BHP underpins strength for Aussie stocks (BHP)

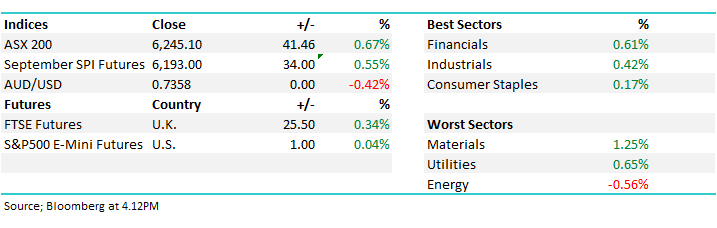

WHAT MATTERED TODAY

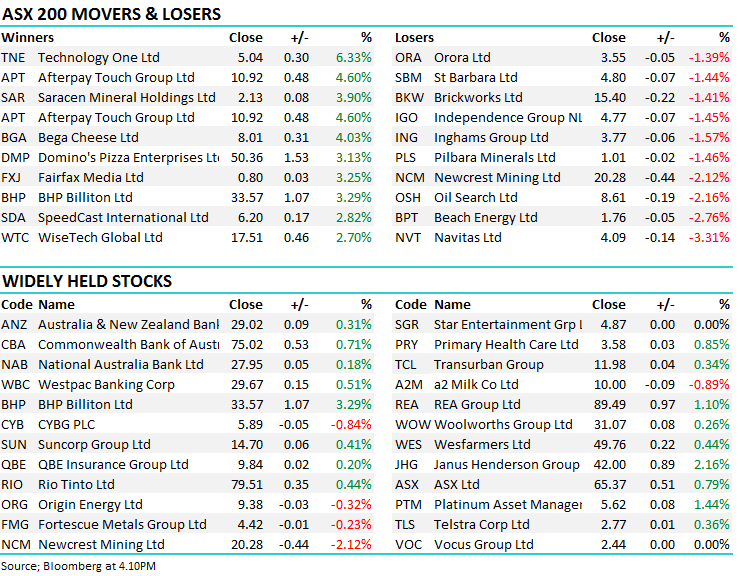

The Australian market bounced back today after a couple of sessions of weakness – not a bad effort with BHP leading the charge after a strong set of production numbers while alluding to a competitive tender process for their shale assets. The stock opened strongly ($33.60 – and continued to tread water throughout the day to settle at $33.57 after testing $33.75 on the upside and $33.20 on the downside. Elsewhere, Ramsay (RHC) came back into favour grinding higher through the session while Macquarie (MQG) was strong adding 2.28% on the day plus we saw some buying in the technology names – Afterpay (APT) continues to rip higher up another 4.60% to close at $10.92 as did some of the other Technology stocks.

We wrote the following this morning however failed to pull the trigger given our neutral stance at the moment…It’s hard to pull the trigger when conviction about the market is low at this point in time….

Following on from recent reports there are 3 positions MM are likely to be considering today:

1. With gold falling over $US12/oz last night MM will be assessing Evolution Mining (EVN) into any relative weakness. (EVN actually closed higher after trading in a tight range – which made it easy to sit on the sidelines).

2. With both gold and copper down overnight MM will be assessing OZ Minerals (OZL) into any relative weakness. (ditto for Oz Minerals after failing to trade near our $8.80 entry point)

3. With Europe regaining a “bid tone” MM will again be considering buying the BetaShares Wisdom Tree Europe ETF (HEUR). (A position we’ll continue to consider if European market remain strong relative to the US however no real impetus to act today)

Overall, the ASX200 added +41 points, or -+0.67% to close at 6245 – recouping yesterday’s loss plus some. Dow Futures are currently trading up +10pts

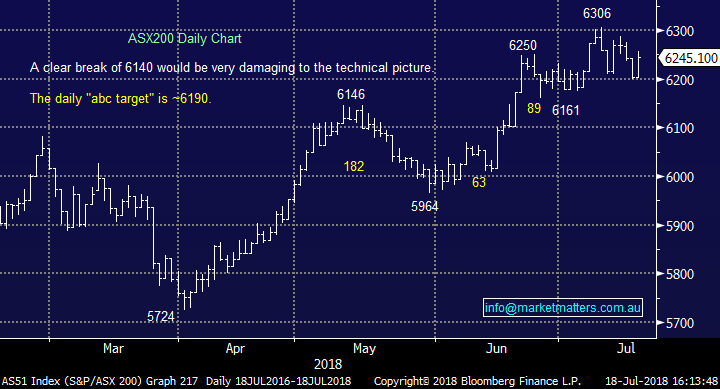

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves: JP Morgan diverged views for a couple of energy stocks today, sending Oil Search lower with a downgrade, and Senex higher with an upgrade.

· Oil Search (OSH AU): Downgraded to Neutral at JPMorgan; PT A$8.80

· Pact Group (PGH AU): Upgraded to Buy at Morningstar

· Senex (SXY AU): Upgraded to Overweight at JPMorgan; Price Target A$0.46

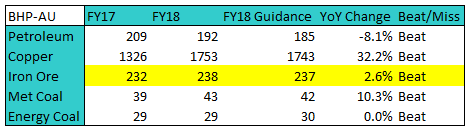

BHP Billiton (BHP) $33.57 / +3.29%: BHP today released an impressive set of FY18 production results, beating guidance and market expectations across the board, along with setting new records for annual iron ore, met coal and copper production. Along with the figures, BHP gave production guidance into FY19, expecting higher iron ore & coal, while a small fall in copper production is expected.

Other things to note in the release was a forecast for higher exploration costs into the second half of the year, while a mention was given to the US Shale assets sales with the company having this to say – “The exit process for Onshore US is progressing to plan. Bids have been received and we aim to announce one or more transactions within the coming months, targeting completion of any transactions by the end of the 2018 calendar year.” It sounds like multiple buyers are still in the hunt, potentially forcing the price higher and increasing the returns back to shareholders. It is widely understood that any proceeds will return straight to shareholders in the form of buy-backs and special dividends.

BHP Billiton (BHP) Chart

OUR CALLS

No changes to the portfolios today.

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 18/07/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here