Banks Seasonality working to offset Materials & Energy (MQG, CBA, WBC, ANZ, NAB, GMA)

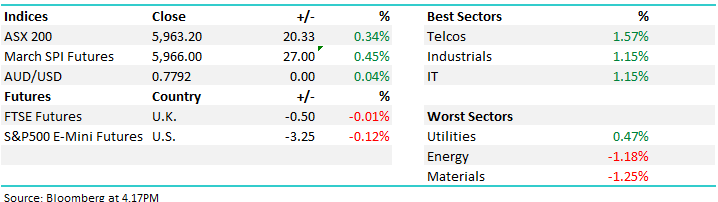

WHAT MATTERED TODAY

It feels like we’ve been writing about Trump / trade wars & tariffs all week with market movements based on the rhetoric coming out of Washington. By weeks end though, markets had settled and all sectors on the Australian bourse (except energy) actually closed higher with the ASX 200 putting on 0.57% / 34pts over the week.

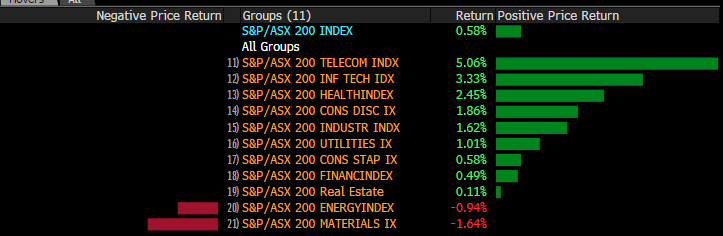

Weekly Sector & Market Performance

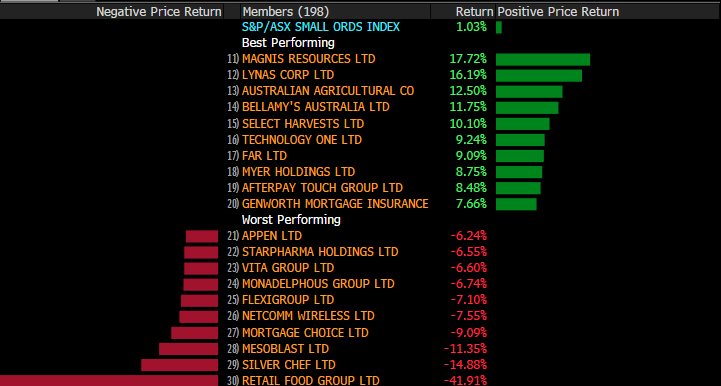

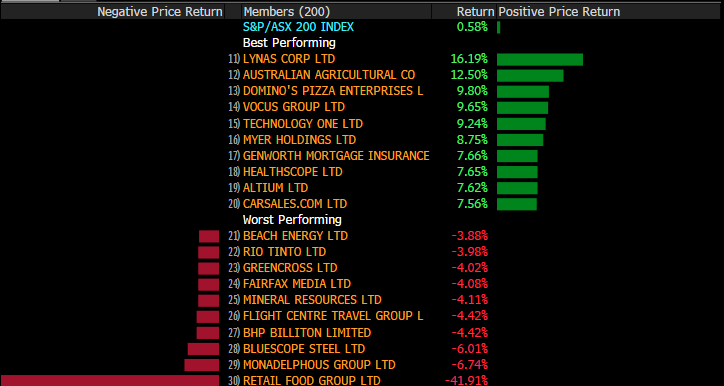

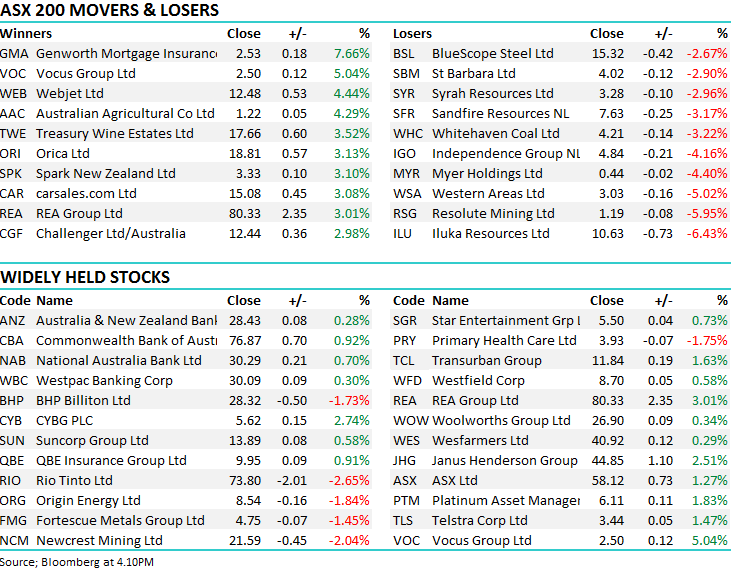

Looking at key stocks on the week in both the large caps and the Small Ords shows another period of big underlying moves – not to the extent we saw during official reporting season but still worthy of mention.

Starting in the Small Ords, Lynas (LYC) was a standout on the back of a better report early in the week, a turnaround story and that’s being reflected in the four fold increase in the share price since 2017. On the flip side, Retail Food Group (RFG) has found itself in a world of pain following difficulty finalising their results and subsequent negotiation with bankers around debt covenants. They now hold $260m in debt with a market cap of $217m and an earnings picture that it under significant pressure. To us, this is simply unsustainable and a real risk to the company’s ongoing viability. Silver Chef (SIV) is another one under pressure with their Auditors putting big question mark over their recent set of accounts – again, a stock we would have no interest in even at these depressed levels.

Small Ords Weekly Performance

In the larger cap space we saw some relief buying in Australian Agricultural (AAC) and Genworth (GMA), the latter of which we hold in the MM Income Portfolio. This has been our worst performing investment since the portfolios inception with the stock owing us $2.79. We maintained our position through the recent weakness for 3 main reasons.

1. The company has a buy back in play that ‘should’ have been providing some support to the stock

