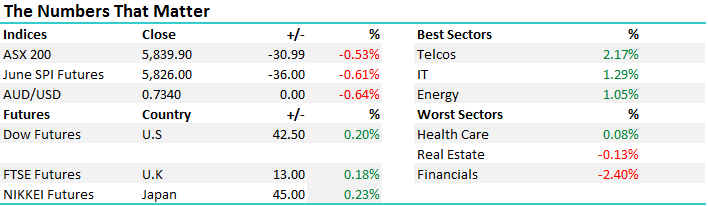

Banks put big pressure on the ASX ahead of budget

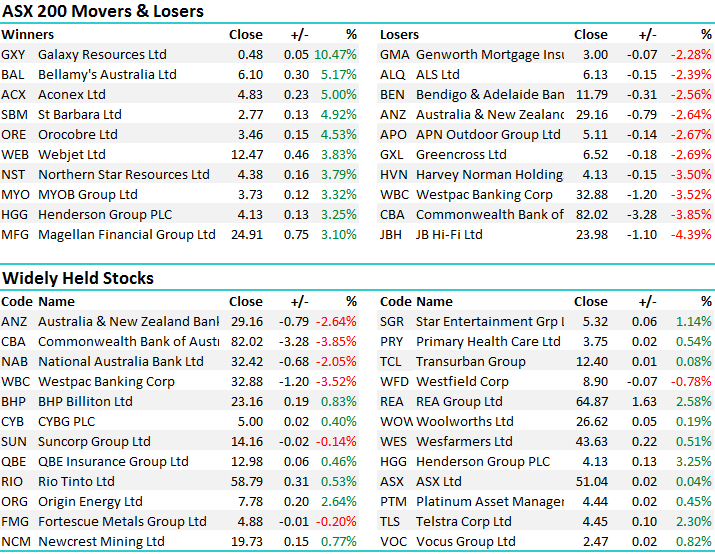

A big day for the banking stocks with the BIG 4 accounting for more than 45pts of the index decline, or in other words, all the weakness was associated with the banks on reports circulating that a $6bn tax over 4 years is likely to be announced in the budget tonight. Apparently this will be in the form of a new transactions tax on interbank transactions with the AFR reporting that Treasurer Scott Morrison will be calling the CEO’s of the big 4 ahead of the announcement this evening.

The banks make about $30bn annually in profit and if the $6bn figure is right over 4 years, the impost on earnings annually would be around 5%, which is big and the reason for the decent fall in share prices today. However, the Australian banks have a very good track record of passing on higher funding costs, credit risks and other headwinds to customers. According to UBS numbers, they reckon the easiest way for banks to achieve this would be to reprice their mortgage books. To offset a $1.5bn headwind they estimate the Banks would need to reprice their variable mortgage books by 12- 15bp.

We know May is a weak period for banks and this has largely played out to script, however we now need to be very conscious that we’ve seen 80% of the usual May weakness in the first 9 days of trade so clearly we now need to be sniffing around for opportunities to buy the sector after selling out of CBA and ANZ, and only partially up weighting in NAB.

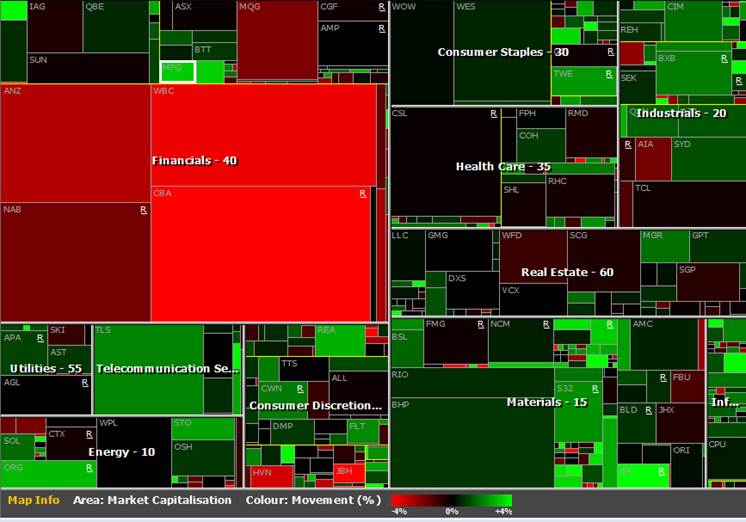

Where the pain was today….all targeted towards the banks….

Staying on the banks, CBA was the weakest link by a reasonable margin today after they gave a weakish Q3 trading update this morning. Cash earnings were tad light at $2.4bn, margin a little lower which was to be expected, CET 1 at 9.6%, which is a bit below the others but importantly, their bad debt charge was very low at 11bp of gross loans versus the 17bp in the first half, which casts a further shadow on their cash earnings result.

CBA closed down -3.85% to $82.02, ANZ was off -2.64%, Westpac was down -3.52% while NAB was the best of a bad bunch ending -2.05% lower at $32.42

Commonwealth Bank (CBA) Daily Chart

Given the selling amongst the banks it was always going to be an uphill battle for the market today and after a few attempts to rally, we closed near enough to the daily lows. We had a range of +/- 40 points, a high of 5870, a low of 5830 and a close of 5840, down -31pts or -0.53%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

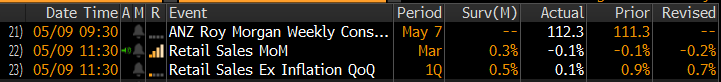

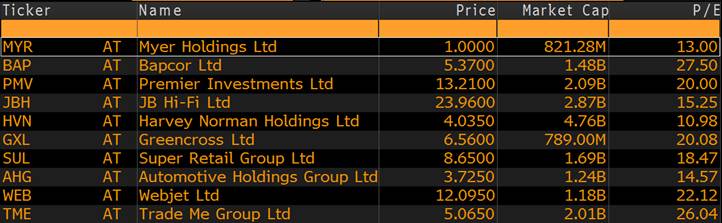

Retail Sales; The retailers are doing it tough in Australia at the moment with retail sales printing -0.1% versus +0.3% expected today and unsurprisingly we’re seeing weakness amongst the listed retail players. Amazon is coming which increases competition, will reduce margins particularly in the consumer electronics businesses and will clearly be a negative for earnings. Hard to see why you would be there at the moment.

Here’s a list of the main retailers….some are getting cheap but all too hard at the moment.

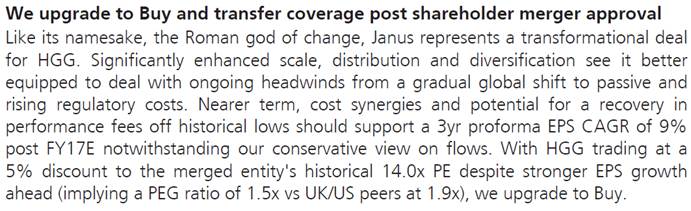

Source: Bloomberg

Retail Index Daily Chart – Bearish price action continues

Henderson (HGG) & Oz Minerals (OZL); Two very different stocks however a number of similarities in terms of the feedback we’ve received over the early life of the holdings. Today HGG rallied strongly on the back of a positive note from UBS – an extract of which is below however we now sit on a nice +12% profit on this position observing the market now turning very positive a stock that it was collectively bearish on at the start of the year. We reference Oz Minerals here simply because there is often times to be patient in positions when we can, as long as we have flexibility elsewhere in the portfolio. Oz Minerals fits into that basket at the moment.

…From UBS

Henderson Group (HGG) Daily Chart

Enjoy the budget this evening – we’ll cover the main takeout’s in the AM report in the morning

Have a great night,

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 09/05/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here