Bingo gets whacked (BIN, WBC, BOQ)

WHAT MATTERED TODAY

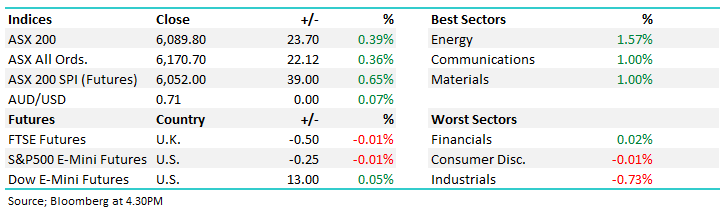

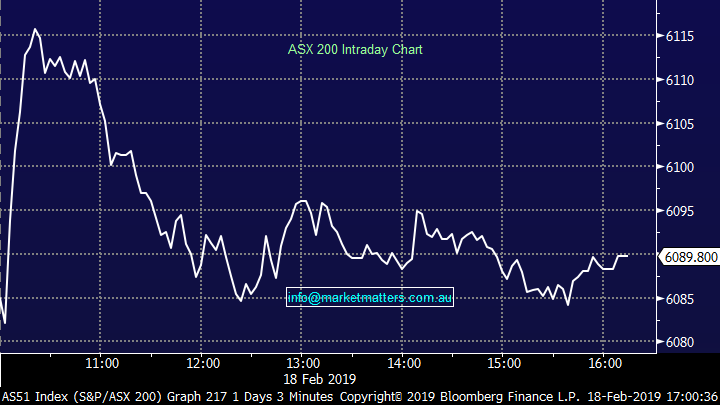

The US market provided a good lead for stocks this morning and the market was strong early – up nearly ~60 points in the futures market before some sellers angled into the rally. Asian markets were higher as continued rumblings of an imminent trade deal bubbled away in the background – China up ~2%, Hong Kong up +1.65% while US Futures stayed fairly muted throughout our time zone. Given that positive backdrop, the Australian market adding just +23pts / +0.39% was pretty underwhelming – Energy stocks a standout while the broader industrial lagged.

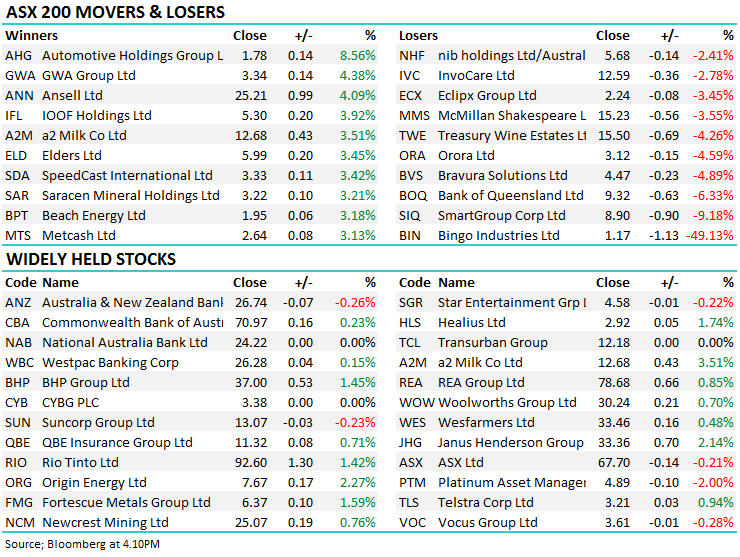

Results continued to dominate news flow today however it was a massive downgrade from Bingo (ASX:BIN) that was out pre-market that copped most attention across trading desks. When a growth company fails to deliver growth the market can be very unforgiving. Harry covers the BIN result below – it wasn’t pretty and the sustained selling throughout the day highlights that insto’s pumping it out throughout the day which momentum traders will be in there for the broker downgrades tomorrow. This is one to watch towards the end of next week before the ACCC rule on the Dial-a-Dump deal. If it doesn’t happy, a decent buyback will likely be announced. (That decision was due out this week however the ACC have delayed until the 28th Feb)

Elsewhere, Westpac (ASX:WBC) gave a trading update with no real surprises – the stock up 4c at $26.28 while poor old Bank of QLD (ASX:BOQ) followed their regional counterpart down the chute today, off by ~6% on an earnings downgrade. More on these below.

