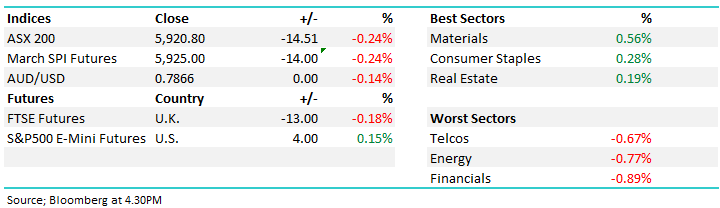

Banks under the pump (CBA, KDR, NCM)

WHAT MATTERED TODAY

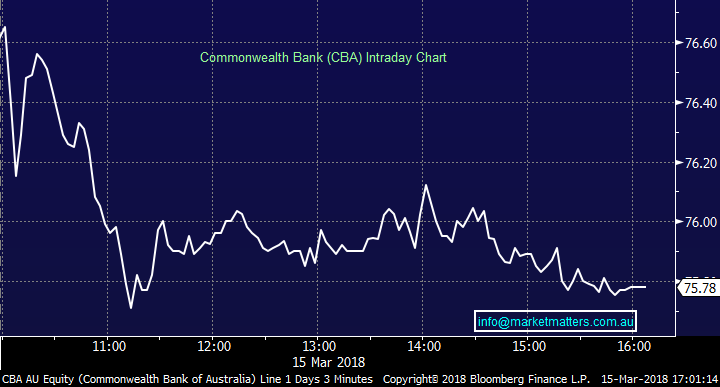

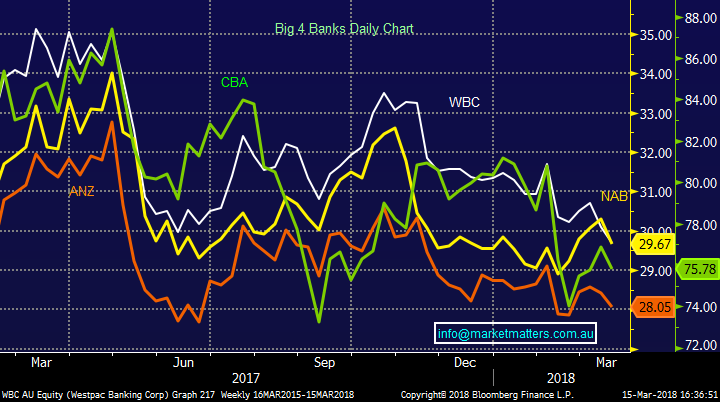

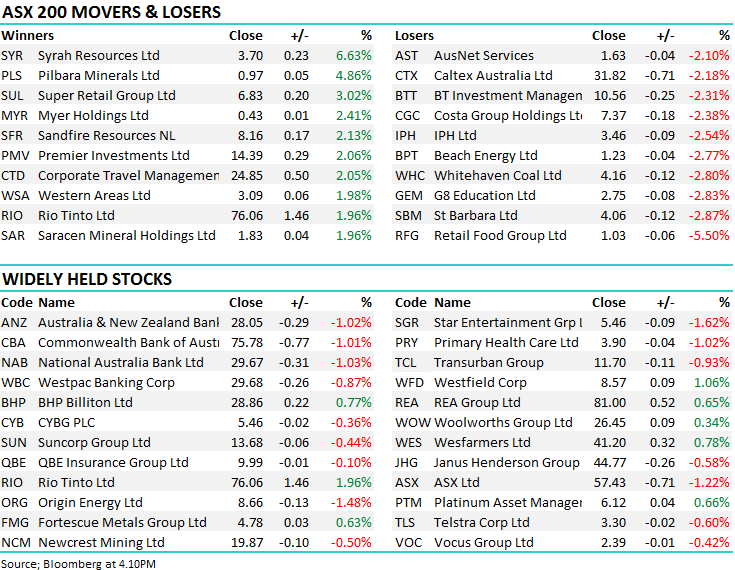

Financial stocks were the cause of pretty much all of the pain on the ASX today with the banking enquiry focussing on CBA – some extraordinary headlines making their way into the press which was also the case yesterday when NAB was in the hot seat – the BIG 4 banks taking -18points from the index with Commonwealth Bank down 1 per cent to $75.78, Westpac off by 0.9 per cent at $29.68, ANZ down 1 per cent to $28.05 and NAB down 1 per cent at $29.67.

