BOQ reports soft half year numbers (BOQ, OZL, VRL)

WHAT MATTERED TODAY

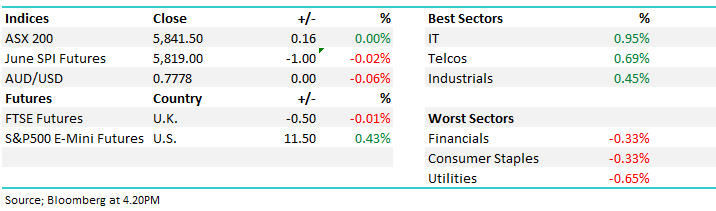

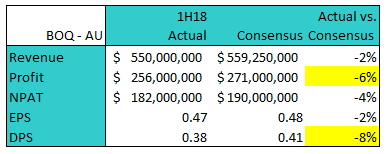

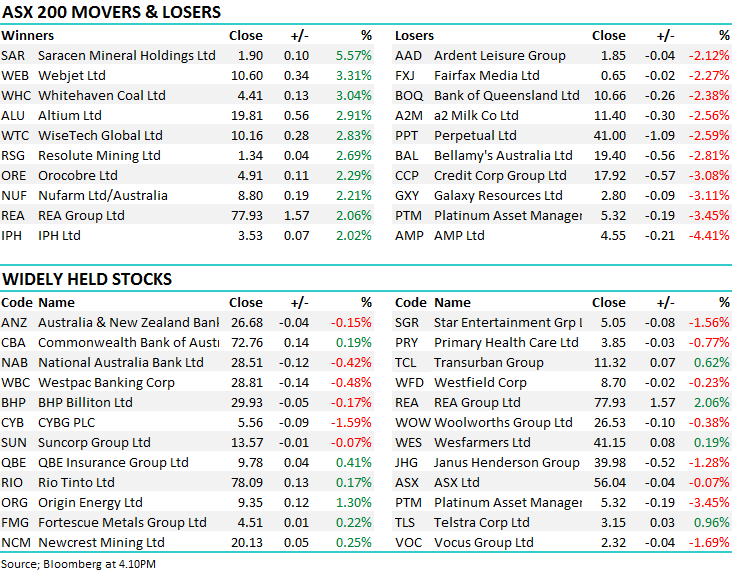

A very weak session for local stocks even though the index finished flat with early optimism sold into fairly aggressively, particularly on the close despite US Futures trading higher / S&P pointing to a rise of 0.5% in the US tonight. The domestic trading desks we deal with are all on the positive side of banks yet we’re seeing decent selling continue, that suggests its overseas selling into a low volume school holiday trade while the commodity / energy stocks were also sold off from early highs.

Elsewhere in Asia, trade was mixed with China falling around 0.60% following a raft of economic data out around lunch time… GDP grew 6.8% in the first quarter which was in line with expectations + the same as the prior quarter while Retail sales were better than expected offsetting Industrial production was up 6.0% last month but missed forecasts of 6.3% - all up, a decent set of numbers from China today.

On the broader market today, the index finished flat however we were down 30pts from the daily highs – the index again closing at 5841. This frustrating range between 5800/5900 continuing.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

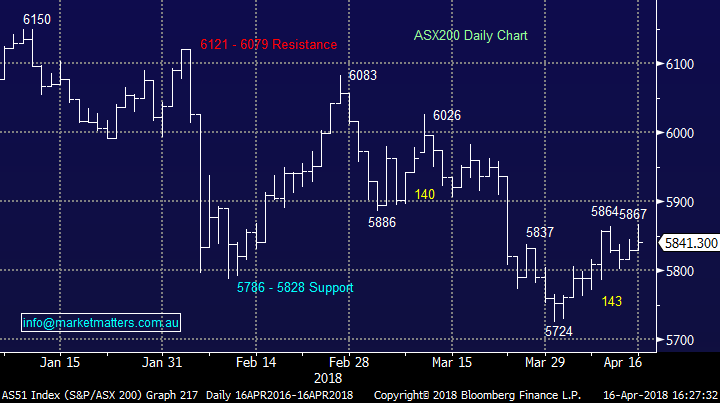

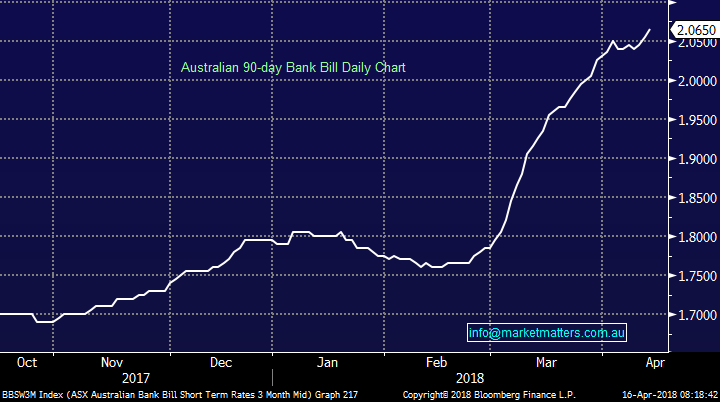

Bank of QLD $10.66 /-2.38%; The stock reported half year results this morning and was sold down on the back of them. We actually covered BOQ in the Monday report concluding that… The main issue for the regionals has been rising short term interest rates in the wholesale market. The regionals are more exposed to external funding sources than the majors and the chart of the 90 bank bill rate highlights this theme – it also means that interest rates on mortgages will be going up.

90 Day Bank Bill Rate

We like the banks here, and have exposure to them, however we’ve got a clear preference for the majors. ANZ, NAB & Westpac also go ex-dividend in May (in that order)

That view held true today with one of the major imposts hitting the result being pressure on Net Interest Margins (NIM), the increase in the cash bill spread probably produces a 5 bps NIM decline and front to back book pricing adds another 5 bps NIM decline. This is unlikely to be offset by lower deposit costs so BOQ is in some trouble here, and will be forced to raise rates or suck up lower margins.

The market was expecting a poor result and they delivered in spades….

Bank of QLD (BOQ) Chart

Village Roadshow (VRL) $2.67 / -15.24% ; The theme park operator and film distribution company sighted the Commonwealth Games and wet weather through March as reasons for downgrading FY18 number significantly. Now expecting up to a $10mil loss, or at best a break even at the profit line, the year that was meant to stand out for VRL now seems in ruins. There has been a great deal of talk around how the Commonwealth Games would impact the Gold Coast economy, with many expecting high visitor numbers to reinvigorate the area, which have now been left disappointed. Consensus was for NPAT of around $16mil for the year and the stock was smashed accordingly after the poor trading update. We don’t own VRL, nor are we enticed at these levels.

Village Roadshow (VRL) Chart

Oz Minerals $8.92 / 0.79%; A stock we own in the Growth Portfolio delivered a good set of March quarter production numbers today + they re-affirmed guidance. Main points below from Rocky…

· MQ results in line for copper and gold prodn.

· Costs a tad higher in MQ (final open pit mine costs prior to cessation) but confirmed to be back in guidance range for FY i.e. the next 3 qtrs to be a low lower.

· FY18 and FY19 guidance maintained

· Carrapateena on track, going well.

· Net cash. Current OZL cash balance ~$646m.

Oz Minerals (OZL) Chart

OUR CALLS

We added to Perpetual (PPT) today in the Income Portfolio around $41 – taking the weighting to 7%. We’ll cover more of the rationale in the Income Report tomorrow.

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 17/04/2018. 5.09PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here