Overall, the ASX 200 closed up +23points or +0.39% to 6089. Dow Futures are currently trading flat

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

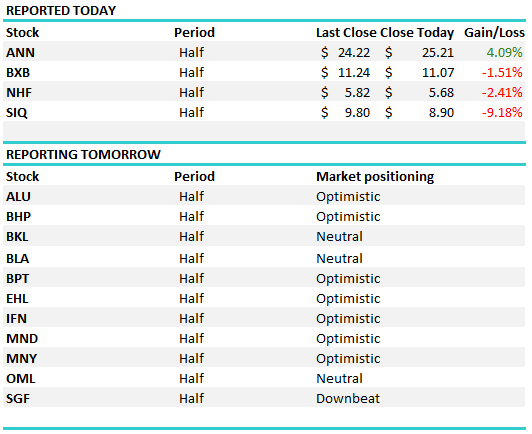

Reporting; A big week ahead on the reporting front with Wednesday and Thursday both being massive, although a lot across the ticker tomorrow as well headlined by BHP & Cochlear. We sold COH from the Growth Portfolio today ahead of the result – we simply didn’t want to take the risk into tomorrow’s numbers and cut it for a small profit. In terms of current market expectations, expect net profit for the half of ~$130m on revenue of ~$713m. The market is expecting profit growth of ~14% for the full year.

Cochlear (ASX:COH) Chart

NIB Holdings (ASX:NHF) -2.41% missed expectations for the half with underlying operating profit at $114.3m v ~$125m expected however they did upgrade guidance for the full year from at least $190m to at least $195m, which is actually fairly close to current market expectations. NHF says that they “do not anticipate the second half of FY19 to be as strong as the first. Key factors expected are unfavourable claims seasonality, the fact that the first half was boosted by a claims provision release within ARHI and likely weak market conditions affecting parts of the Group”. Markets assumed this seasonality – not a new thing. We like NHF into further weakness

Smart Group (ASX:SIQ) -9.18% Another high flyer that has hit some turbulence today with about a 3% miss on the earnings line and the market has knocked it by 9%. SIQ has been under pressure for a while – down from a high of ~$13 to sub $9 today however earnings momentum now an issue and the market is still optimistic the stock. We have no interest at this stage.

Ansell (ASX:ANN) +4.09% did well adding after they printed a decent first half result plus narrowed guidance to the top end of EPS range USD $1.06-1.12 – up from $1.00-$1.12 – which implies about a 3% upgrade to where consensus was sitting.

Brambles (ASX:BXB) -1.51% finished lower after rallying into their result. Numbers were in line with expectations however market clearly positioned for a bit more. This is a business in recovery mode and todays report is another step in the right direction

Altium (ASX:ALU) just out this afternoon – will cover that in the morning…

Bingo Industries (ASX: BIN) -49.13%; The waste management company has been savaged by the market today following a significant downgrade to full year expectations ahead of their half year results due out next week. Bingo revised their EBITDA guidance to be broadly flat on FY18, down on previous guidance of 15-20% growth. Part of the issue is that the market was well above the company’s guidance, and for the full year had priced in around 35% growth.

Here’s what the company blamed it on;

1. A faster than anticipated softening in multi-dwelling residential construction activity across BINGO’s key markets in NSW and Victoria.

2. No price rise in FY19.

3. Reconfiguration of our development projects.

So is this a just a delay in Bingo’s growth or is it a structural issue that could continue to impact the company in the medium term? Firstly, the construction activity issue is something that Bingo cannot control, it is cyclical but will likely take time to play out.

