Banks down but not out after tough week

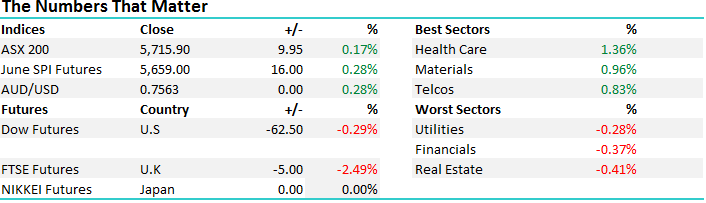

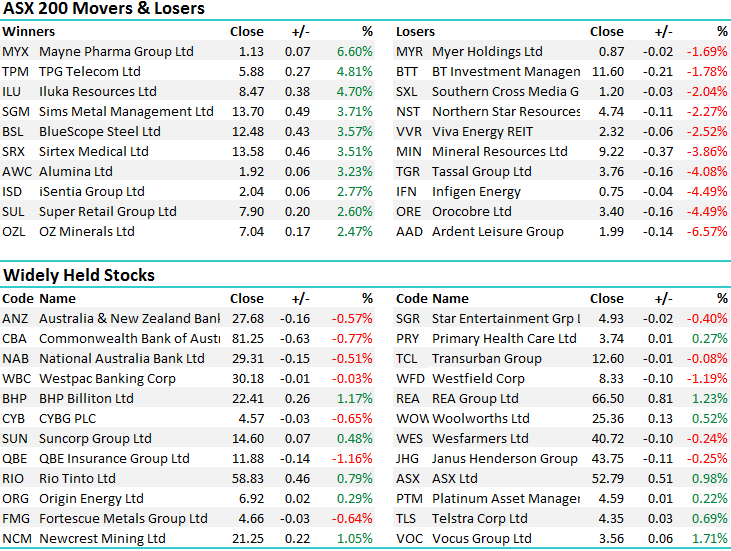

The market wrapped up a choppy week on a positive note today with the healthcare stocks finding most support. A fairly big weekly range for the market of +144pts after a big sell off on Tuesday / Wednesday before a tepid recover on Thursday / Friday. Overall the index finished the week down by -58pts or -1.01%

On the broader market today we had an overall range of +/- 30 points, a high of 5723, a low of 5715 and a close of 5715, up +10pts or +0.17%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

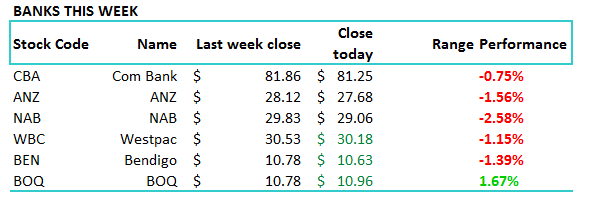

The banks have been in the firing line this week with a rating agency downgrade early on and news that the SA Govt would impose their own bank levy certainly saw volatility tick up, however the underlying performances have OK considering that we often see the banks bottom out in the last week of June, ready for a seasonally strong period in July.

NAB the worst of the majors on the week while CBA was hurt the least which makes sense. Given the composition of NAB earnings they feel the most pain from these changes + they have a high payout ratio so in theory their dividend is at most risk than the other – hence the drop of -2.58% this week. ANZ remains the cheapest (just) followed by NAB, although we tend to think that ANZ’s earnings will start to lag after they continue to exit Asian operations. The old trade-off between safety and growth. It will improve their capital position as the expense of earnings . It’s the reason why ANZ does not feature in the MM portfolio now.

Bank performance over the week – regionals better than the majors. NAB hardest hit, CBA least

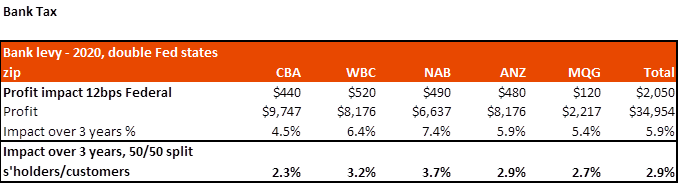

The obvious question is whether or not this week’s moves are already been priced in. Shaw and Partners’ bank analyst David Spotswood ran a few assumptions today following news of the SA bank levy + he also assumed the federal bank levy doubles by 2020 to 12bps (states zero) but that the banks can pass on half the cost to customers. The impact he foreshadows is below – about a -2.9% HIT to earnings for both taxes BUT this assumes a doubling of the already announced Federal tax which is yet to be confirmed (but clearly possible).

Clearly, the move is not a disaster for the banks but certainly not positive in an environment where earnings growth is hard to come by. We hold WBC, CBA, NAB but we are active around our allocations to these.

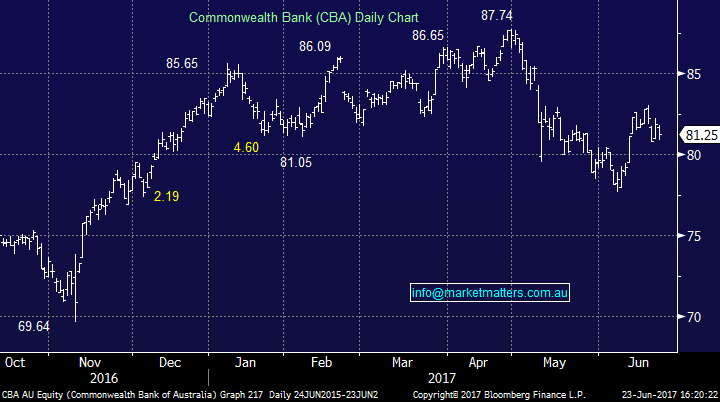

Commonwealth Bank (CBA) Daily Chart

Have a great night & keep an eye out for the Weekend Report on Sunday

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 23/06/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here