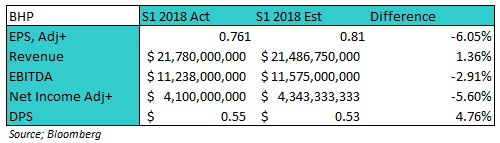

BHP out after market – miss on earnings (~5%) but a big beat on dividend (~12%) (BHP, VOC, SUL, WSA)

WHAT MATTERED TODAY

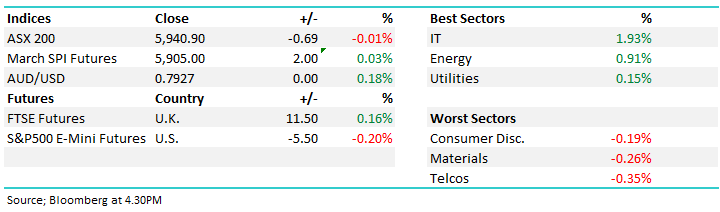

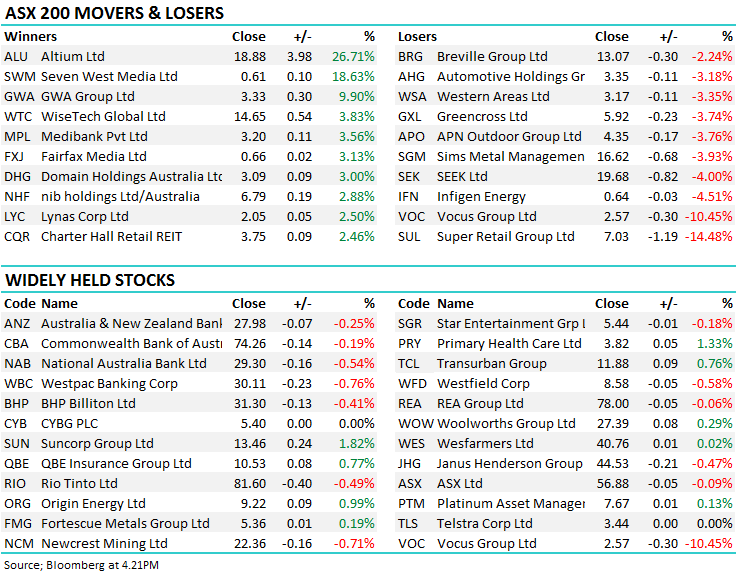

Stocks were weaker again this morning in early trade, before buyers stepped up to the plate throughout the day and the index grinded higher – closing near its highs. A barrage of reports hit the mkt pre-open (and BHP just out now) and that kept the desk busy early on with most focus amongst the miners - which is an area we like at the moment so it dominated our attention. Overall, the market finished flat but +28pts from the lows, and just 1 point off the high. The ASX 200 settling at 5940

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

Reporting today…

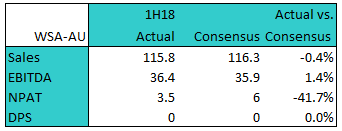

Western Areas (WSA); inline (just) although some underlying softness in some parts but maintained guidance – stock down -3.35% to $3.17 – more on this one below

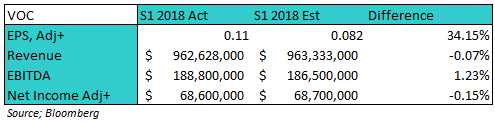

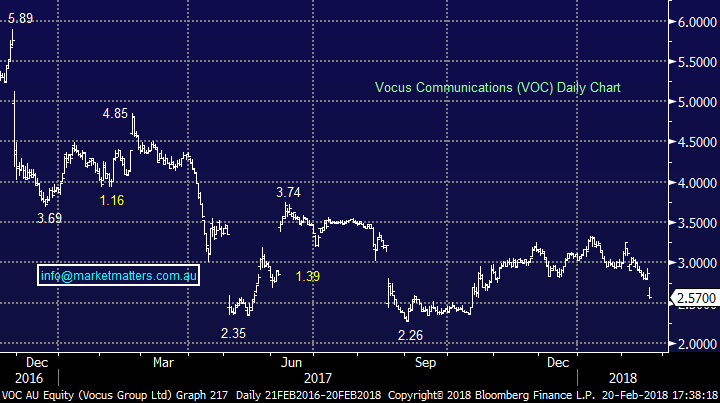

Vocus (VOC); Printed inline but downgraded guidance – stock down -10.45% to $2.57 – more on this below

