Buyers outlast today (RIO, CYB)

WHAT MATTERED TODAY

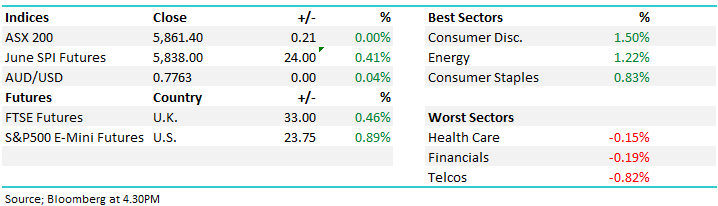

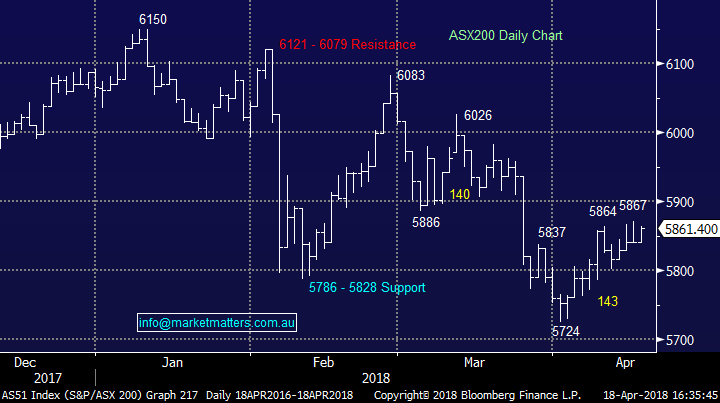

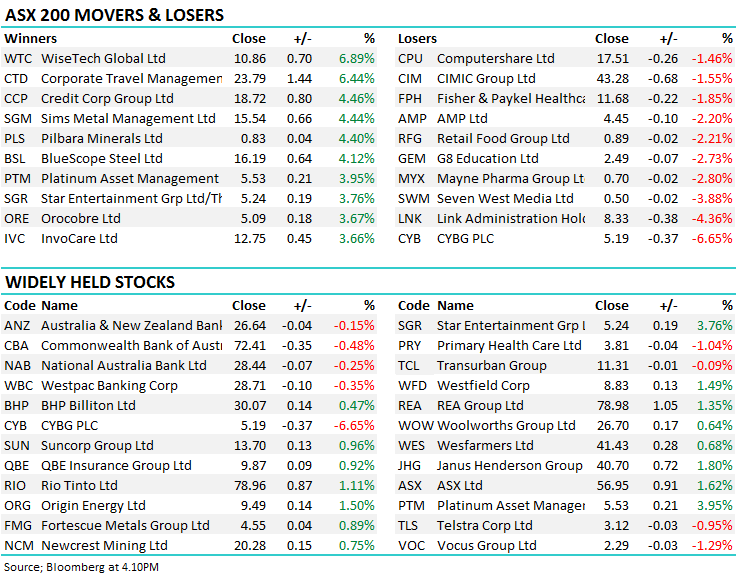

The buyers persisted today and the strong lead overnight flowed through to a reasonable day on the market today. Banks were weak, but this was offset with positive moves from the resource and energy sectors. Global stability helped turn the fortunes of the diversified financial sector around, with Janus performing strongly, but AMP remained in the naughty corner. Rio kicked off the first quarter production reports for the miners, and did it in style – more on this later.

All in all, a reasonable day for the broader market as the buying sustained. The index finishing up 20 points to 5861, adding 0.34%.

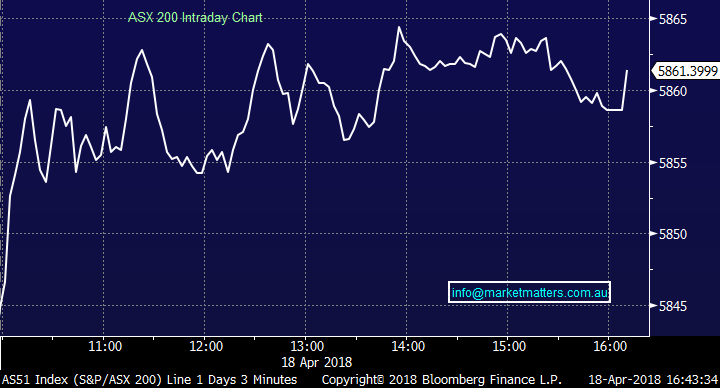

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves:

- Eastern Goldfields (EGS AU): Cut to Reduce at Hartleys Ltd; PT A$0.25

- Harvey Norman (HVN AU): Upgraded to Neutral at JPMorgan; PT A$3.65

- Liquefied Natural Gas (LNG AU): Rated New Market Perform at Wells Fargo

- OZ Minerals (OZL AU): Upgraded to Neutral at Credit Suisse; PT A$9.05

- Star Entertainment (SGR AU): Raised to Outperform at Credit Suisse

CYBG (CYB) $5.19 / -6.55%; down sharply today after announcing plans to increase provisions for payment protection insurance (PPI) as the amount of complaints rise above expectations. The PPI programs relate to poor advice given to clients of CYBG before it was spun out of NAB in 2016. The issues have been known for a while and we wrote about it July of last year, however the increase in claims has risen above our own expectations that the claims would total around or below what CYB had previously provisioned for, along with the £511m that the previous owner NAB had set aside. We hold CYB in the Growth Portfolio, and maintain the view that they are in good shape to manage this tough period as previously discussed.

CYBG (CYB) Chart

Rio Tinto (RIO) $78.96 / +1.11%; Rio released Q1 production numbers before the market opened, and seems to be on track for all aspects for the business except for the (relatively) small mineral sands. Guidance was lowered for Titanium and zircon production as operating issues have arisen in South African and Canadian operations. Although Rio is the largest player in titanium and second in zircon globally, they are only a small contribution to its bottom line. The market was looking for meet or beats on iron ore, aluminium and copper, and that was what was mostly delivered. The copper number was significantly higher than this time last year, which was likely the most important number in today’s release, as recent expansions at Escondida in Chile have delivered better quality at higher rates. Aluminium was also key as the recent much talked about price pressure will be key to Rio’s earnings in the months ahead.

Rio Tinto (RIO) Chart

OUR CALLS

No changes to the portfolios today

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 18/04/2018. 5.09PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here