Broad based buying today – aggressive in patches! (SEK, TLS, APX)

WHAT MATTERED TODAY

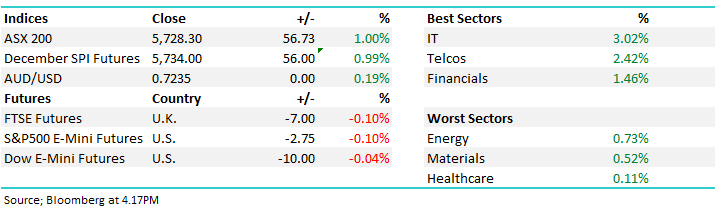

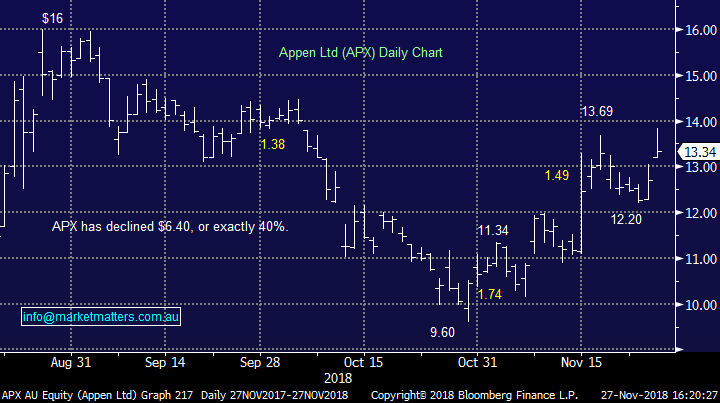

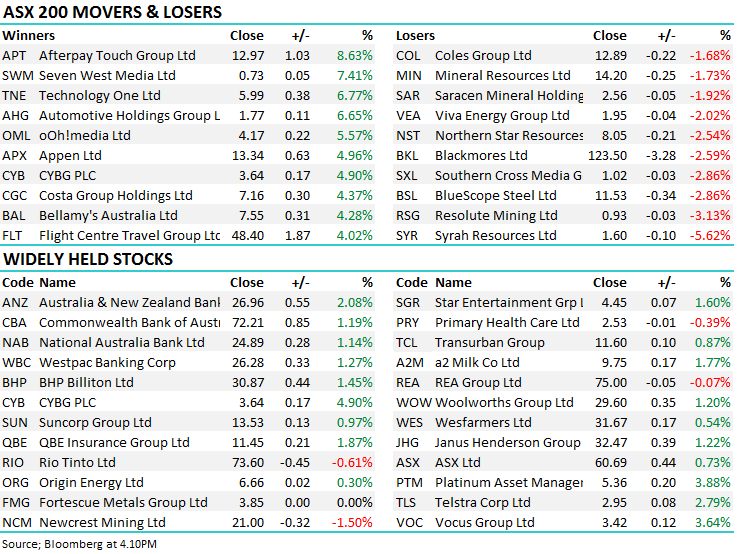

A good session for Aussie stocks today although it was choppy in the morning despite the strong overnight leads. More news around Trump adding tariffs to China, including a 10% tariff on Apple phones!! prompted some jitters early on however a low at midday held and the market rallied +58points from 5670 to close at 5728 – a strong move underpinned by good buying in the likes of Challenger Group (ASX:CGF) which saw high volume buying without any major news flow underpinning it, a bullish sign while Telstra (ASX:TLS) added +2.79% to close at $2.95.

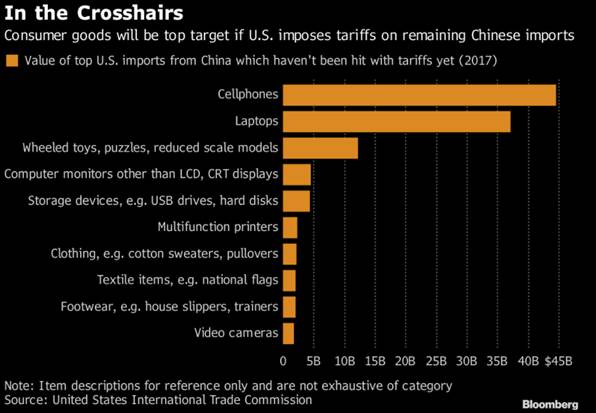

The Banks were also in the winner’s circle with the group adding 16 index points to the ASX 200 – ANZ the best of the bunch up +2.08% on the day with the market clearly starting to fixate on their strong (future) capital position. Appen (ASX:APX) was the best of the tech names we now own, adding +4.96% however it was up more than 8% at its peak thanks to a UBS upgrade.

I had a quick chat with Harry this morning about the Christmas rally plus our current view on resources & banks…click to view

Overall, the ASX 200 closed up +56 points or +1% to 5728. Dow Futures are currently down -40 points or -0.01%.