Monadelphous (MND); A miss in terms of EBITDA however revenue guidance was really strong, implying $1.6bn v the mkt at $1.5bn so upgrades likely – stock up +2.06% to $18.32

Oil Search (OSH); Full year result which was okay – earnings broadly inline, profit inline – pretty much smack on. Stock down -0.53% to $7.55

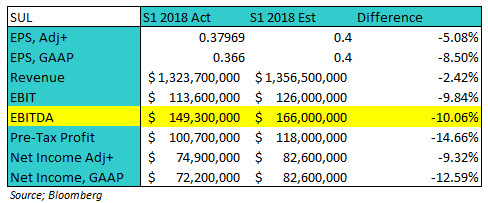

Super Retail Group (SUL); Earnings miss by a long way (~10%) and the stock hit hard – finishing down -14.48% to $7.03 – more on this below

Flexigroup (FXL); No one really covers it these days however result was ok to my eyes but a business that doesn’t really get the heart pumping – better off in ZIP Money – stock up 3.92% to $1.725

Greencross (GXL); Result had been pre-reported at the group sales/NPAT line so not a lot of new areas to dig into – all up ok + company reckons that ‘consensus’ numbers are on the money for the full year. Sales slow in their pet division but the vets are doing well – stock down -3.74% to $5.92

Northernstar (NST);In-line + dividend increased as the mkt was expecting. Don’t see any significant changes to consensus earnings. There was a lot more detail provided on exploration / growth which I didn’t review – stock closed down -1.75% to $2.81

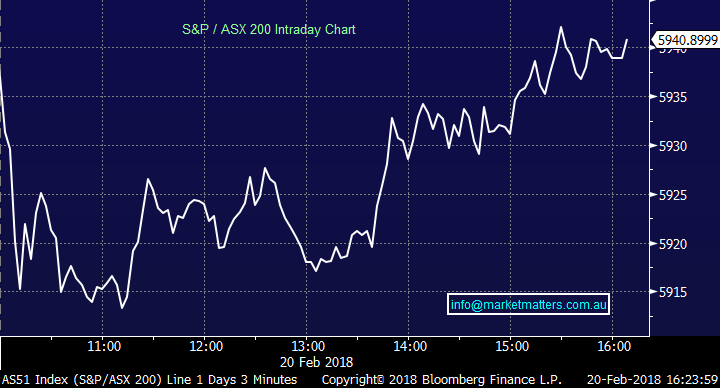

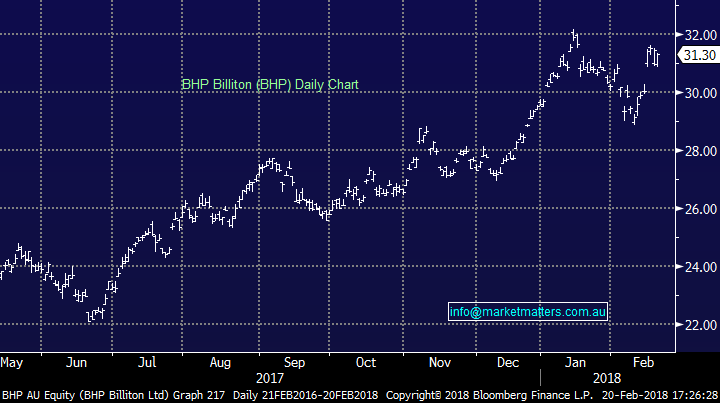

BHP (BHP); Just out…looks like a miss in terms of earnings, a beat in terms dividend, revenue was okay – but a miss overall. Stock closed down -0.41% today at $31.30 but that was before the result which has a massive amount of detail so first glance can be deceiving, however overall I think it’s soft…albeit with a few swings and roundabouts…

Main line here is the EBITDA miss of 2.91% which is big for BHP and the profit line was a ~5% miss – again – that’s big. Offset partially by the better divi.

In terms of the dividend, its comprised of 2 parts, (i) Base dividend struck at 50% payout ratio for US38c and (ii) supplementary component at 17c taking the full payout ratio for ordinary shares to ~72% - which is big. The obvious question, why the miss in terms of earnings? Not really sure until we dig further but on initial run through we see that by division some slight weakness in petroleum (3%), iron ore (3%) and coal (13%). Anyway, it’s a miss which is rare for BHP however more details to come on the conference call no doubt – starts at 7.30pm

BHP Daily Chart

CATCHING OUR EYE

1. Supercheap Auto (SUL) $7.03 / -14.48%; Poor result and the stock was dealt a lesson today trading down ~15% but even that was up from the session lows. Revenue a slight miss but the rest was weak. Highlights how tough it is in retail with massive amounts of margin pressure being applied here. We talked about that in JB’s recent result but not a lot to like here in terms of SUL. They also talked about ‘Rays’ which is a store I like, and that’s to be consolidated under the Macpac brand – the deal will be mid-single digit EPS accretive in FY19 pre-synergies however SUL have a poor track record in previous acquisitions / integrations and along with a weak result, it does very little to warm the heart.