The lack of a price increase is a business decision from Bingo, which planned to raise prices at the same time as the Queensland waste levy was introduced. As the levy is yet to come into effect, and won’t until next financial year, Bingo hasn’t increased pricing in the current financial year – an issue, but not a long term one. Finally, the development delays aren’t ideal but also should not been seen as ongoing, and will help lift FY20 significantly.

Adding to the disappointment for Bingo is the progress that direct competitor Cleanaway Waste (ASX: CWY) made at their half year result released last week. CWY jumped over 13% on the day as profits rose strongly and guidance for the second half was solid. Up next is the ACCC ruling on Bingo’s proposed takeover of Dial-a-dump which is expected later this week. The update is hugely disappointing, and the stock now trades at all-time lows. A long road ahead to convince growth investors, that it’s still a growth company. Broker downgrades flowing through tomorrow and the selling today was sustained – more downside from here in the next day or so, however the stock remains on our radar.

Bingo (ASX: BIN) Chart – ouch!

Bank Of Queensland (ASX: BOQ) -6.33%; A couple of contrasting bank reports came out today highlighting the divergence between the major banks and the regionals. Bank of Queensland was one of the worst performing stocks in the ASX200 for the session, following the release of their 1st half update. As is the case across the Australian credit market, loan growth is weak for BOQ while funding pressure has caused a decline in the net interest margin (NIM). The NIM is expected to fall 2-4bps from a year ago to 1.93%-1.95% while declining non-interest income (fees & charges, trading etc.) & a lack of loan growth will mean earnings will struggle. Regulatory costs have also climbed and will remain elevated for now thanks to the Royal Commission.

Despite the negativity on earnings, there are a few highlights in the update. The leasing business of BOQ has been helping stem the earnings leak while bad debts do remain low despite a small uptick that is expected. This won’t be enough however, and regionals are clearly doing it tougher than the majors. We will only think of a switch into more protracted weakness.

Bank of Queensland (ASX: BOQ) Chart

Westpac (ASX: WBC) +0.15%; On the other side of the ledger, Westpac (ASX: WBC) also had their first quarter update, and the stock is traded marginally higher in the session. Contrasting to BOQ, Westpac managed to increase the NIM on the quarter, which should rise around 6bps for the half thanks to their out of cycle rate hikes. Westpac does face low loan growth, as is the same across all players in the market, however the big banks seem to have more power to maintain a higher NIM with lower funding costs while an effort to limit costs should flow through to profit growth for the year.

Elsewhere, impaired loans saw a small increase in line with BOQ, and Westpac’s capital position continues to stay strong as the bank approaches the APRA 10.5% CET1 ratio. The big banks certainly have the edge in a tough operating environment for our lenders. Currently, on a PE basis the regionals are starting to see a discount applied. We are keeping an eye on this and if the discount becomes attractive we may look to position more towards Bendigo & Bank of Queensland as a relative value opportunity.

Westpac (ASX: WBC) Chart

Broker Moves;

· Domain Holdings Downgraded to Neutral at Macquarie; PT A$2.60

· Domain Holdings Downgraded to Hold at Morningstar

· Magellan Financial Downgraded to Neutral at Goldman; PT A$32.70

· Abacus Property Downgraded to Neutral at Citi; PT A$3.87

· AMP Downgraded to Neutral at JPMorgan; PT A$2.35

· Vicinity Centres Downgraded to Neutral at UBS; PT A$2.72

· Link Administration Cut to Sell at Deutsche Bank; PT A$6.30

· Link Administration Upgraded to Overweight at JPMorgan; PT A$8

· Baby Bunting Upgraded to Outperform at Macquarie; PT A$2.65

· Brickworks Downgraded to Sell at Morningstar

· nib Downgraded to Hold at Morningstar

· Whitehaven Upgraded to Hold at Morningstar

· Healius Upgraded to Add at Morgans Financial; PT A$3.15

· Aveo Downgraded to Hold at Morningstar

OUR CALLS

We cut COH for the Growth Portfolio today ahead of earnings results tomorrow.

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 18/02/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.