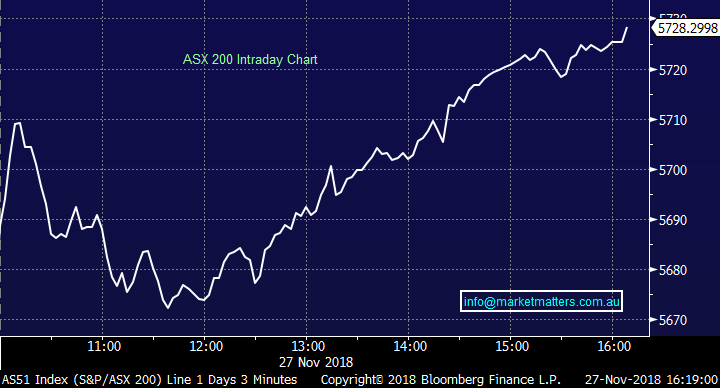

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Trump Posturing; Lots of news circulating around the market today regarding Trumps posturing ahead of the G-20 summit later in the week where Trump and Chinese President Xi Jinping will look to do a deal over trade. Looking into the crystal ball we see Trump coming out before trade starts next week with a ‘phenomenal’ deal for the US with Xi Jinping a great friend and exceptional person! Seems the market is coming around to that thinking as well with Aussie stocks seeing strong support into the close.

Earlier in the day news was out that the U.S was prepared to impose tariffs on all remaining imports from China if they couldn’t come to an agreement at the G-20. So far, the U.S. hasn’t put tariffs on many consumer goods like mobile phones, laptops, storage devices, toys, and some clothes. Bloomberg is saying that will change if no agreement is reached…with the following list given as targets.

The G-20 Summit started with finance meetings yesterday with the Leader’s Summit taking place on the 30th Nov to 1st December (i.e this Friday and Saturday). News flow will be interesting over the weekend.

Broker Moves; We’ve had a fair amount of commentary around Nufarm (ASX:NUF) in our Monday missives…with some very helpful insight from subscribers that deal with the company. Today Credit Suisse, had some positive words to write about NUF saying… Nufarm’s omega-3 canola will be a “company transforming opportunity” with first commercial output expected in 2019. The development offers positives including scope for market growth, constrained supply, limited alternatives cost of production advantage and patent protection (source – Credit Suisse)

RATINGS CHANGES:

· Appen Upgraded to Buy at UBS; PT A$16 – stock rallied +6% today

· Integral Diagnostics Rated New Positive at Evans and Partners

· Coles Group Rated New Sell at UBS; PT A$11.90

· Sims Metal Upgraded to Hold at Morningstar

· oOh!media Upgraded to Buy at Morningstar

· Whitehaven Upgraded to Hold at Morningstar

· Charter Hall Retail Downgraded to Sell at Morningstar

· Oil Search Upgraded to Overweight at JPMorgan; PT A$8.65

· Santos Upgraded to Overweight at JPMorgan; PT A$7.10

Appen (ASX: APX) Chart

Telstra (ASX: TLS) $2.95 / +2.79%; the big telco turned a soft morning’s trade into one of its best in recent weeks to add nearly 3%, knocking off some of its recent weakness. The stock has been soft lately, even during the bounce in the market thanks to an ACCC ruling on the company’s copper network. ACCC has long held Telstra to a set price the company can charge other telecommunication retailers for using their national copper network. The market had held the view that this restriction would be either relaxed or lifted as the network becomes obsolete with the NBN being constructed, and the network loses its monopoly status. There is still a portion of the population yet to be connected to the NBN, and even by 2024, ~8% of Australians, mostly in rural areas, will still rely on this network.

With the limitations still in place over Telstra’s copper line pricing, Telstra’s ability to lift profits remain constrained. However, as the company noted, with the extension of ACCC’s declaration, we will have to wait until early 2019 to see if they do raise the chargeable price. We own Telstra, and like it from these levels.

Telstra (ASX: TLS) Chart

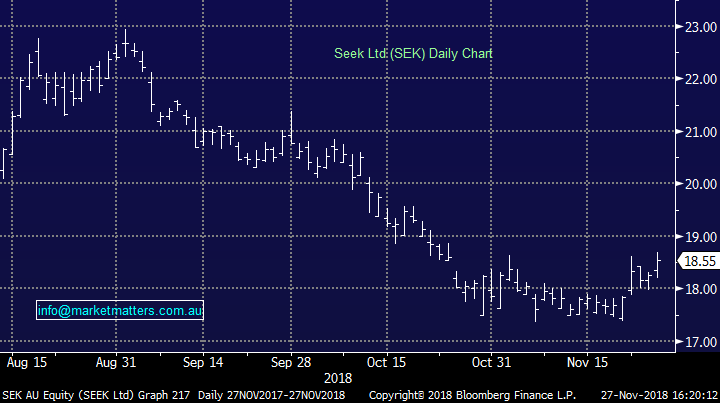

Seek Limited (ASX: SEK) $18.55 / +1.59%; The online jobs platform outperformed the broader market today in a case of no news is good news for the stock. The company held their AGM today, and there were no skeletons in the presentation closet helping the stock move higher. SEEK said that revenue growth is on track to improve by 16% to 20% this financial year compared to FY18, while underlying earnings before interest, tax, depreciation and amortisation (EBITDA) is tipped to grow between 5% and 8% over the period.

Our largest job-seeking website is also investing heavily to drive future growth but that will come at the expense of near-term profitability with underlying net profit expected to stay flat in FY19 despite the healthy top-line increase. That could disappoint some as online platforms are supposed to be highly scalable – meaning a small increase in sales should translate to a bigger increase in net profit due to high fixed costs. It’s hard to really like Seek here, near the top of the labour market and still pushing a expense ramp up story. There are other growth names we prefer – see recent activity for an idea.

SEEK Limited (ASX: SEK) Chart

OUR CALLS

No changes today – we’re looking to increase resource holdings overall into weakness

Have a great night

James/ Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 27/11/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.