Big line of AMP shares through the market this morning (AMP, WHC)

WHAT MATTERED TODAY

Another day of light volume through given school holidays - the market swinging around in a reasonable 43pt trading range, closing up but selling into the close saw the market finish off the highs. As we suggested this AM, even the dovish comments around rates by Jerome Powell were not enough to make fresh 2019 lows for US 10-year bond yields implying they have reached a new level of equilibrium, at least for now. Hence we now expect rates to trade sideways while markets wait on further economic data – the catalyst is probably earnings. If markets are being driven by rates, and rates are now in a holding pattern as official moves catches up to market positioning, then it implies that equities could stall around current levels.

Today we again saw some intra-day weakness play out, similar the what we’ve seen over the last few days and that has created a negative short-term technical picture for MM with our initial downside target for the ASX200 ~6590, only marginally lower, but lower none-the-less.

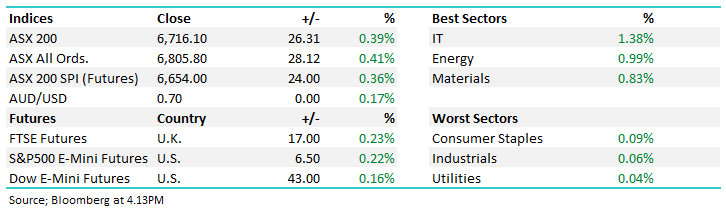

Overall, the ASX 200 added +26pts today or +0.39% to 6716. Dow Futures are trading up +43pts / +0.16%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

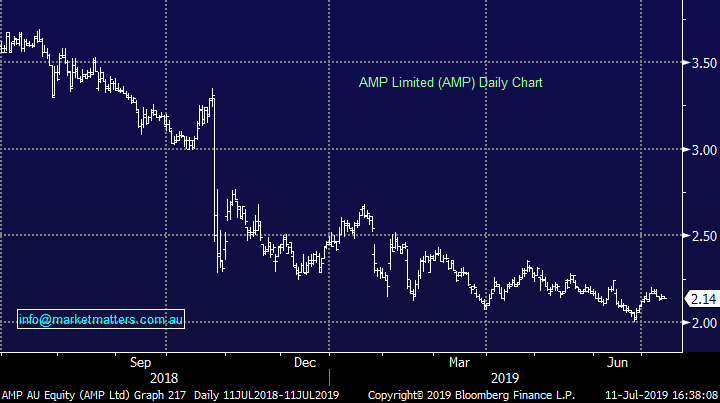

AMP $2.14 unchanged: 1.16% of the company changed hands this morning with 34.2m shares trading at $2.14. We like this sort of action in beaten up stocks as it shows that new money is starting to become attracted. Stocks generally don’t rally in a sustainable way until the stale longs are out, and new money has looked at the story with fresh eyes . AMP needs a final washout low to look interesting we think.

AMP Chart

Whitehaven Coal (WHC) +4.93%; kicked off the quarterly reporting period for the miners today releasing their June quarter production report which is providing a positive read through for their full year results due out next month. The final quarter’s contribution pushing the year’s output above guidance for raw coal production numbers. Run-of-mine (ROM) production came in at 23.2Mt, above the upper level of guidance at 22.8Mt. The result was driven by a big beat at the Narrabri facility, however there are signs that this may not flow through to a big profit beat at the result. Saleable coal production, the finished product which WHC can then offload, missed guidance by around 5% at 19.8Mt.

On the pricing side of things, Whitehaven managed to negotiate a 5% premium to the index for their thermal coal product in the quarter. Prices on the metallurgical side came in even better, with a 12% beat to the spot over the June quarter. Technically, the rejection of the $3.60 level is a positive in the short term. Medium to longer term Whitehaven becomes a little more tricky. We like it for an income play with high free cash flow on low CAPEX.

Whitehaven Coal (WHC) Chart

Broker moves; Bluescope Steel (BSL) - one of our new holdings in the Growth Portfolio copped an upgrade today from Goldman Sachs. We bought into the stock on the recent retracement with the view that analysts had baked in a lot of the negativity around earnings which the company could weather on the back of a strong balance sheet. They continue to buy-back stock in the market, supporting any softness in the share price. A change in fortunes from a steel margins perspective will help the stock higher.

- Platinum Asset Downgraded to Sell at Bell Potter; PT A$4.22

- New Hope Upgraded to Buy at Wilsons; PT A$3.60

- Evolution Downgraded to Hold at Morgans Financial; PT A$3.44

- Resolute Mining Upgraded to Buy at Goldman; PT A$1.60

- Newcrest Downgraded to Sell at Goldman; PT A$26

- OceanaGold GDRs Upgraded to Buy at Goldman; PT A$4.80

- Sims Metal Downgraded to Neutral at JPMorgan; PT A$11

- Bluescope Upgraded to Buy at Goldman; PT A$13.51

- Woodside Downgraded to Underweight at JPMorgan; PT A$33.85

OUR CALLS

**No amendments today**

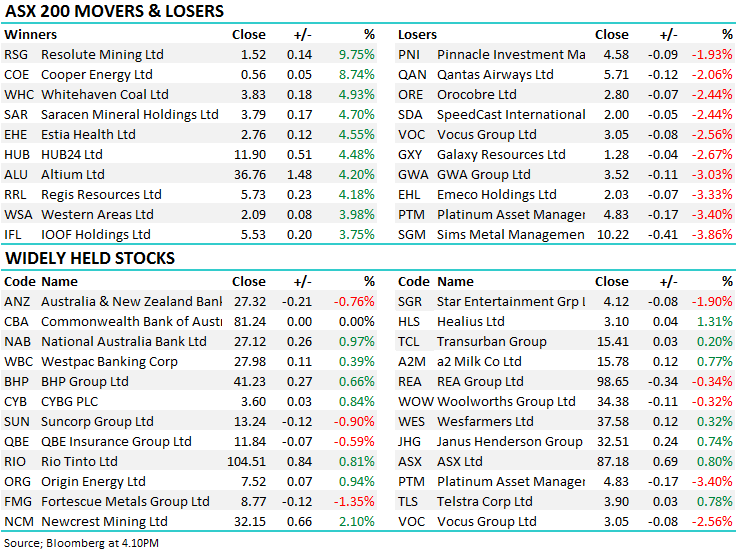

Major Movers Today – Decent move is Estia Healthcare (EHE) today along with Whitehaven (WHC) on its production numbers.

Have a great night

James, Harry the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 11/07/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.