Banks in the crosshairs of rating agencies

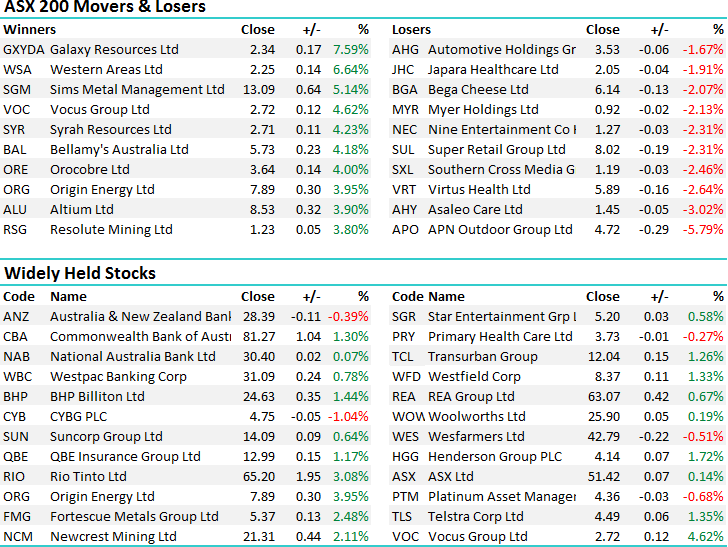

A good start to the week with stocks up early led by strong buying across the commodity names, particularly RIO which continues to roar ahead after adding +5.8% last week and putting on another +3.08% today. We own RIO and a week ago our ~$70 price target looked stretched however at todays close at $65.20, it looks a lot more attainable. Goldman’s disagree downgrading the sector on Thursday slapping a $55 price target on RIO, a $22.50 price target on BHP and a $4.00 price target on Fortescue, based largely around their more bearish Iron Ore assumptions.

The banks also copped a downgrade today, however this came from the ratings agencies following the Big Bad Bank Tax introduced by Treasurer Morrison in the recent budget. S&P saying that it has lowered its assessment of the standalone credit profiles of almost all financial institutions operating in Australia for a number of reasons, one of which being weakening implied Govt support! More on this below.

On the market today, we had a strong open and most sectors stayed that way for the remainder of the session - a range of +/- 51 points, a high of 5778, a low of 5734 and a close of 5771, up +44pts or +0.76% - so a good session for a Monday and a very good bounce back from the -109pts that we lost last week.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

The banks have clearly been in focus over the past month and we’ve written extensively about them. Our view remains that weakness should be bought, and we’ll continue to up weight in that area of the market into any further decent declines. At this stage we have 17.5% in NAB, CBA and WBC looking to up weight in CBA on a drop below $79. The big 4 account for around ~30% of the index so we’re still light on in this area however we’re certainly not looking to track an index or achieve ‘relative returns’ we’re more about absolute gains.

Today S&P lowered its ratings on 23 Aussie Financial Institutions saying; "In our opinion, economic imbalances in Australia have increased due to strong growth in private sector debt and residential property prices in the past four years, notwithstanding some signs of moderation in growth in recent weeks. Consequently, we believe financial institutions operating in Australia now face an increased risk of a sharp correction in property prices and, if that were to occur, a significant rise in credit losses -- Despite increased downside risks, in our base case we expect that recent and possible further actions by the Australian authorities should aid in an unwinding of the imbalances in an orderly fashion -- To reflect the increased risk, we have lowered our assessment of the stand-alone credit profiles (SACPs) of almost all financial institutions operating in Australia -- We are lowering our long-term issuer credit ratings on 23 financial institutions in Australia by one notch each."

So clearly, it’s not all about the bank tax however there is certainly a level of implied Govt underwriting of Australia’s banks and any signs that the certainty of that underwriting has taken a hit, will see the cost of funding tick up. On best guess assumptions are a credit downgrade by one notch adds around 10bp to the cost of funding.

This is interesting and we doubt Scott Morrison and Co saw this coming. If the banks are downgraded, the cost of funding goes up and the borrower wears it, and according to the banks the levy will also be passed on, so the Govt may have just been responsible for a rate hike on the voting public by ~0.20%. or more.

Westpac were saying today that the impact of new bank levy will be $65m after tax in FY17 and $260m after tax in 2018. This is equivalent to 0.8% of profits in FY17 and 3.0% of profits in FY18. Saying no company can simply absorb the tax, so we expect cost of tax to be passed on.

Westpac (WBC) Daily Chart

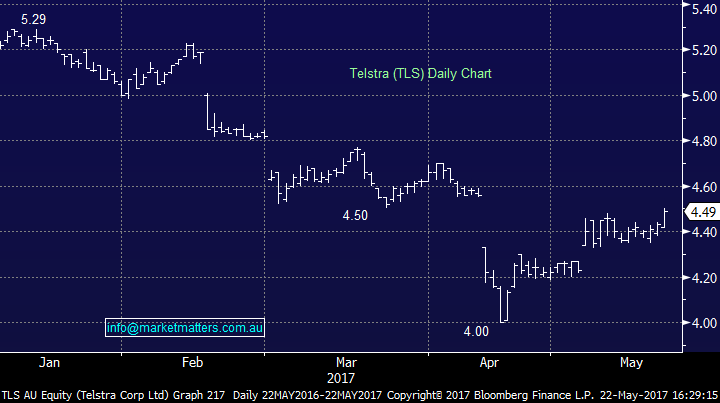

Elsewhere, a couple of charts caught our eye today with Telstra starting to look good technically despite the surge of negativity on the stock. Clearly there are some headwinds facing TLS but we continue to question ‘how much negativity is already in the price’? Remember, negativity is at its peak at the lows! Looking interesting here!

Telstra (TLS) Daily Chart

Western Areas was another to hit the radar on Friday and again looked good today. There remains a few questions around the Nickel price at the moment however it looks reasonable for further short term upside

Western Areas (WSA) Daily Chart

….and Alumina also had a good session adding +3.26% to close at $1.90. We didn’t ‘get on’ this given our current exposure in the resource space however it’s looks technically.

Alumina (AWC) Daily Chart

Have a great night,

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 13/02/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here