2. The parent company that still owns 26% of the stock is a natural seller, some relieve should be seen if / when their stake is placed and there are rumours this is about to happen

3. The company has a huge amount of excess capital on their balance sheet that should (ultimately) find its way back to shareholders.

The stock closed today at $2.53 up 7.66%. On the flipside, Myer has been dumped from the ASX 200 which put pressure on the stock today, however they are in the green for the week.

ASX 200 Weekly Performance

Today, the S&P/ASX 200 Index finished 20 points higher to 5963 points - a rally of 0.34%.

ASX 200 Chart

ASX 200 Chart

CATHCING OUR EYE

1.Macquarie Group $105.46 / +1.38%; A good day today with the stock breaking out to new highs. We outlined 5 shorter term plays to look at this morning and Macquarie was one of them. We hold the stock in the MM Growth Portfolio and wrote the following in the AM report day….We believe MQG will make fresh all-time highs in the very near future – we’re long and happy! Its strong correlation to US indices which are again looking excellent adds weight to this opinion.

· Buy MQG below $104.50 targeting over $110 with stops below $101.60 – note only ok risk / reward but the bullish trend is very strong.

Also, once / if MQG breaks above $105.60 technically stops could be raised to $103.80 making the risk / reward more attractive!

Macquarie (MQG) Chart

2. Bank seasonality; We’ve written a number of times recently about bank seasonality with the March / April period being a very strong one for the sector – today the banks got into the groove and rallied nicely – CBA adding 0.92% to $76.87, NAB adding 0.7% to $30.29, ANZ adding 0.28% to $28.46, and WBC up by 0.3% to $30.09.

Here’s a quick look at the seasonality for CBA over the last 10 years. Typically, CBA will put on +6.5% over the March / April period and this is clearly the time to be / stay long the sector.

OUR CALLS

No trades on the MM Portfolios today

Have a great Weekend,

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 09/03/2018. 4.30PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here