Bendigo leads banks into the red

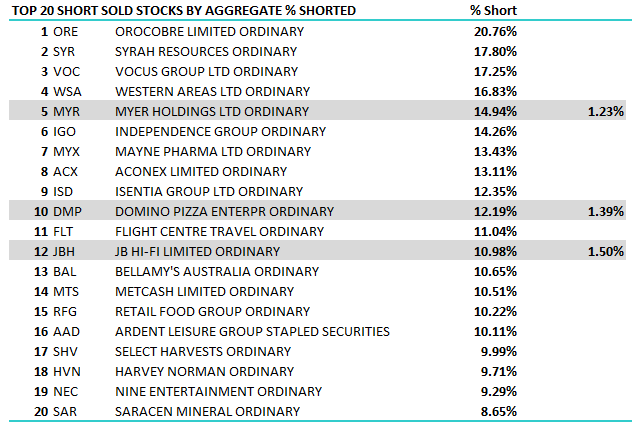

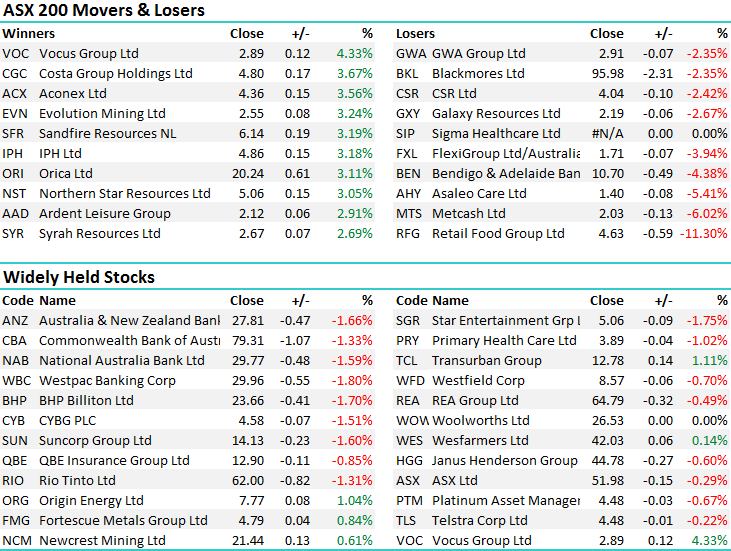

A weaker than expected session today with the banks coming under renewed pressure accounting for -21pts of the markets decline before some tentative buying crept in late. Still, it wasn’t enough particularly when the majority of the material stocks were also weak + we also had a couple of stocks specific headwinds. A change in accounting practices saw Retail food Group (RFG) clobbered by -11.3% and UBS were the first cab off the rank downgrading the stock by -18% to $4.63 – the stock dropped -11.3% while Bendigo Bank (BEN) also felt some pain on another accounting change with the stock down by -4.38% to close at $10.70 – more on that below.

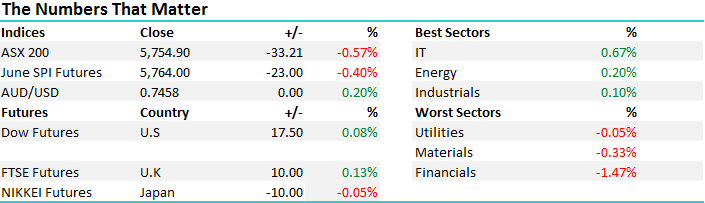

On the broader market today, the IT sector led the way while most weakness was felt in the Financials which lost -1.47% - an overall range of +/- 44 points, a high of 5781, a low of 5737 and a close of 5754, off -33pts or -0.57%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

