldman; PT A$2.70

· Santos Reinstated at Goldman With Neutral; PT A$6.90

OUR CALLS

No changes today.

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 5/12/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.