Big sell off the wrap up a choppy FY17

The market sold off hard today with weakness early, a couple of tentative attempts to get off the mat before another strong wave of selling late in the session to wrap up what’s been a very choppy FY17. The year started out getting over the BREXIT hangover with the market rallying strongly from the 5233 mark on the ASX 200. We had the final rate cut by the RBA in August before Donald Trump surprisingly won the US election in November. This put some fire in the belly of the market which rallied strongly into the May high of 5956, and we now find ourselves closing out the year at 5721, an overall gain of 9.3% for the ASX 200. The best year in the last 3 despite a soft finish today.

On the broader market, the Energy, Material and Financial stocks (i.e – the reflation trade) performed best in a relative sense. We had an overall range of +/- 83 points, a high of 5804, a low of 5718 and a close of 5721, off -96pts or -1.66%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

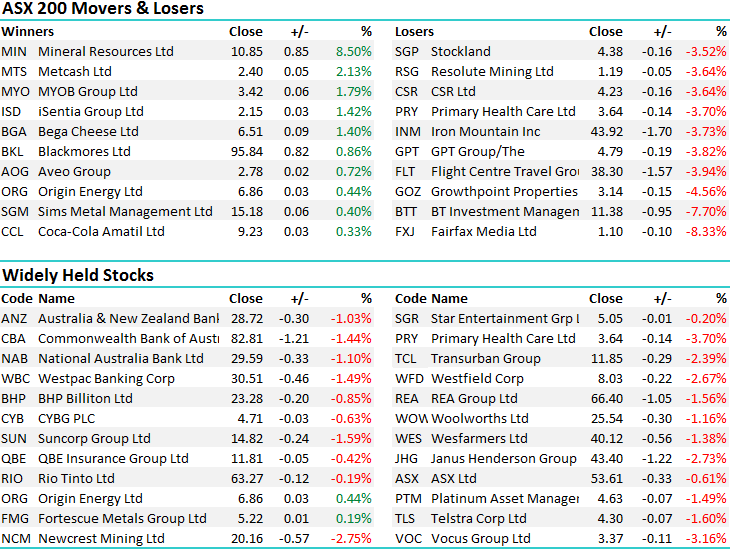

When the market sells off like it did today, it’s worthwhile looking under the bonnet to see what areas saw most pain and what areas held up in a relative sense. Once again, the Financials and Material stocks were reasonably well supported in a weak market with the likes of Fortescue closing up, RIO was down only -0.19% while the banks were down somewhere between 1-1.5%. We added another 2.5% to Westpac this morning taking our total holding to 7.5% of the MM portfolio.

Westpac (WBC) Daily Chart

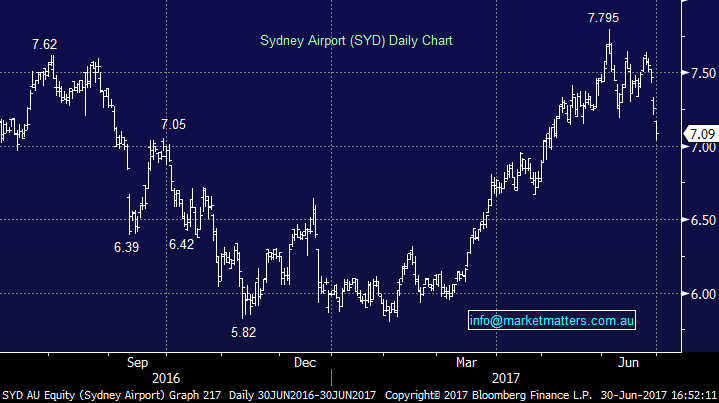

Once again it was the ‘yield play’ stocks that were under most pressure, with Sydney Airports off by -2.34%, Transurban down by -2.39% while there was some big selling amongst the real estate stocks, Mirvac down by -3.18% and GPT off -3.82% - which highlights how close investors are to the jump seat in these type of stocks. Safe, defensive, low risk stocks can certainly have big moves!!!

Sydney Airports (SYD) Daily Chart

We’ve been active in the Media this week with some interesting discussions with Fund Managers, from both Wilson Asset Management, and Aitken Investment Management. Firstly, BUY HOLD SELL for Livewire featured James Gerrish this morning, in a recording done last week. The video covers The dogs of FY17 asking the question if the companies currently in the ‘dog-house’ will keep howling next year, or if they might just get their bark back.

We also cover some key macro issues with Charlie Aitken from AIM, concluding that volatility is sure to tick higher – and it certainly has this week. To watch that video – click here

Happy end of Financial year for all of us at Market Matters!

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 30/06/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here