It was a weak lead from overseas markets combined with a big index options expiry this morning that created some big large on open – CBA for instance opened at $77 only to see it trade around $76 over the next 15 mins – they them chopped around the lows for much of the day…

Commonwealth Bank (CBA) Chart

We also had news breaking during our session that weighed on US Futures early on with the European Commission looking to fire back at US Tariffs under a plan the European Commission is considering, according to a report by the Financial - according to a draft report seen by the FT, a "digital tax" would be assessed against companies' revenues rather than profits. The tax, which the FT said was likely to be set at 3%, would apply to tech companies with more than 100,000 users in Europe, and cover everything from ad revenue to subscription fees and everything in between. The tax, which may be announced next week in Brussels, is estimated to raise about 5 billion euros a year, the FT reckon. Fight fire with fire and ultimately you get the basis for a trade war – hence US Futures were sold down early and our market followed before our post lunch recovery.

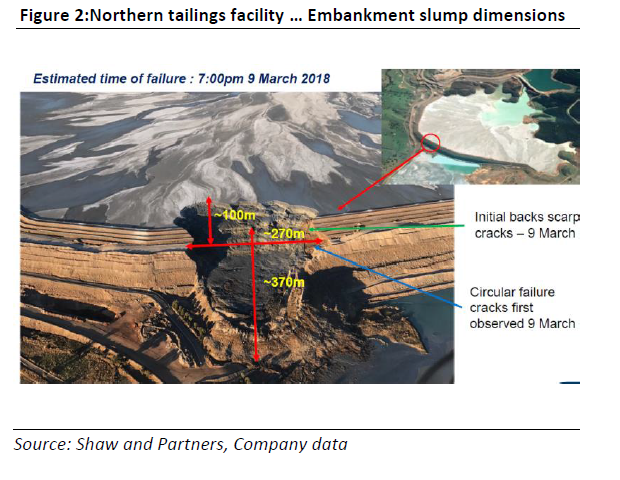

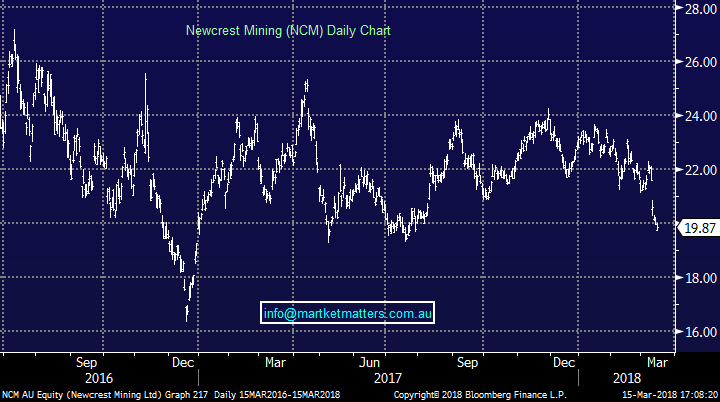

On the flipside, the Material stocks were reasonably well bid throughout the day with BHP and RIO copping some love…NCM on the other hand had another down day courtesy of their tailings dam breach earlier in the week. More on that later.

Overall, the index lost -14pts or -0.24% with the index settling at 5920 – Financials providing the biggest weight on the mkt.

As we suggested in the AM report today, in our opinion US stocks feel like they are slowly changing their tune as they embrace potential market negatives daily as opposed interpreting it as good news. We’ve been looking for US stocks to experience choppy consolidation around current levels before pushing to fresh highs into May and this is undoubtedly what the market is giving us at present. It’s very important for us to clarify our investing position moving forward:

· MM is currently a seller of strength in stocks, not a buyer of weakness.

Following yesterday’s close by the ASX200 below 5950 we are now short-term neutral local stocks needing a close back above 6030 to switch us bullish.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

1. Kidman Resources (KDR) $2.20 / 0.46%; We held KDR in the MM Growth Portfolio and sold into today’s strength around $2.25. Clearly a ‘less liquid’ stock than some which creates some issues around selling volume however we’re now out booking a nice ~21% profit. We continue to like the sector and will be likely buyers into any weakness, with our focus now switching to Orocobe (ORE).

Kidman Resources (KDR) Chart

2. Newcrest Mining (NCM) $19.87 / -0.50%; Had a conference call today updating all about the latest at Cadia – and the call seemed to sooth some concerns and the stock bounced from the day’s lows. All in all, the company painted a better scenario than we thought they would - not perfect but not as bad as feared. That said, markets like certainty and reward it when they see it - not necessarily when it is just promised or hoped for! At this stage we’re on the sidelines and will likely remain there for some time - simply Cadia is too important for earnings + production metrics and the issue we think seems a more complicated one than is being suggested by the company.

Newcrest (NCM) Chart

3. Banks; a quick take on relative performance amongst the BIG 4 over the last year - clearly CBA has lost its premium to the other majors

OUR CALLS

We sold Kidman Resources (KDR) from the Growth Portfolio today booking a nice ~21% profit

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 15/03/2018. 5.11PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here