Banks the main reason for today’s weakness…

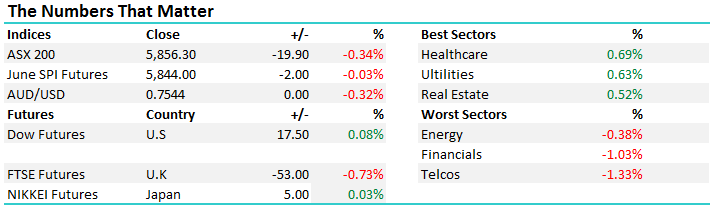

The sector performance on the ASX today mirrored that of wall street overnight with the banks and other financial stocks feeling the heat as U.S bond yields continued to pullback. As we highlighted in the AM report today, financials have a high correlation to interest rates and they’ve declined in the last week or so from ~2.60% back to ~2.33%.

Here’s a very good chart from this morning’s report that highlights the trend…overlaying US 10 year bond yield with the US Banking Index.

Consider the above + there are more rumblings coming out of local regulators around risk weightings on loans (which would require banks to hold more capital) + the decent run up in bank share prices over the past few months and you can see why profit taking was obvious in the market today. That said, we don’t think this is the start of a bigger decline for the banks, more a short term pullback before the sector pushes higher into the back end of April. If US bond yields are leading the sector, then we should look for the short term catalyst for interest rates, and conveniently that comes tomorrow night with US Non-Farm payrolls due. The ADP print was out last night and it was very strong and that caused a decent rally in stocks before Fed comments around fiscal tightening prompted the selloff. Strong ADP data is generally a good pre-cursor to a strong Non-Farms number which should prompt a move higher in bond yields, and therefore the banks. That’s out roadmap for now at least.

The other aspect to consider is around the afternoon buying we saw today – a theme we’ve seen in the last few trading days as well – clearly there is appetite to buy weakness. April is the best moth of the year for a number of reasons, a lot of dividends are paid but we also have School holidays, which start next week, so volumes are light. When cash levels are high, more cash is distributed through dividends, and volumes are light the market typically rallies.

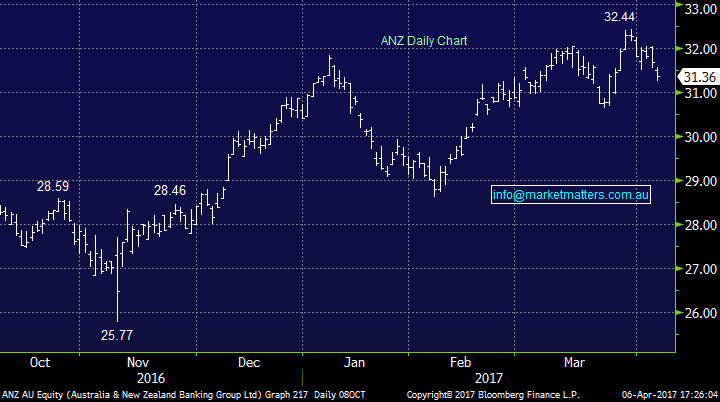

On the market today, we opened down a tad this morning but selling was once again most dominant in early trade with a lunchtime low playing out, and a decent rally into the afternoon session. We had a range today of +/- 38 points, a high of 5871, a low of 5833 and a close of 5856, down -19pts or -0.34%. Of the -19pts that we lost, the four majors accounted for -17pts of it.

ASX 200 Daily Chart

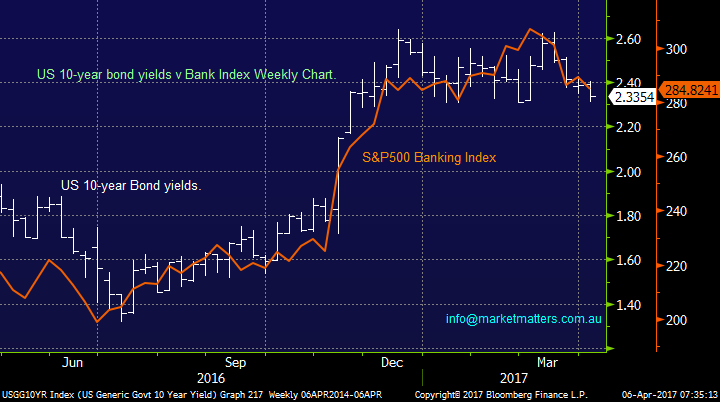

Obviously the banks are in focus for a few different reasons, however the press is focussing once again on capital – as they were in 2015, however its different now. Back then they raised $24bn to meet regulatory requirements, as it stands now, ANZ has $5bn of excess capital, SUN $285m, BOQ $333m. The other three majors will be around $1bn short if the regulator tweeks risk weightings as they are talking about. That $1bn for 3 of the 4 majors could can be fixed by underwriting 1 dividend reinvestment plan – no equity issuance. The other consideration is that if costs go up for banks because of higher capital, we all know they’re pretty good at passing that cost onto customers, which is what they would do.

ANZ Bank Daily Chart

In terms of the resource stocks today, they were better than the banks but still struggled in aggregate. One exception was the GOLD space which was higher - we currently hold Regis Resources (RRL) and Evolution (EVN) however we do view these as shorter term trading positions and will look to exit on the next spike higher. Watch for alerts on these in the coming days.

Regis Resources (RRL) Daily Chart

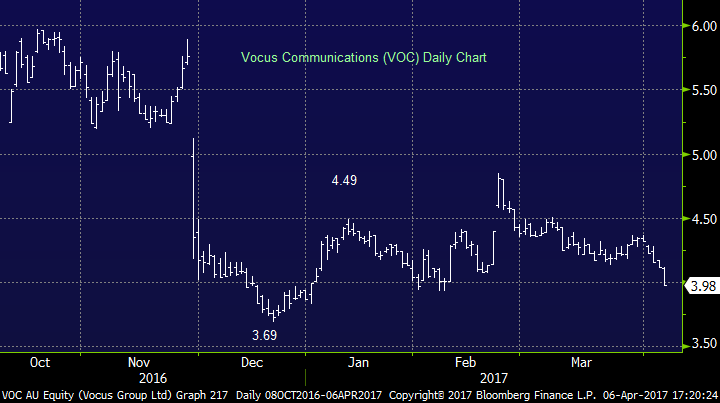

Vocus Communications (VOC) was lower today, by -3.4% to close at $3.98, and it doesn’t look good technically. This continues to be a thorn in our side and today’s news didn’t help. ASX listed Superloop (SLC) said they plan to build a new subsea cable between Australia and South East Asia which will likely impact the feasibility of VOC’s Australia Singapore Cable (ASC). It seems that SLC have already locked in a few of the bigger named customers which puts added pressure on VOC. More info to come out in the next few days with hopefully and update from VOC themselves.

Vocus (VOC) Daily Chart

Have a great night,

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 06/04/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here