Supercheap Daily Chart

2. Vocus $2.57 / -10.45%; Today’s result was inline, if not a slight beat with EBITDA coming in ~2% above consensus, however VOC was hit hard after reducing EBITDA guidance for FY18 by ~3% citing over hedging the energy portfolio and the continuing battle to get NBN customers in the door. Vocus has been a well-documented fall from grace and today’s result highlights the ongoing difficulty that management has with this business. They cut the dividend (expected) while looking to reinvest into the business, they’re struggling to combine its various businesses meaningfully and continues to look to deleveraging through selling non-core assets. The issue here is what is now the core business. Their telecoms arm has headwinds that have muted the growth forecasts of previous years, while the Australia-Singapore Cable project, although on track to finish on time in 1H19, is yet to sign any customers, always a battle for long term projects in an industry where technology advancements are thick & fast.

Result OK – just guidance downgrade was the issue

Vocus Daily Chart

3. Western Areas (WSA) $3.17 / -3.35%; A stock we like but at lower levels…. NPAT line was as miss but that’s neither here nor there, EBITDA was a tad ahead of market expectations (~1%) and importantly, we’re seeing continued improvement in EBITDA margin which now sits at 31.4%. This a reflection on absolute cost reduction, the impact of successful new offtake contracts and a marginal increase in nickel prices. They’re talking up organic growth prospects which we like and they are being very disciplined in terms of costs. Guidance - ALL FY18 production and cost metrics maintained. Any weakness back down to around ~$2.80, which seems a long shot however these stocks are very volatile, would see us dust off our buyers hat. The market is negative WSA, with 11 sells, 3 holds and 4 buys. We like it when the market is skewed to the downside – it sets up a better chance of positive surprise.

WSA talked up the outlook for the Nickel market saying that “We firmly believe the shortage of clean nickel sulphides for the EV sector is a looming issue that the market has only recently acknowledged.”

That fits with recent commentary from Credit Suisse after they hiked their Nickel price deck by 20% pa to 2021. No doubt it’s a late call but they reckon that because of Supply deficits, rising premiums and falling inventories – Nickel is starting to look good.

Stainless steel remains the dominate demand driver for Nickel however the real kicker for Nickel demand in the coming years comes from LiB battery cathodes.

Western Areas Daily Chart

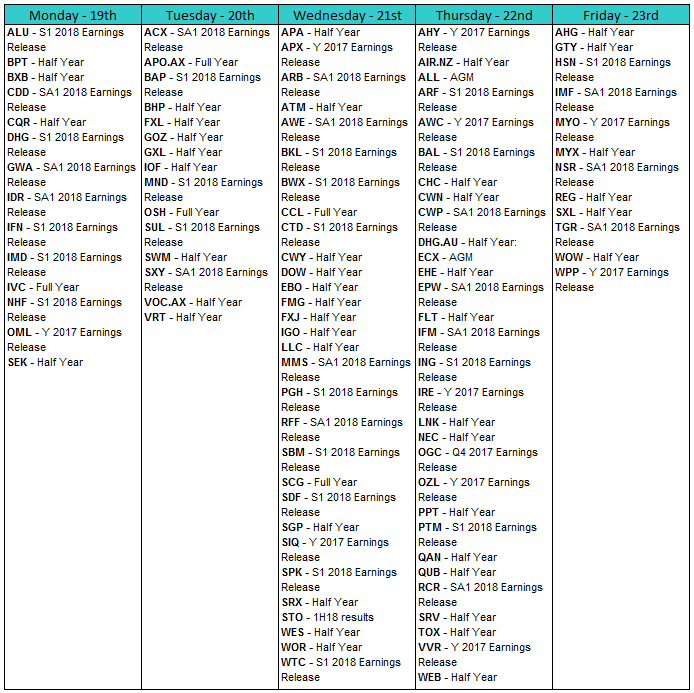

REPORTING THIS WEEK

OUR CALLS

No changes to the portfolio’s today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 20/02/2017. 5.09PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here