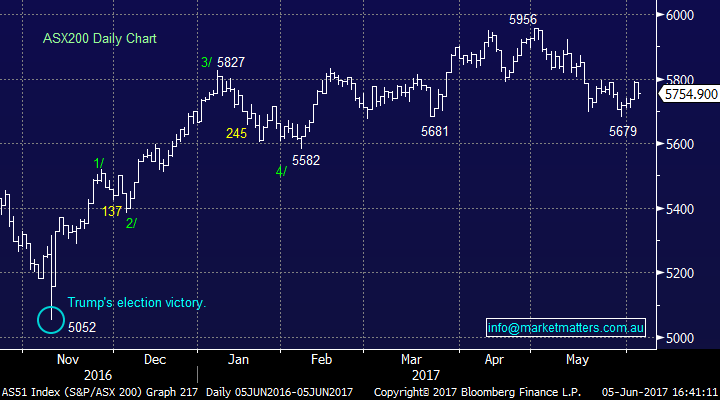

It was an interesting move in Bendigo Bank (BEN) today with a change in accounting of their HomeSafe product. This is a product ‘sort of’ like a reverse mortgage but with a different structure. It’s not a loan against equity but a deferred sale of an agreed proportion of the home, and therefore releases cash to the owner. For years BEN have been booking gains from revaluations however they are now moving to exclude unrealised gains from cash earnings – which is sensible, however it does have an earnings impact of around 8% in FY17, dropping to mid-single digits in the outer years. We don’t own BEN however today the stock dropped by -4.44% to close $10.70 and would start to look interesting on a move closer to $10 as analysts revise earnings lower. If it does continue to slide, we’d think it’s an overreaction as very little has actually changed with the underlying business. We do not own BEN.

Bendigo Bank (BEN) Daily Chart

QBE had some reasonable news out today with the March Global Insurance Premium rate index out for 1Q17 showing rates still falling but decreases are moderating. This is the trend we’ve discussed on numerous occasions and is clearly one of the reasons we like the stock (environment getting ‘less bad’). While the revenue environment remains challenging, they’re doing a good job on costs and claims and we’re seeing reasonable signs in the macro factors that support their earnings. The stock closed down by -0.85% to $12.90. We own QBE.

QBE Insurance (QBE) Daily Chart

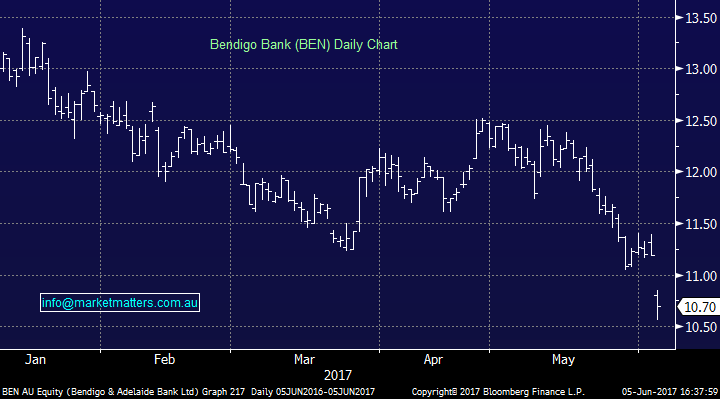

We haven’t included this table in lately however we do keep a handle on it, and look at the movers in terms of shorts. Much written / discussed about retailers with the looming ‘Goliath’ in Amazon soon to arrive. JB Hi Fi is a highly short sold stock with more than 10% of shares held short, and shorts increased by another +1.50% on the week.

Still, analysts are still very much mixed in terms of the impact of Amazon + it should also be noted that retail sales have been pretty dire in recent periods. Macquarie, UBS and APP still clearly flying to flag on JB however we have little appetite for this stock at the moment, nor many others in the sector. All too hard! We do not own JBH.

JB Hi–Fi Daily Chart (JBH)

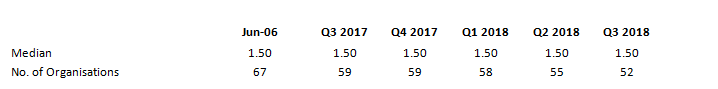

Rates day tomorrow and another non-event it would seem with the futures market pricing just a 5% chance of a cut, which seems a bit rich to us. The RBA will keep rates on hold and that is likely to be the trend out to the end of 2018 if economists are correct!

Aussie Dollar – will tank if RBA does a surprise cut!!

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 05/06/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here