Blood early but buyers step up to the plate…

It’s always going to be an interesting day when you click on the Bloomberg before sun up and the DOW has fallen ~400pts, particularly when it’s on speculation that a US President is heading towards impeachment….blood on the streets early on particularly in the banking space with the big 4 down sharply on open and the index dropping below 5700 by 11am, the target we’ve been writing about following the break of 5816 yesterday.

Since the May 1st high on the ASX 200 of 5956, the index has fallen -4.3% to today’s low. Clearly this has been a weak period for the market as is often the case in May and June is also reasonably soft. That said, we think the bulk of the sell-off has played out and although we may see some more ‘slight weakness’ in June, we thought it time to start spending some of our high cash positon in the Market Matters portfolio.

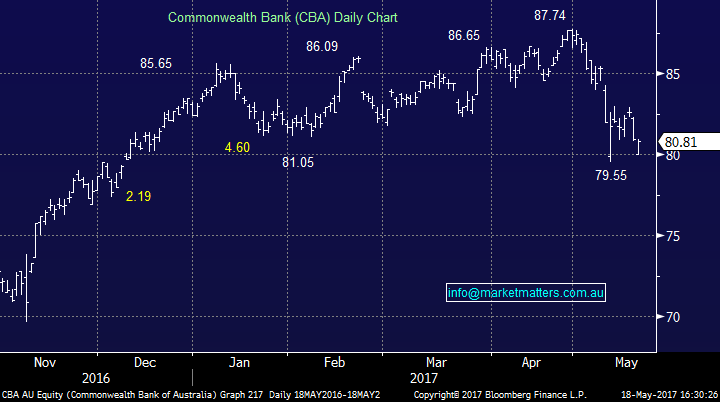

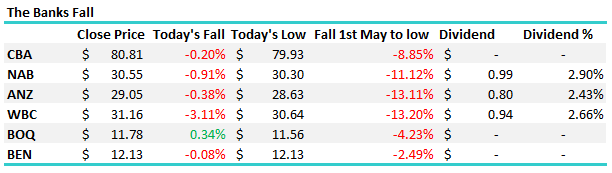

Today we bought CBA at $80.00 taking our cash position down to 23.5%. We allocated 5% of the MM portfolio with the view of increasing this to 7.5% on a move below $79. Alas, we got the 5% but a decent bounce prevailed with CBA closing at $80.81.

Better employment data was the catalyst for the initial ‘buying of weakness’ particularly in the banks with the unemployment rate coming in at 5.7% versus 5.9% - it was a lot of ‘part time’ workers added however the trend is still favourable and it was enough of a circuit breaker for the sell off this morning.

We had a range today of +/- 88 points, a high of 5774, a low of 5697 and a close of 5738, off -48pts or -0.82%. SPI FUTURES were down -57pts this morning and we did drop -64pts yesterday so a recovery from the panic this morning was always a likely scenario. The options traders that sell volatility (as we do) are back in business it would seem after a period of high complacency and low premiums!

At time of writing, US FUTURES are trading higher with the S&P mini’s up +6pts

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

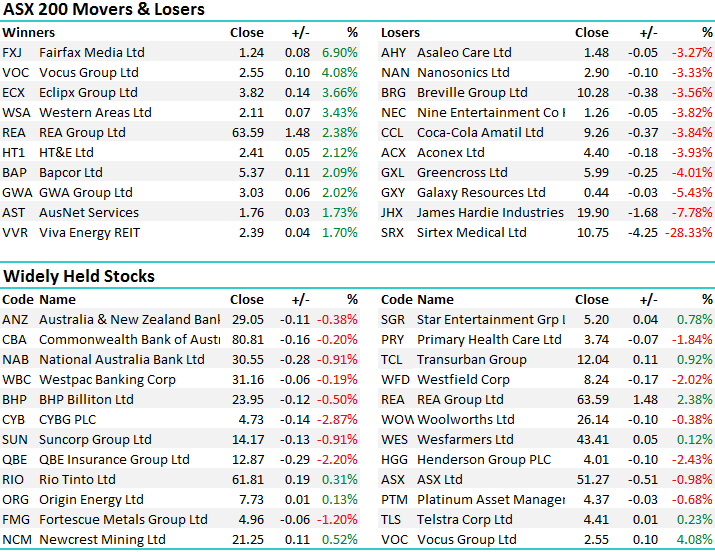

It was actually a very interesting session today and gave good insight into investor thinking / positioning. The banks were hit early which is understandable given the weakness is overseas financials but they recovered strongly from the lows, as did a lot of the industrial stocks that have been strong recently. Buying weakness shows that investors, like us are flush with cash and looking to deploy – however it was the strength in the resource names that was most telling. RIO was v’strong building on strength yesterday while early weakness in BHP was bought – and the stock closed down just 12c. Oz Minerals, a stock that has been a challenge in recent times also had a decent session finishing up on the day.

Oz Minerals (OZL) Daily Chart

Elsewhere, Golds were good early which you’d expect given the rise in volatility however they were sold into as the market recovered. We remain keen on Regis (RRL) but are being picky on entry levels.

Commonwealth Bank (CBA); we bought it this morning at $80.00 allocating 5% of the MM Portfolio – another 2.5% to be added if it slides down to sub $79 however it does look like a reasonable low in the place today.

Commonwealth Bank (CBA) Daily Chart

The banks more broadly have come under a lot of pressure in recent times with the big 4 down between 8-13% depending if they have gone ex-dividend. Today it was Westpac with 94cps coming off the price and the stock ended down just $1.00 – a very good result.

At Market Matters, we believe in being active rather than passive around our portfolio and that’s not all about being traders, it’s more about tweaking around the edges of our holdings to optimise returns. The concept of passive management has gotten a lot of airtime in recent weeks however as Geoff Wilson rightly said in the AFR the other day, when active managers are forced to cut fees, and everyone is talking about being passive, that’s exactly the time to be active! Moves such as the ones we’ve seen in the banks in May is an example of why we are active and will remain that way.

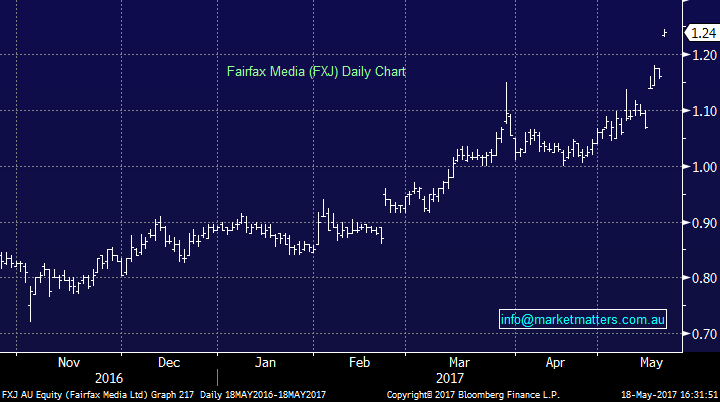

Some interesting corporate news today with a second Private Equity group now lobbing a bid in for Fairfax (FXJ) – a slightly higher offer to that of TPG and it’s now a competitive process. We also hear that FIRB is a good chance of approval and Fairfax will now allow DD from both parties. We get the feeling that the bids still undervalue FXJ and a spin off of the domain business could still be the preferred path.

Fairfax (FXJ) Daily Chart

Have a great night,

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 18/05/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here